Amy Introduced the A14 Weekly Option Strategy Workshop

on the Round Table on December 1, 2021

Amy Meissner

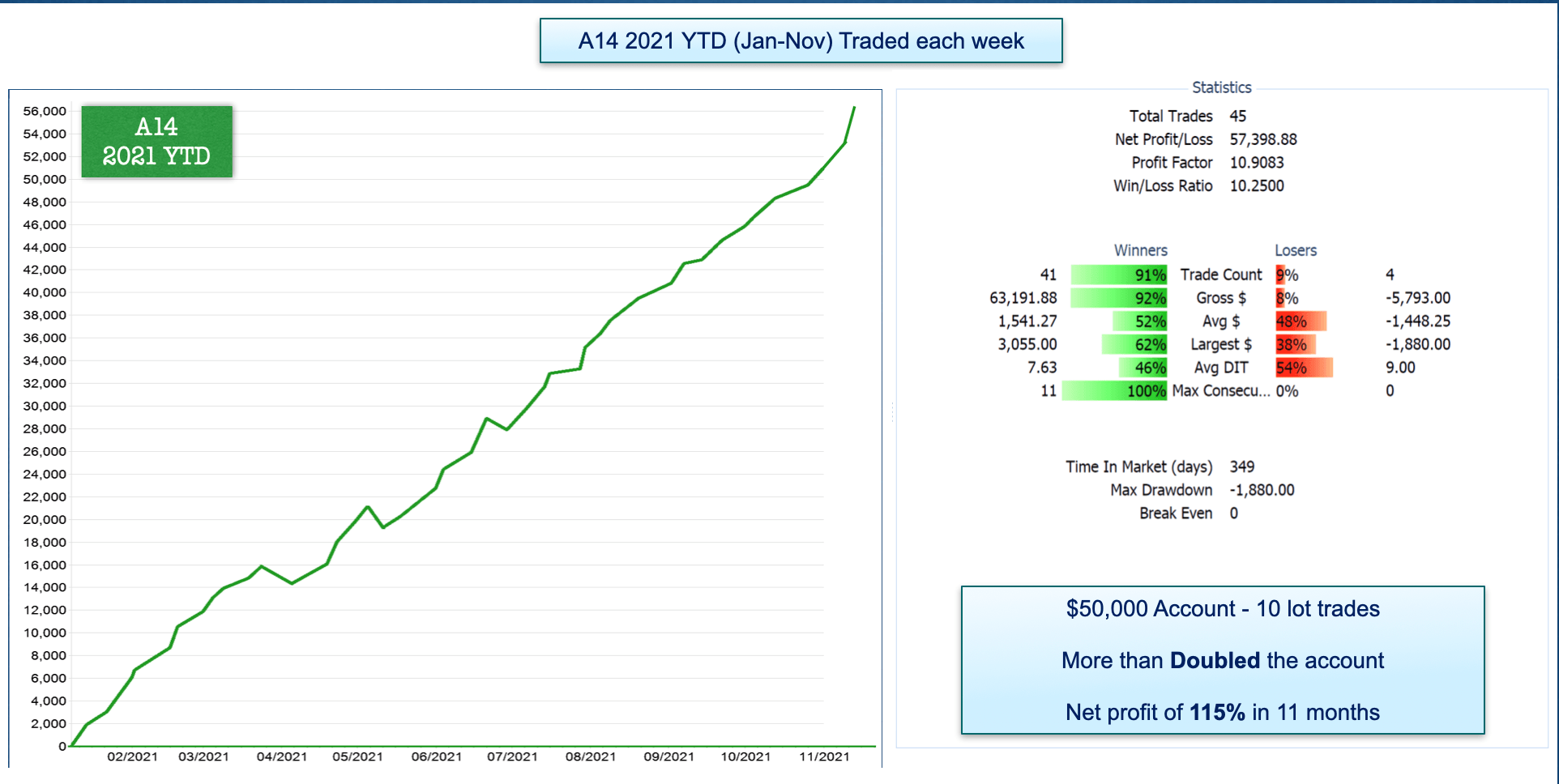

How Were Amy's Live Trading Results?

In a word… Outstanding

Amy started with a $32,447.49 account in September 2020.

In the 15-month period that followed, she deposited another $29,661.02 for a total cash outlay of $62,108.51.

Something extraordinary

Amy's account today is $204,545.76!

The net profit was $142,437.30 including all fees! That is a 229.336% profit.

Remember that a 100% profit doubles an account.

Amy MORE THAN TRIPLED HER ACCOUNT in 15-months!

We've been watching trading systems for a long time. This is the highest yielding market neutral options performance we've seen!

This is the type of results directional traders hope for!

The A14 Weekly Option Strategy was the end result.

- No need to pick direction. Don't have to be a technical analysis guru.

- Single order at entry. No need to multiple legs.

- No need to sit in front of the computer during trading hours.

- Adjustments are simple and only need to be checked once a day.

- Adjustment tactics can be used with other strategies.

A14 Weekly Option Strategy Overview

- Planned Capital is $5,000 to $8,000 for a two-lot trade.

- Minimum account is $10,000 to trade a two-lot.

- Profit target is +5% or more. Amy averaged +6.5% per trade

- Losses average ~6% and generally under -10%.

- Win/Loss Expectancy was 9:1.

What You'll Get

- Core concepts of the A14 Weekly BWB tactics used.

- Rules and Guidelines for the A14 Weekly BWB strategy (including: Entry, Adjustments, and Exit).

- Several step-by-step examples of the A14 in Up, Down, and Choppy markets.

- Additional Adjustment options that can be used.

- Using the A14 Adjustment strategy for the Boxcar.

- Workshop classes had several Q&A sessions.

- All classes were recorded and available for playback.

Workshops Are For Educational Purposes Only

The workshop is intended to show you examples for you get ideas for your own trades.

You are responsible for your trades.

A14 Weekly Options Strategy Workshop

This is a recorded workshop. When you sign up, you get:

- Core concepts of the A14 Weekly Options Strategy

- Rules and guidelines for the A14 Weekly Options Strategy (including entry, adjustment and exit)

- Several step-by-step examples of the A14 in up, down and choppy markets

- Additional adjustment options that can be used

- Using the A14 adjustment strategy for the Boxcar Trade

- Dedicated discussion forum

- All classes are available for playback

Aeromir Corporation is NOT a Broker Dealer.

Aeromir Corporation engages in trader education and training. Aeromir Corporation offers a number of products and services via the internet at aeromir.com. Aeromir Corporation offers web-based, interactive training courses on demand and live training.

This information neither is, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell securities. You shall be fully responsible for any investment decision you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Prior to buying or selling an option, you must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, by calling 1-888-OPTIONS, or at www.theocc.com. The information on this web site is provided solely for general education and information purposes. No statement should be construed as a recommendation to buy or sell a security or to provide investment advice. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Supporting documentation for any claims, comparisons, statistics or other technical data in this presentation is available at Aeromir Corporation.

Parameters relating to past performance of strategies discussed are not capable of being duplicated. In order to simplify the computations, slippage, commissions, fees, margin interest and taxes are not included in the examples used on this web site. These costs will impact the outcome of all stock and options transactions and must be considered prior to entering into any transactions. Multiple leg strategies involve multiple commission charges. Brokerage firms may require customers to post higher margins than the minimum margins specified on this web site. Investors should consult their tax advisor about any potential tax consequences. Simulated trading programs are designed with the benefit of hindsight. No representation is being made that any portfolio or trade will, or is likely to, achieve profits or losses similar to those shown. All investments and trades carry risks.