The decisions of millions of investors and traders affect the price movements in the options market. There are many useful statistics in addition to price movement that indicate what other market participants are doing. This article will focus on two factors many traders consider when trading options; daily trading volume and open interest.

Trading Volume

Daily trading volume represents the number of option contracts being exchanged between buyers and sellers. This exchange identifies the level of activity for that option contract. Volume can give you insight into the strength of the direction of the current market for the option's underlying stock/index. It is important to remember that trading volume is relative, and needs to be compared to the average daily volume of the underlying. A large percentage change in price, accompanied by larger-than-normal trading volume, is a good indication of the strength of the direction of the price move. On the other hand, large percentage increases in price accompanied by small trading volumes are less likely to indicate a market direction. That combination (large increase in price with low volume) may indicate that a reversal is forthcoming.

As mentioned above, for every buyer, there is a seller … the transaction between the two counts toward the daily volume.

Here is an example of trading volume in a put option XYZ at the strike price of $75 which did not have any contracts traded on a specific day. The trading volume is zero. The next day, a trader buys 10 put options and a market maker sells 10 put options – the total trading volume for that day is 10.

Volume is important when doing technical analysis, as it gives you important information about market movement. Traders view volume as an indicator of the strength of a trade – the higher the volume, the more interest there is in the underlying. Therefore, higher volume leads to more liquidity, so it can be easier to enter and exit a position more quickly. Volume, however, is relative. It needs to be compared to the average daily volume of the underlying.

Open Interest

Open Interest is a concept that can sometimes be confusing, especially to novice traders. Although it is usually one of the default data fields on most brokers' option chains – along with bid price, ask price, volume, and implied volatility – some traders ignore open interest. It is often considered less important than the option price, or current volume, Open interest provides some useful information veteran traders take into consideration when entering an option position.

Open interest will tell you the total number of each option contract that is currently open (in active positions). This includes contracts that have been traded, but not yet liquidated by either an offsetting trade, an exercise, or assignment. When you are looking at open interest of a particular option, you cannot tell whether the options have been bought or sold.

Using the same example of a put option XYZ at the strike price of $75; on a particular day 5 option contracts were bought, and 5 option contracts were sold. The open interest for this option is now 5.

An option's open interest decreases when buyers and sellers of options close out their positions. An option's open interest increases when investors put on new long positions, and when sellers put on new short positions.

One way to use open interest is to look at it relative to the volume of option contracts traded in any particular day. When trading volume is greater than the open interest, it is indicative that trading activity in that particular option was exceptionally high that day. In general, the higher the open interest, the easier it will be to trade that option quickly and at good pricing.

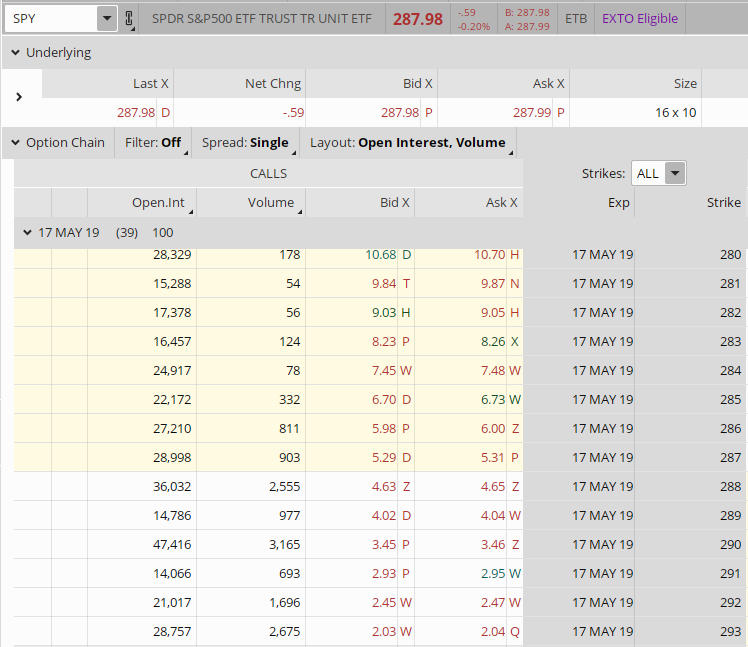

Below is an option chain for the underlying SPY showing the volume and open interest for various strike prices for the May 17, 2019 expiration cycle. This visual will give you a feel of the difference between the two.

Figure A. SPY Option Chain

What are some differences between trading volume and open interest?

- While trading volume is updated constantly throughout the trading day, open interest is calculated only once a day, at the close.

- An option's trading volume can only increase, whereas an option's open interest could either increase or decrease. Unlike an option's trading volume which includes contracts being bought and sold, open interest shows only the amount of contracts that are held.

- Volume of options can only increase, while open interest can either increase or decrease.

So why is Open Interest an important factor in option trading?

When you are looking at the total open interest of an option, there is no way of knowing whether the options were bought or sold – which is probably why many option traders ignore it altogether. One way to use open interest is to look at it relative to the volume of option contracts traded. When the volume exceeds the existing open interest on any given day, this suggests that trading in that particular option was exceptionally high that day. Open interest can help you determine whether there is unusually high or low volume for any particular option.

Open interest also provides information regarding the liquidity of an option. If there is no open interest for an option, it may be harder to get decent fills on a trade entry or exit. When options have large open interest, it means there are a lot of buyers, and sellers, which can result in an easier fill at a good price.

Summing it up …

- Volume and open interest both reflect the activity level and liquidity of options.

- Volume refers to the total number of completed trades. Hence, volume is a good measure of strength and overall interest in a particular option.

- Open interest reflects the number of option contracts held by traders in positions; whether they have been bought or sold.

We all know that trading is more of an art than a science.

A measure of what other traders are doing can be a valuable tool in your trading business. Daily trading volume and open interest are useful indicators to enhance your trade entries, and exits, at the best price and fastest execution.

Are you looking for a trading group, a mentor, or a place to share your trade ideas? Look no more, join today!

If you have additional thoughts on how volume and open interest help in your options trading, feel free to comment below.