Has the topic of options been a challenge for you to understand? It can be confusing when you first start to learn about options. Once you become more familiar with what an option is and how the pricing is determined, you will feel more comfortable. As you get used to the terms and language of options, you’ll be on your way to even deeper knowledge.

Today you will learn about stock options and their relationship to the underlying stock.

The key concepts of options need to be understood before you can move onto more in depth conversations about options.

What is the definition of a stock option?

Investopedia.com states: “An option is a financial derivative that represents a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date)”.

To put it simply, an option is a contact which allows the owner of the option contract the right to buy or sell a stock at a particular price and time period.

The option contract has specifications that are the same for all contracts. Once you know the specifications of one particular option, you will be able to relate the same information to all options.

Just like stocks, option contracts are bought and sold in a market and have their own prices. The stock market has its’ own market where stocks are traded. Options are traded in a different market and are independent of the market where stocks are traded.

Some Essential Characteristics of an Option…

- The total cost of an option, which is also known as the premium, is determined by the price of the stock, the time which remains until expiration, the strike price, and the volatility.

- If you buy an option, you are known as a holder of an option. If you sell an option, you are known as a writer of an option.

- When you buy an option you have a right, but you are not obligated, to do something with the option. You can allow the option to expire, or you can choose to close out the position before expiration.

- An option is a depreciating asset. It has a limited life, due to the date it expires. All options expire at a certain point in time.

- Options are regulated by security laws and regulations.

- In basic terms, when you buy an option, you are what is known as” long the option”. When you sell an option contract you are what is known as ”short the option.”

An option chain provides details about an option

An option chain illustrates all puts, calls, strike prices and pricing information for a particular expiration period.

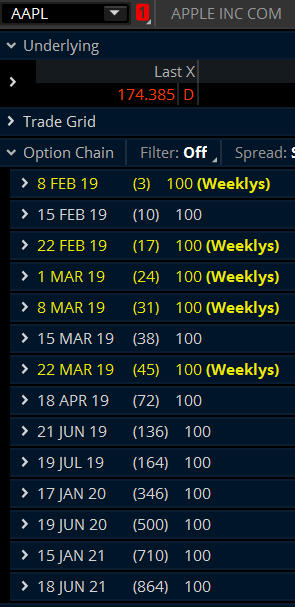

Figure A: AAPL Option Chain Showing Multiple Expiration Dates

An option can have many different time frames. A time frame consists of a certain amount of time before the option expires. For instance, you can have an option with 1 day until expiration all the way up to years until expiration.

As you look at Figure A above, you’ll see the various expiration dates offered for AAPL options.

(This snapshot was taken on February 5, 2019.)

The first option contract shown in the option chain is the 8 FEB 19. This contract will expire on February 8, 2019. This option contract expires in 3 days. This contract is known as a weekly.

Now, take a look at the last option the 18 JUN 21 in Figure A. This contract will expire on June 18, 2021. The option will expire in 864 days. This expiration is often referred to as a LEAP.

An option is a derivative…

An option is a security that is traded. It is known as a derivative product. A derivative is a product which derives its’ value from the price of something else.

A stock option derives some of its value from the price of the underlying stock. There are many other securities which have options such as interest rates, volatility products, commodities, bonds, currencies, indexes etc…

An option depreciates over time.

It has a limited life. The life of an option is determined by the expiration of the option. If the underlying price of the stock does not move and volatility stays the same as when the option was bought or sold, an option will tend to lose money as it approaches its expiration date.

Stock options are bought and sold as contracts.

One stock option contract is equal to 100 shares of the underlying stock. If you buy two stock option contracts it will equal 200 shares of the underlying stock. If you buy 10 option contracts it would equal 1000 shares of the underlying stock.

Many factors determine the price per contract of an option.

Items which affect the price of an option are as follows:

- Underlying price

- Strike price

- Time until expiration

- Volatility

- Interest rates (Cost of money)

- Dividends

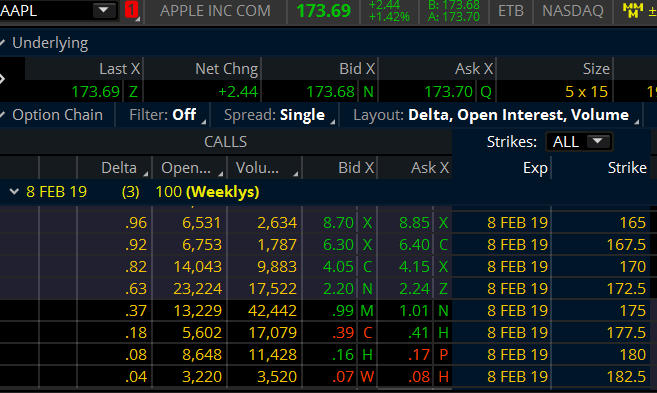

Figure B: AAPL Option Chain showing Call Option Strike Prices and Bid/Ask Price

The current, or last, price of the underlying stock AAPL at the time this snapshot was taken was 173.69.

The strike prices for the call options are listed in the column to the right titled Strike. Each strike has a corresponding value. As you can see the values or strike prices range from 165 to 182.50 in figure B. The strike prices which are in-the-money will be more expensive than the strike prices which are out -of- the- money.

Since the price of AAPL is currently trading at 173.65, the 165 strike price is in-the-money. The in-the-money 165 strike price option has more value than the 182.5 strike option which is out-of-the-money. When an option is in-the-money it has intrinsic value. Please refer to the article published on August 17, 2018 which you can find here: https://aeromir.com/00182/what-are-intrinsic-and-extrinsic-option-values

To determine the approximate price of the option you would take the average of the bid and ask prices. For example, the 165 strike price call option has a bid price of 8.70. The ask price is 8.85.

8.70 bid + 8.85 ask = 17.55 divided by 2 = 8.775.

Therefore, 8.775 is the approximate price for one contract of the 8 FEB 19,165 call strike.

How to determine the price of a position with more than one option contract…

Total Dollar Cost of a Position = Number of Contracts x Price per contract x 100

To determine the price of the option you would multiple the quoted price of $8.78 times 100 shares which equals $878.00. If you buy 10 option contracts at $8.78 it would cost you $8780.00.

When an option contact is bought or sold, it is essentially a sales agreement between two parties.

When an option is bought or sold it does not necessarily mean the buyer and the seller are tied together. In actuality, if you buy an option you do not buy it from the seller of the option. Also the seller of an option does not sell to the buyer.

An organization known as the Options Clearing Corporation, often called the OCC, is between the buyer of the option and the seller of the option. The OCC will sell to the buyer of the option and buy from the seller of the option. The OCC is neutral. This creates a favorable situation where the buyer and the seller of the option cam execute the trade without having the other party involved.

Summary of option contract specifications…

- Underlying stock – There is stock which represents and is the basis for the option.

- Type of option – The option can either be bought or sold by the owner.

- Strike price – This is the price for which the option can be bought or sold.

- Expiration Date – This is the time period the option will have before it expires.

- Price – This is the price the option is currently trading at in the market.

- Size – Each contract is a representation of 100 shares of the underlying stock.

You now have some knowledge about stock options. You will be able to take the next steps learn the many possibilities to trade stock options.

Be sure to become part of the Aeromir community so you learn even more from newbies and veteran traders.

It’s free.

Please comment below to share some of your knowledge about the basics of stock options.