by Tom Nunamaker | Jul 30, 2014 | Options trading, Trading

About thirteen years ago, as I was approaching retirement from the U.S. Air Force, I knew I would have more time to devote to trading. I have a friend in Australia with two PhDs who built his own trading software in the 90s. His software exclusively used the ES...

by Tom Nunamaker | Jul 29, 2014 | Options trading, Trading

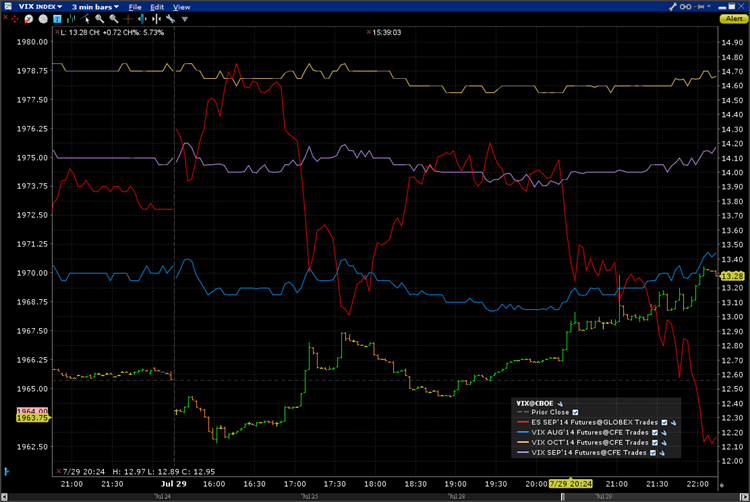

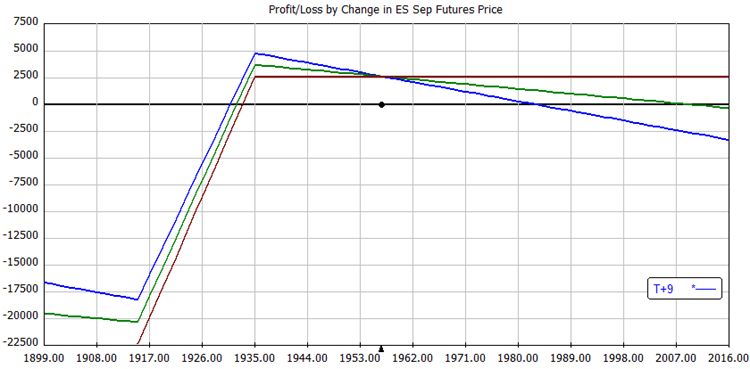

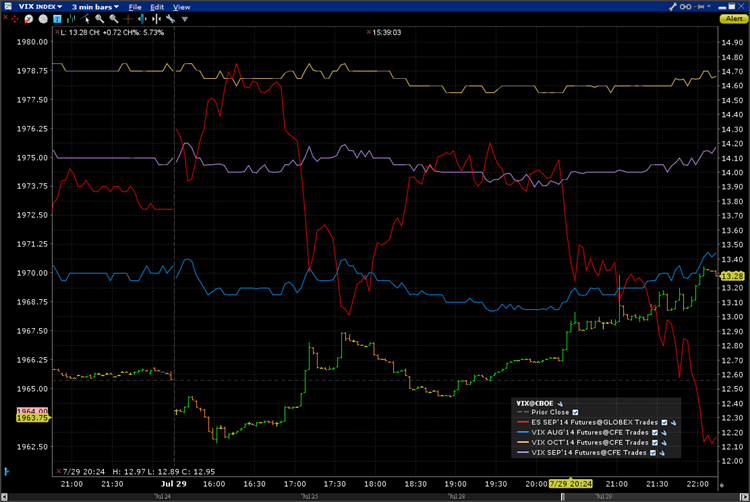

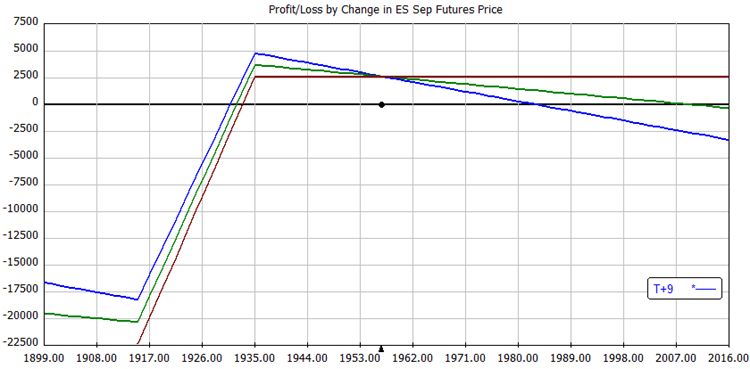

The video below reviews my SPX and ES futures options broken wing butterfly trades. I was filled on a put debit spread on the ES futures options after the regular market was closed. I'll update the trade with the new charts in the forums. Enjoy the video! Join us in...

by Tom Nunamaker | Jul 21, 2014 | Options trading, Trading

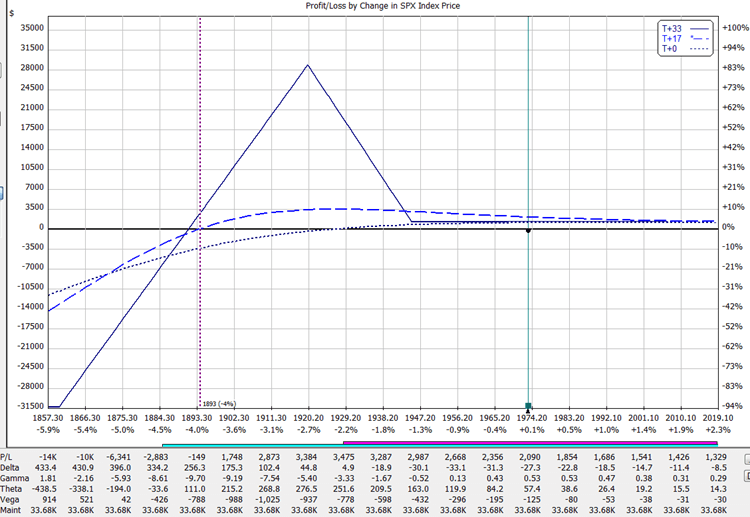

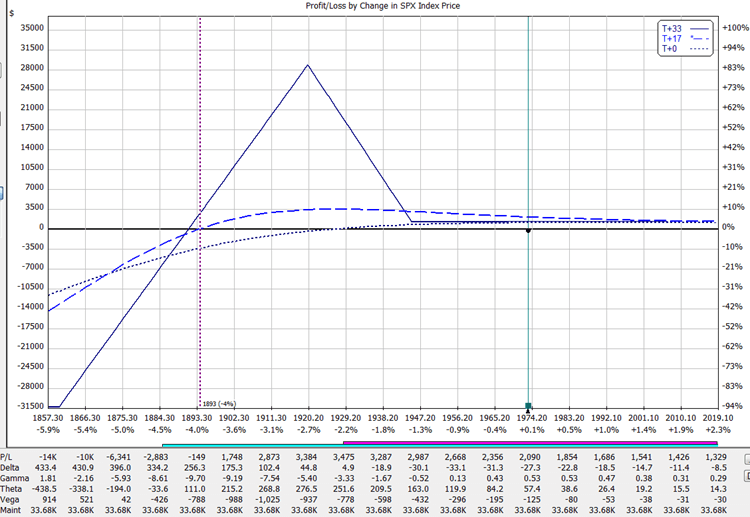

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Aug 23rd with 33 days to expiration. The ten lot of puts are at 1945/1920/1860. The 1920's were about a -19 true delta (in OptionVue). I sold two lots at a $1.90 credit and eight lots at a...

by Tom Nunamaker | Jul 14, 2014 | Options trading, Trading

One of the reasons I like option trading is you can be so creative. Buying a stock or future is one of two lines: sloping up at 45 degrees or sloping down and -45 degrees. That's it. With options, we have so much more flexibility. I gave a presentation on option...

by Tom Nunamaker | Jul 8, 2014 | Options trading, Trading

I recently wrote a primer on option synthetics. To continue the discussion on option synthetics, I talked to Seth Freudberg at SMB Training about presenting for the Options Tribe about Option Synthetics. Here's the replay of the meeting: You can download the...

by Tom Nunamaker | Jul 2, 2014 | Options trading, Trading

My wife and I have suddenly become addicted to My Kitchen Rules and MasterChef Australia. Naturally, this has us constantly thinking about the cooking world and perhaps visiting Australia to partake of the outstanding food found there! I read a really good article on...