Tom Nunamaker is presenting his Easy Peasy Iron Condors (EPIC) on the Round Table on Wednesday 24 Jan 2024. The EPIC is an iron condor options trade that expires the same day (0 DTE).

>>> Register for the Round Table webinar here <<<

Tom has been trading 0 DTE SPX iron condors during most of 2023. Tom started trading the John Einar Sandvand method, then migrated to the Tammy Chambless Multiple Entry Iron Condor (MEIC). Tom has improved the performance of both of these popular 0 DTE iron condor strategies but scaling out of each side with multiple stop orders.

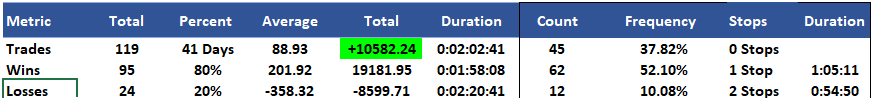

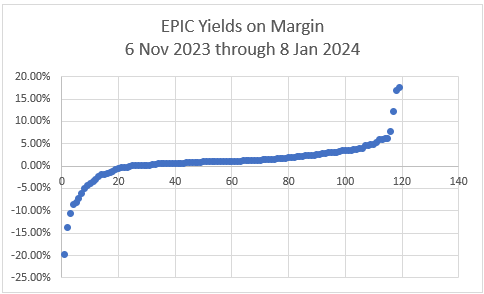

Tom started trading his new variation on 6 November 2023. Here are his trading results as of 8 Jan 2024:

EPIC trade results from 6 Nov 23 to 8 Jan 24

Account size: $50,000

Return +21.16% in two months

Average of 2.902 Trades per day

Average yield on margin per trade was +1.030504%

Average losing trade -4.43% on margin

Average winning trade +2.41% on margin

Commissions were $4262.76 which were 28.71% of gross trade proceeds.

Tom is teaching a class showing exactly how he trades this trade starting next week.

Tom will include his Excel spreadsheet that connects to thinkorswim and his trade log spreadsheet to track his trading results. The trading spreadsheet let's Tom quickly find candidate iron condors and paste the order into the thinkorswim platform. After the condor is filled, Tom enters his fill prices and clicks a button to generate all of his stop orders to paste into thinkorswim. The whole process after getting filled on his condor takes 10-15 seconds to send all stop orders to three accounts!

Class starts on Tuesday 30 Jan after the cash market closes.

>>> >>> Learn more about the upcoming class here <<<

missed the presentation yesterday. will you be posting the recording for this ?

I didn’t have time to finish the PowerPoint slides so I pushed the webinar two weeks in the future. Sorry about that.

Do you need to have ThinkOrSwim to run this strategy? Can it be done using TAT/IBKR?

You can use any broker, but there are a lot of stops to enter. If you can setup shortcut keys (IBKR) to speed up order entry, it should be fine.

Can it be done in algo with tastrade api

Can it be done with api of ibkr or tastytrade.

I can’t understand that the commission is more than profit or not in tos