Moneyness is a common term which is very important when looking at an option chain. Moneyness in an option chain refers to the relationship of where the price of the underlying is currently trading and the strike price of the option within the option chain.

If this is the first time you have heard the term Moneyness, the term may sound funny to you. But, it is one of the basic concepts of option valuation. Knowing and understanding Moneyness will help you to interpret the information within an option chain.

What is an Option Chain…

An option chain is a display or listing of all the call and put option prices, along with their corresponding premiums, for each expiration period. Each option chain can supply the bid-ask quotes of each strike price of the option in each expiration period. Using the bid-ask quotes allows a trader to estimate the premium of the option at each strike price and expiration period in the option chain. A trader can usually get a fill on an option order somewhere between the bid and ask price in the option chain.

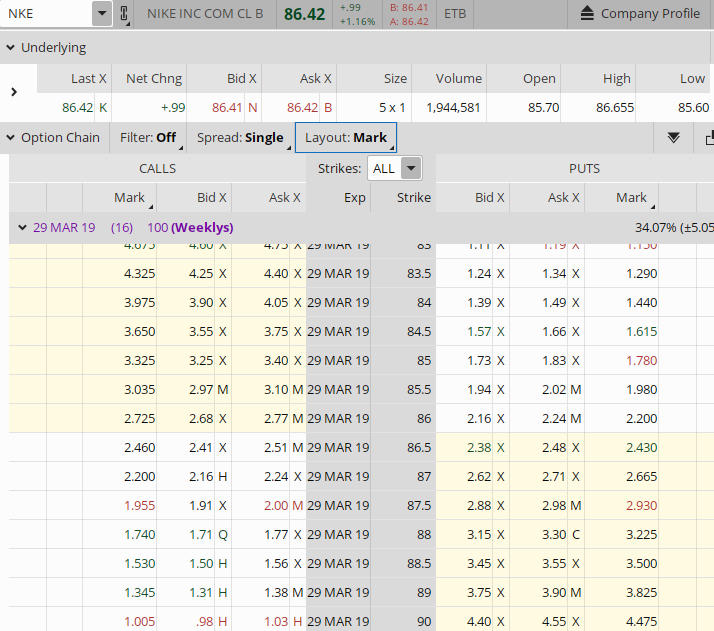

Figure A. NKE Option Chain

Figure A shows an option chain of NKE. The underlying price is 86.42 as shown at the top left of the option chain. The strike prices, and the bid-ask spread for both the calls and puts, are shown below using the 29 March 19 expiration cycle.

Understanding the Language of Moneyness…

Traders will often refer to an option as being In-The- Money (ITM), At-The-Money (ATM), or Out-Of-The Money (OTM). Other terms traders use are Near-The -Money, or Close-To-The-Money. This terminology is very important in reference to an option chain. Moneyness helps a trader to understand what the information in the option chain is showing.

What is an In-The-Money Option (ITM)…

When the strike price of a call option is below the current trading price of the underlying equity, it would be referred to as In-The-Money (ITM). As an example, a 86.00 call strike option contract would be ITM if the underlying equity price is 86.01 or greater. The equity must be trading above the strike price of the call option in order for the call option to be In-The-Money.

In Figure A, the price of NKE is trading at 86.42. The 86.00 strike call option is currently ITM. To determine how much the 86.00 strike call is ITM, take the current price of NKE (86.42), and subtract the 86.00 call strike of the option, which equals 0.42.

A put option would be ITM when the strike price of the option is above the current trading price of the underlying equity. In Figure A, let’s use as an example the 87.00 put option. The put option strike would be ITM if the current price of the underlying is below the strike price of the put option. Since the current price of NKE is trading at 86.42, and the put option strike price is 87.00, the put option is 0.58 ITM. This is calculated by taking the strike price of the put option (87.00) and subtracting the current price of NKE (86.42), which equal 0.58.

What is an Out-Of-The-Money Option (OTM)…

When the strike price of a call option is above the current trading price of the underlying equity, it would be referred to as Out-Of-The-Money (OTM). As an example, a 87.00 call strike option contract would be OTM if the underlying equity price is 87.01 or greater. The equity must be trading below the strike price of the call option to be Out-Of-The-Money.

In Figure A, the price of NKE is trading at 86.42. The 87.00 strike call option is currently OTM. To determine how much the 87.00 strike call is OTM, take the call option strike price 87.00 and subtract the current price of NKE (86.42), which equals 0.58.

A put option would be OTM when the strike price of the option is below the current trading price of the underlying equity. In Figure A, let’s use as an example the 86.00 strike put option. The put option strike is OTM if the current price of the underlying is above the strike price of the put option. Since the current price of NKE is trading at 86.42, and the put option strike price is 86.00, the put option is 0.42 OTM. This is calculated by taking the current price of NKE (86.42) and subtracting the 86.00 put option strike, which equals .42 OTM.

What is an At-The-Money Option (ATM)…

When option strike price is the same as the current price of the underlying, it is At-The-Money (ATM). An ATM call or put strike option is equal to the current price of the underlying.

What is a Near-The-Money Option …

When the price of the underlying is in close proximity, but not exactly equal to the strike price of the option, it is many times referred to as being near-the-money or close-to-the-money.

What Determines the Value of an Option at Expiration?

In-The-Money options have value because of their premium. If the option is In-The-Money, it can be exercised. If the option strike is ITM by only one cent, it will have value at expiration.

As an example to illustrate the value of an option at expiration, a trader bought a 86.00 strike price long call option which expires 29 MAR 19. The option expired, and NKE closed at 87.00. The trader who bought the 86 strike price long call option which expired on 29 MAR 18 realized a profit of 1.00. The option expired 1.00 In-The-Money, which created the 1.00 profit.

OTM options will only have value because of their premium. Since they are Out-Of-The-Money, they cannot be exercised. If an option strike expires just one cent out of the money it will be worthless.

In Summary …

Moneyness is a term which you as a trader will often hear mentioned. Now that you have more of an understanding as to what In-The-Money, Out-Of-The-Money, At-The-Money and Near-The-Money means, it should be easier for you to know what fellow traders are talking about. If an option strike expires In-The-Money at expiration, it will have value. An ITM option can be exercised. If an option strike expires Out-Of-The-Money at expiration it will have no value. An option that is Out-Of-The-Money cannot be exercised.

If you are looking for a trading community that has a wide variety of programs including one-on-one mentoring, educational classes, and interactive trading groups, look no more. Join today!

Please leave a comment below if you would like to add to the conversation.