by Joanna White | May 27, 2019 | Options trading

ETFs (Exchange Traded Funds) have increased in popularity among traders of all types since their introduction in the early 1980's. In a nutshell, Exchange Traded Funds (ETFs) are funds that track indexes such as the S&P 500, NASDAQ, Dow Jones, Russell 2000, etc....

by Joanna White | Apr 28, 2019 | Options trading

The decisions of millions of investors and traders affect the price movements in the options market. There are many useful statistics in addition to price movement that indicate what other market participants are doing. This article will focus on two factors many...

by Joanna White | Apr 12, 2019 | Options trading

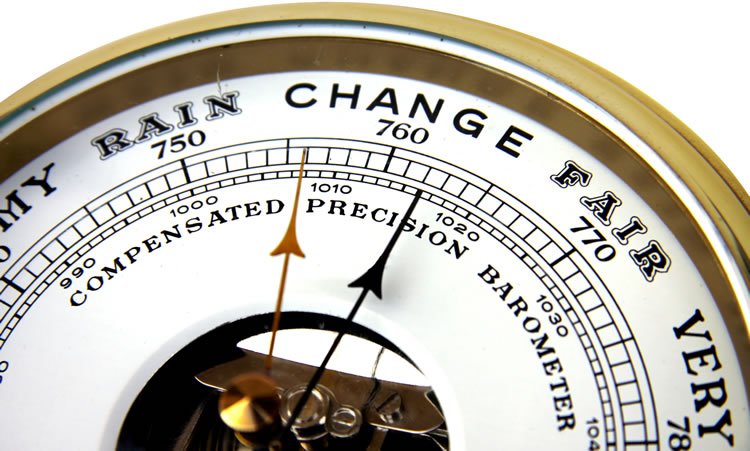

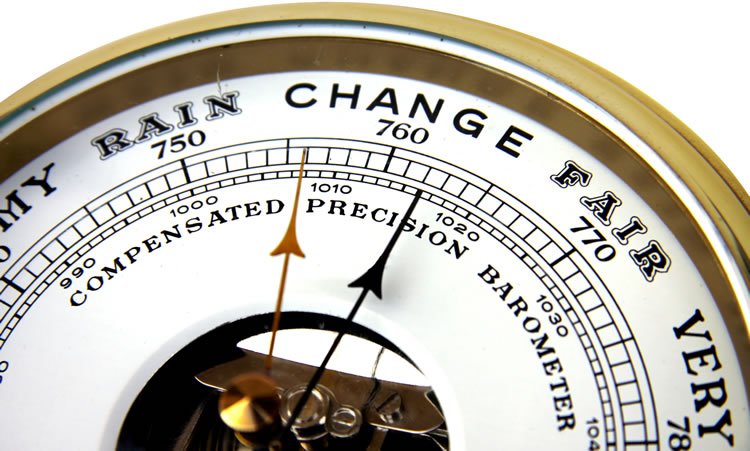

How the VVIX can be Used as a Barometer in Trading Most traders are familiar with the VIX, which measures the volatility of the S & P 500. The VIX was introduced in 1993 by the Chicago Board of Options Exchange. The index measures the 30-day forward...

by Joanna White | Mar 25, 2019 | Futures trading, Options trading

Pairs trading is generally considered a market neutral strategy. Some traders use the strategy as a directional strategy. Pairs trading is one of many approaches a trader can use to reduce risk. The strategy often combines a long position with a short...

by Joanna White | Mar 15, 2019 | Options trading

Moneyness is a common term which is very important when looking at an option chain. Moneyness in an option chain refers to the relationship of where the price of the underlying is currently trading and the strike price of the option within the option...