I recently wrote a primer on option synthetics. To continue the discussion on option synthetics, I talked to Seth Freudberg at SMB Training about presenting for the Options Tribe about Option Synthetics. Here's the replay of the meeting:

You can download the PowerPoint slides here.

I covered

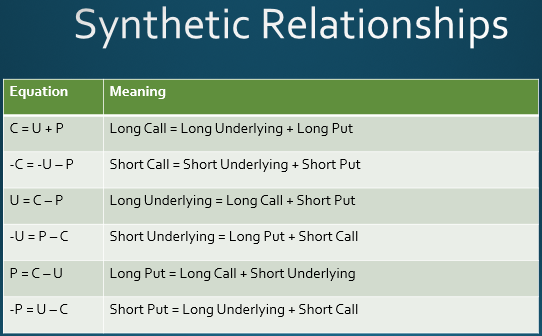

- Put Call Parity

- Synthetic Covered Calls

- Collar versus a Vertical Spread

- Buying or Selling an Index, Futures contract or Stock using only options

- Synthetic underlying positions with different strikes

- Rotating the Risk Chart

- Creating a Box

How can synthetics help me?

They give you a better understanding of how options work. In certain situations, you can use synthetics to unwind trades without giving up all of your profit. If slippage is large and you have two strikes to close, you can setup offsetting long and short synthetic stock positions to neutralize the risk. Then just hold it until expiration and the options will all cancel each other out.

I'll be showing an example in my presentation. I'll post the video here after it's ready to go.