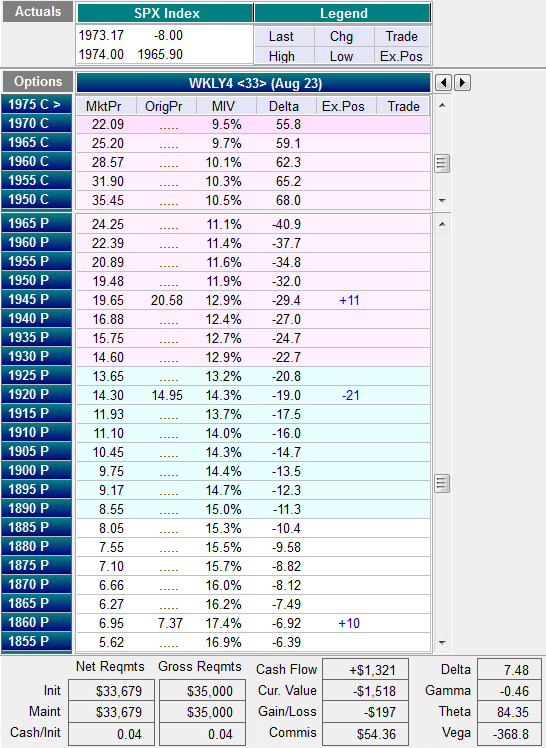

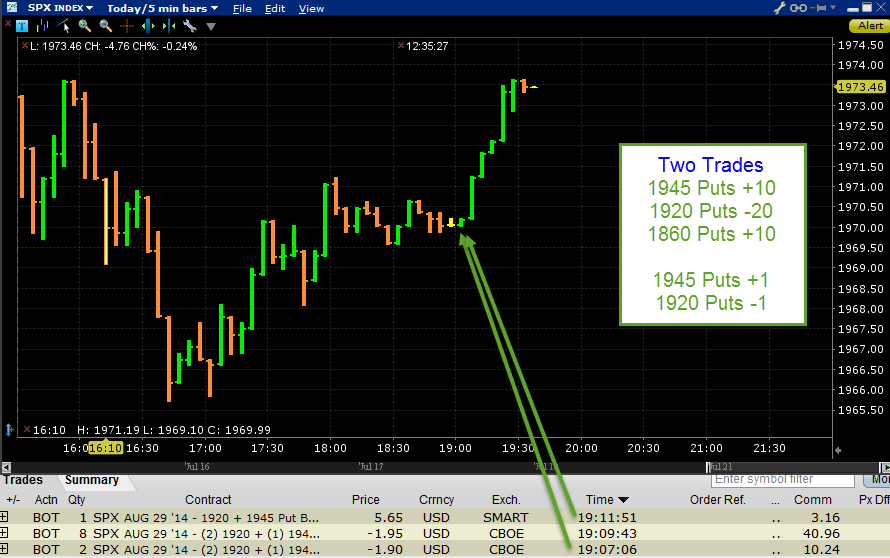

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Aug 23rd with 33 days to expiration. The ten lot of puts are at 1945/1920/1860. The 1920's were about a -19 true delta (in OptionVue). I sold two lots at a $1.90 credit and eight lots at a $1.95 credit. I added my put debit spread hedge at 1945/1920 for $5.65. My last trade that just expired did very well: +$1300.

I put the trade on in the middle of the trading day. Fills were at or near the mid-price and I didn't have to wait very long to get filled…just a few minutes.

OptionVue Matrix

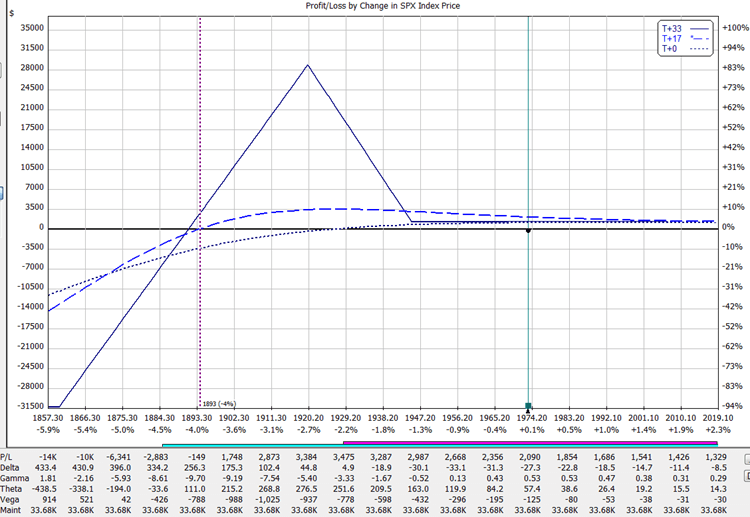

OptionVue Analysis Chart

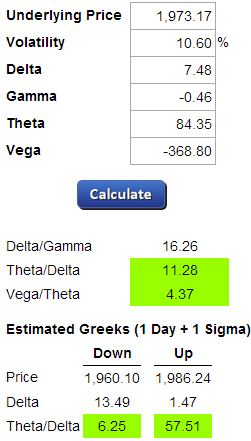

Greeks Analysis

Interactive Brokers Trade Log

Summary

The T+0 line is looking nice and flat. We're rallied nearly five points since I put the trade on so it's off to a good start.

The margin used is about $33,680 using Reg T. The Portfolio margin is just under $20,000 so quite an advantage at the moment.

I'm hoping SPX stays around the price it is at now or drifts a little lower. In 14 days, the returns would up to +4% to +10% in the 1920 to 1980 range assuming volatility doesn't change.

I'll post updates to the trade in this forum thread.