ETFs (Exchange Traded Funds) have increased in popularity among traders of all types since their introduction in the early 1980's.

In a nutshell, Exchange Traded Funds (ETFs) are funds that track indexes such as the S&P 500, NASDAQ, Dow Jones, Russell 2000, etc. When an investor buys shares of an ETF, they are buying shares of a portfolio that tracks the yield and return of the related index. By purchasing an ETF, investors get the diversification of an index fund, at a much lower cost. Some ETF shareholders are also entitled to a portion of the profits sometimes paid quarterly, such as dividends.

At the time of their introduction, one of the primary intentions of ETFs was to give investors low cost, liquid exposure to widely followed broad market benchmarks such as the S & P 500, Dow Jones Industrial Average, etc.

As the number of ETFs offered has increased over the years, so has the number of ETFs devoted to specific sectors of the market. These are called Sector ETFs, and there are hundreds available to traders which are in some very specific segments of the market. These sector ETFs include industries such as, but not limited to, biotechnology, homebuilders, leisure, retail, financials, and health care.

Sector ETFs are a class of exchange traded funds that invest in the stocks and securities of a specific market sector. For example, the Financial Select SPDR ETF (XLF), is comprised of 62 underlying securities that operate in the financial sector and represented in the S & P 500 index.

The use of sector ETFs can help traders diversify their portfolio, while at the same time reduce the market risk of purchasing individual stocks in a particular market segment. For example, buying a financial sector ETF may allow a trader to feel more comfortable about trading in the financial market, rather than buying one or two bank stocks.

Some of the best known sector ETFs and their current prices are shown below:

- Financials (XLF) Current price: $28

- Technology (XLK) Current price: $78

- Consumer (XLY) Current price: $119

- Health Care (XLV) Current price: $89

- Industrials (XLI) Current price: $77

- Retail (XRT) Current price: $45

Sector ETFs can be appealing for traders with smaller trading accounts …

The lower price of the sector ETFs means that less capital is required when trading these vehicles as compared to SPY or QQQ (currently $292 and $189, respectively). The reason is that the higher the price of the broad market ETFs such as SPY or QQQ, the higher the price of their options, all other things being equal. The profit potential relative to the capital requirement is the same for both, so the lower priced ETFs may be more suitable for a trader with limited capital.

To illustrate the price differences between a sector ETF and a broad market ETF, let's use the example of a trader who is considering placing a straddle on some type of ETF in advance of a news event. The news event is expected to significantly move the market in that industry. For this example, the trader is taking a position surrounding a major product announcement by AAPL that is likely to rock the technology sector. We will look at a straddle on the Technology Sector (XLK), as compared to a comparable position on QQQ. QQQ is the ETF that tracks the companies in the NASDAQ 100 index, which is heavily weighted with technology stocks.

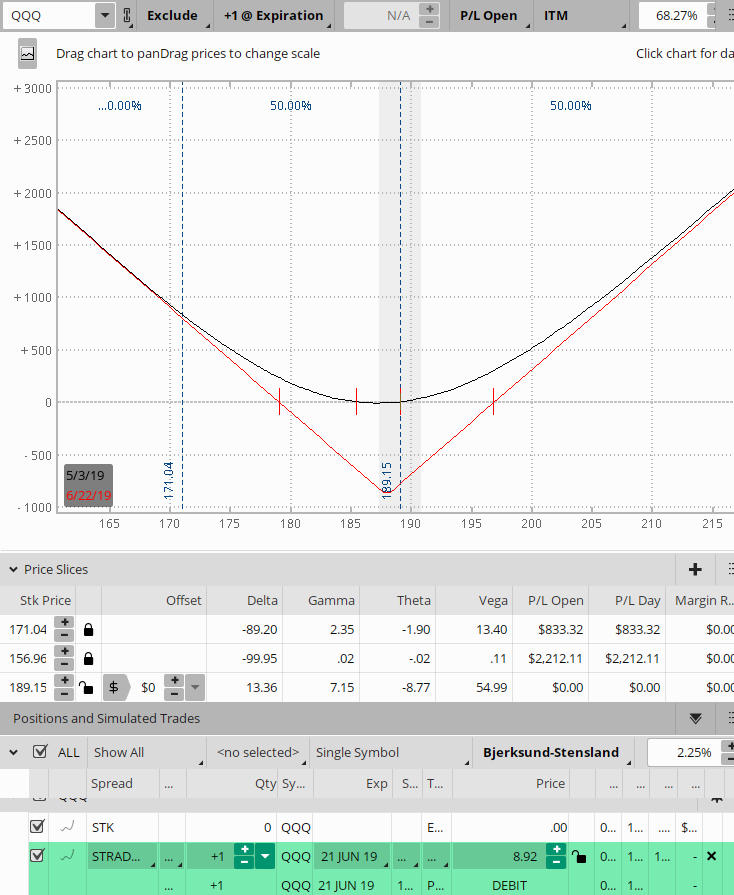

Figure A. QQQ Straddle

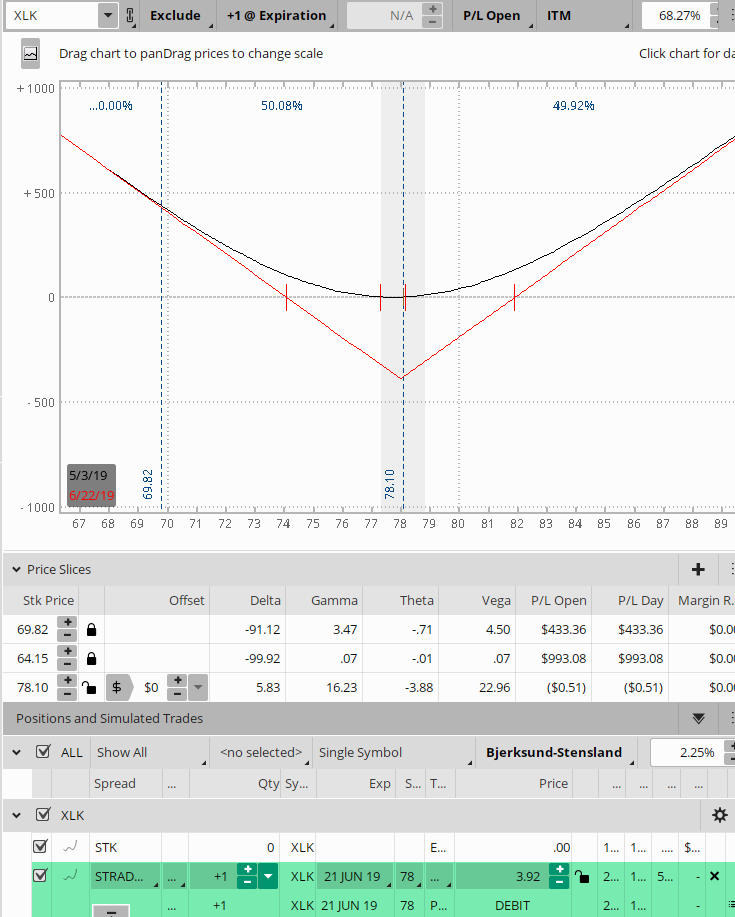

Figure B. XLK Straddle

Figure A shows the straddle position on QQQ set up 49 days to expiration, for a cost of $8.92. The comparable position, a straddle in the technology sector XLK, can be entered at this time for a debit of $3.92, significantly less than the QQQ position. The graphs are similar as far as the risk/potential reward.

In addition to sector ETFs devoted to individual industries, there are families of sector ETFs that cover the full universe of stocks that make up a specific index…

These families include:

- Market Weight Sector ETFs

Market weight sectors are based on the standard market capitalization indexes and their underlying instruments. One of the largest families of market weighted sector ETFs are the Barclays iShares Dow Jones Sector ETF (IYY) iShares Dow Jones Sector ETF. This ETF covers the full sphere of securities that are in the Dow Jones US Index.

Market weight sector ETFs can be appealing to a trader who is looking for exposure to the broad US market. For the most part, they are slanted towards the larger-cap stocks, without much exposure to small cap stocks.

- Equal Weight Sector ETFs

The term “equal weight” means that all stocks have a similar weighting in the index, regardless of the company's size. In an equal weight index, each security affects the overall performance of the index equally; there is not one stock that is more heavily weighted than another. Equal weight sector ETFs may outperform a market weight fund when small cap stocks are performing better than large cap stocks.

Each sector ETF in this family is rebalanced quarterly to maintain the equal weighting.

An example of an equal weight ETF is the Invesco S & P 500 Equal-Weight Sector ETF (RSP), which is based on the S & P 500.

- Fundamentally Weighted Sector ETFs

This is a somewhat new type of index. Fundamentally weighted sectors are a type of ETF in which components are elected based on fundamental criteria as opposed to market cap. They can base their structure on a variety of fundamentals such as price, earnings, revenue, etc. A popular example of this type of ETF is the FTSE RAFI US-1000 Index (PRF) Fundamentally weighted ETF PRF. They have gradually been increasing in popularity among investors looking for a longer term, passive investment.

- Leveraged Sector ETFs

While leveraged sector ETFs provide another opportunity for exposure to the specific market sectors, they also have higher exposure to changes in price and volatility of the underlying index. For example, using a leverage factor of 2:1, if a sector index moves up 1%, the corresponding leveraged sector ETF would by up 2%. This works the same in reverse … if the sector index drops by 1%, the corresponding leveraged ETF would go down 2%. Leveraged ETFs are often used for short term strategies, rather than a “buy and hold” type of investment. ProShares Ultra QQQ (QLD) is an example of a leveraged sector ETF which tracks the NASDAQ 100 Index Leveraged Sector ETF.

In summary …

Sector ETFs provide a liquid, relatively low cost, method for a trader to add diversification to their portfolio. Rather than invest in stocks for a particular industry, sector ETFs can provide less risk than purchasing stocks in that industry. They allow a trader with a strong conviction about a particular market sector to gain exposure without having to choose individual stocks.

It may be worth considering the use of sector ETFs in your own trade plan. As with any instrument you consider trading, It is wise have a full understanding of all the benefits – and risks involved – in order to help you make informed decisions on your trading.

Are you looking for a mentoring program, trading group, or a group of like-minded traders to share both positive and negative trade experiences? Look no more, join today!