by Tom Nunamaker | Jun 21, 2014 | Options trading, Trading

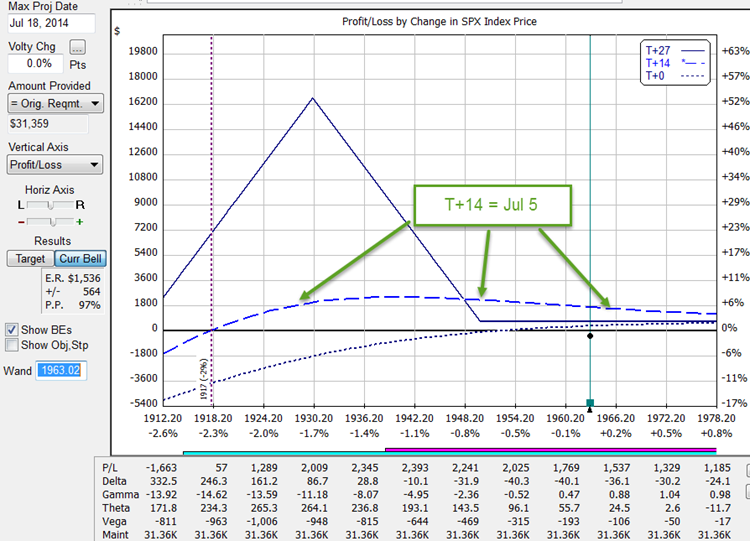

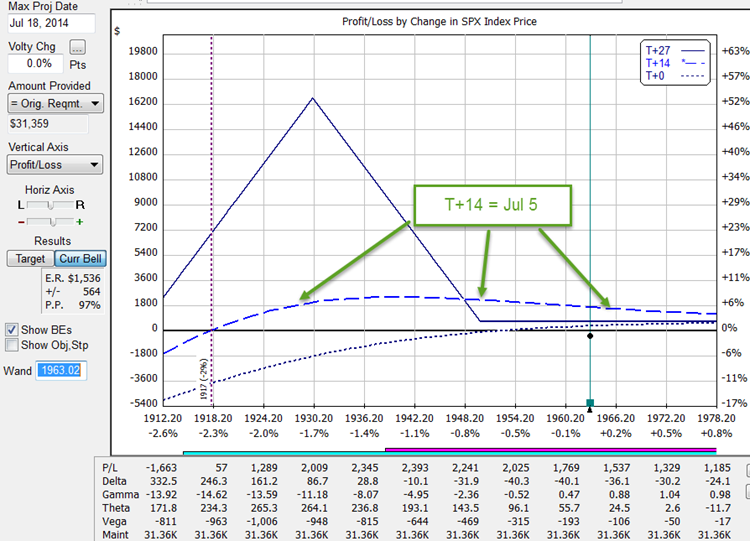

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Jul 17th with 28 days to expiration. The eight lot of puts are at 1950/1930/1870. The 1930's were about a -22 delta. The trade was put on with a little smaller credit than I like, but it's...

by Tom Nunamaker | Jun 19, 2014 | Trading

John Locke published a good article on trading goals earlier today. Trader's commonly ask “what can I make each month trading?” Can I make $1000 per month? $5000 per month? What's my number? This is really a question about what monthly yield or return want...

by Tom Nunamaker | Jun 14, 2014 | Options trading, Trading

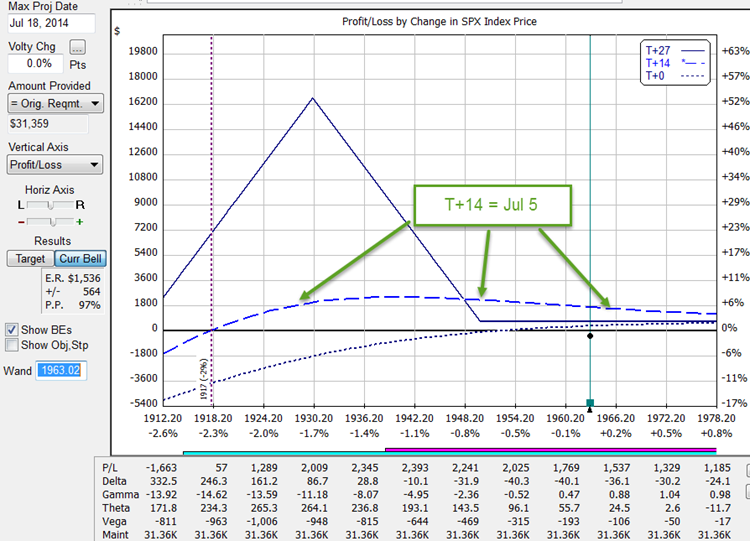

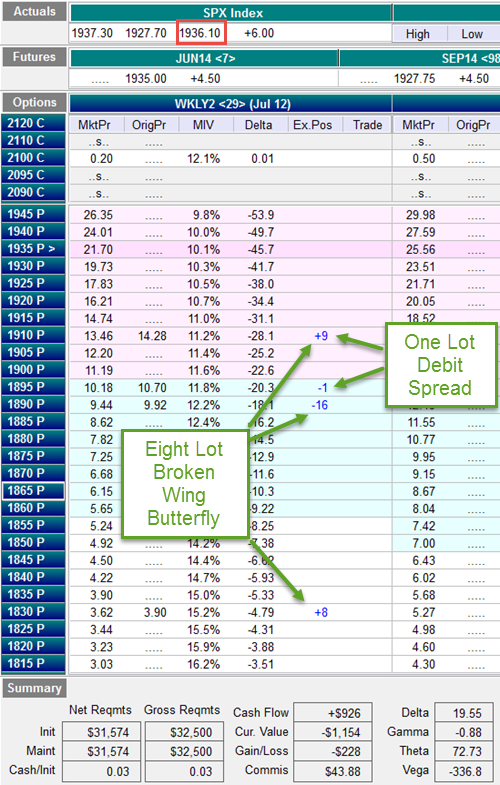

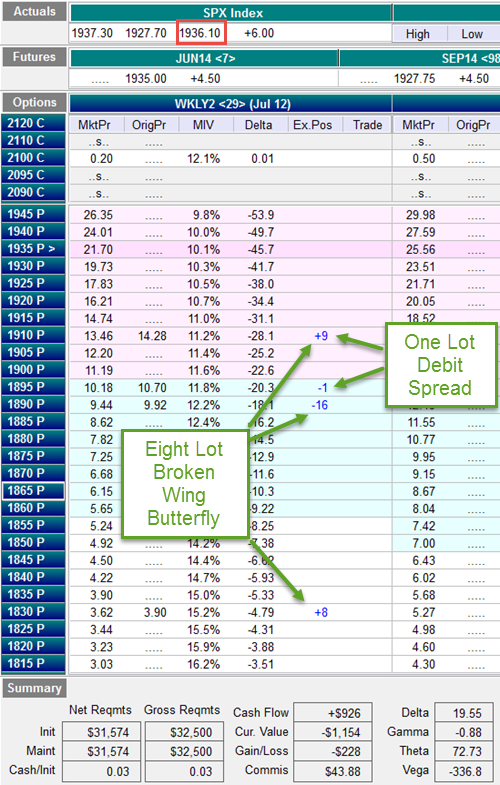

I put a new SPX Broken Wing Butterfly trade on yesterday with 29 days to expiration. It's an eight lot at 1910/1890/1830 with a put debit spread at 1910/1890 for a next credit of $926 on $31,574 of Reg T margin. That would be +2.93% in 29 days if held to expiration...

by Tom Nunamaker | Jun 11, 2014 | News, Trading

In an article from Zero Hedge: http://www.zerohedge.com/node/489531 “… Unless, or course, central banks finally are starting to shift their policy, realizing that they may have lost controlto the upside since algos no longer care about warnings that...

by Tom Nunamaker | Jun 10, 2014 | Trading

This is an interesting post from Jim Riggio in our forums where Jim discusses his charts and why he thinks the S&P 500 up move is getting strong… Jim's Post My “Momentum” charts are showing that the S&P's persistant move higher is...

by Tom Nunamaker | May 18, 2014 | Options trading, Trading

Let me ask you a question. Which position is more risky? Selling a Covered Call Selling a Naked Put Most people would say selling a Covered Call is a great investment strategy, but selling a Naked Put is terribly risky. If you understand Option Synthetics, you'll know...