Intrinsic and extrinsic option values are two components of an option chain which can be very important to an options trader. Knowing the intrinsic and extrinsic option values can help you as an options trader choose a good option candidate with its’ corresponding strike price and expiration. This can be a key factor in laying a foundation for you. This can help to give you an edge in your trading.

If you are new to options trading, please be patient – it takes time to become familiar with the terminology associated with options. It is time well spent for you and your success on becoming a consistently profitable trader.

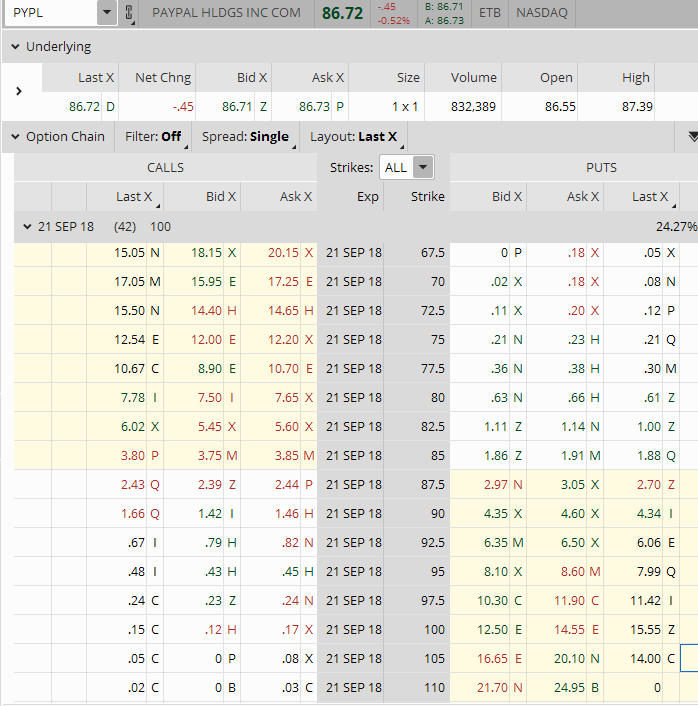

To start, let’s look at the option chain. An option chain shows all the puts, calls, and the strike prices with each corresponding option price for an underlying asset with its’ expiration date. Below is an option chain of PYPL, showing the current trading price of the underlying, as well as the Bid and Ask prices of each strike price. These are two important components to determine the intrinsic and extrinsic option values of the option.

Most trading platforms allow you to see the intrinsic and extrinsic value of each strike price, so it is not necessary to perform the calculations. However, for those who may be new to trading, I will cover several examples, going through the calculations of the intrinsic and extrinsic value of various strike prices.

Figure A. PYPL 21 SEPT 18 Option Chain

What is the Intrinsic Option Value?

To get an understanding of the meaning of the word intrinsic, let’s explore the definition. According to Merriam-Webster, intrinsic is defined as “belonging to the essential nature or constitution of a thing”. According to the Cambridge English Dictionary, intrinsic is defined as “being an extremely important and basic characteristic of a person or thing”.

The Intrinsic Value of a call option is the price the underlying is currently trading minus the strike price. If the value which is calculated is a negative number, then the intrinsic value is zero.

Calculating the Intrinsic Value of a Call Option

Let’s use the PYPL option chain which is shown above to determine the Intrinsic Value of the 80 Strike Call Option. PYPL’s last trading price was 86.72. Take the last trading price (86.72), and subtract the 80 Strike, which equals 6.72. Therefore, 6.72 is the intrinsic value of 80 Strike Call Option. It also means the 80 Strike Call Option is 6.72 In-The-Money.

Now let’s calculate the intrinsic value of the 90 Strike Call Option. PYPL's last trading price was 86.72. Take the last trading price (86.72) minus the 90 Strike, which results in negative -3.28. Since the result is a negative number, there is zero intrinsic value in the 90 Strike Call Option. It is currently Out-Of-The- Money, therefore, it does not have any intrinsic value.

Calculating the Intrinsic Value of a Put Option

To determine the intrinsic value of a put option, take the Option Strike price minus the underlying asset price which equals the intrinsic value of the put option.

As an example in Figure A, take the 90 strike put option minus the last trading price (86.72) which equals the intrinsic value of 3.28. The 90-strike put option is 3.28 In-The-Money.

Now calculate the intrinsic value of the 80 strike put option. Take 80 minus the last trading price (86.72) which equals a negative -6.72. Since the intrinsic value is a negative number this means the intrinsic value is zero. The option is 6.72 Out-Of-The-Money.

What is the Extrinsic Option Value?

The definition of extrinsic, according to Merriam-Webster, is “not forming part of or belonging to a thing “extraneous”. According to the Oxford Dictionary, extrinsic is defined as ”not part of the essential nature of someone or something; coming or operating from outside”.

Have you heard the saying “time is money”? “Time is money” applies to the extrinsic value an option. If you have a liability, you want to be paid for carrying that liability. Therefore, one of the costs of carrying that liability is the time value or extrinsic value of that option.

The extrinsic value of an option is many times referred to as “the time value”. The time value is one of the primary elements which affects the premium of an option.

An option contract will usually lose value as it approaches its’ expiration date. As a rule, an option that is currently trading Out-Of-The-Money, with 30 days left until expiration, will have more extrinsic value or time value, than an out-of-the-money option with 7 days until expiration. The reason for this is, there is more time left in the 30 days till expiration option than the 7 days to expiration option. Since there is more time remaining in the 30 day option, it has more extrinsic value.

Implied volatility also affects the extrinsic value of an option. Implied volatility is the degree that an underlying asset could move over a certain amount of time based on the current market prices. Implied volatility is only an estimate. If the implied volatility increases, the extrinsic value will rise. If implied volatility goes down, the extrinsic value of the option will also decrease.

In-The-Money-Options can have both Intrinsic and Extrinsic Values. Out-Of-The-Money options only have extrinsic value.

Calculating the Extrinsic Value of an Option

To determine the extrinsic value of an option for both the calls and the puts, use this formula:

Current option price minus the Intrinsic value = Extrinsic Value.

Calculating the Extrinsic Value of a Call Option

Let’s use the example of the PYPL 80 Strike Call Option which was calculated above to have an intrinsic value of 6.72. To calculate an approximation of the current option price of PYPL 80 Strike Call Option, let’s use the option chain in Figure A. The bid price is 7.50 and the ask price is 7.65, so the average of the two prices is 7.57. This is the approximate option price. Now, take the option price (7.57) minus the intrinsic value (6.72) which equals an extrinsic value of 0.85.

Now let’s calculate the extrinsic value of the 90 Strike Call Option. The bid price of the 90 Strike Call Option is 1.42 and the ask price is 1.46. The average price of the bid/ask is 1.44. The intrinsic value was calculated above to be zero. Now, take the option price 1.44 minus the intrinsic value zero which equals an extrinsic value of 1.44.

PYPL has a current price of 86.72. Therefore, the 90 Strike Call Option is Out-Of-The-Money. The value of the option is made up solely of its’ extrinsic value.

Calculating the Extrinsic Value of a Put Option

Let’s use the example of the PYPL 80 Strike Put Option which was calculated above to have an intrinsic value of zero. To calculate an approximation of the current option price of the PYPL 80 Strike Put Option, let’s continue to use the option chain in Figure A. The bid price is .63 and the ask price is .66. The average of the two prices is .65, which is the approximate option price. Now, take the option price (.65) minus the intrinsic value which is zero, which equals an extrinsic value of .65. PYPL is currently trading at 86.72, so the value of the 80-strike put option is made up entirely of its extrinsic value.

Now let’s calculate the extrinsic value of the 90 Strike Put Option. The bid price of the 90 Strike Put Option is 4.35 and the ask price is 4.60. Therefore, the average price of the bid/ask is about 4.48. The intrinsic value was calculated above to be 3.28. Now, take the option price (4.48) minus the intrinsic value (3.28) which equals an extrinsic value of 1.20.

Summing it up…

Intrinsic and extrinsic option values can help a trader to determine which option or options could help increase the probability of a profitable position. In-The-Money options can have intrinsic and extrinsic value. An In-The-Money option can be exercised. Out-Of-The-Money options only have extrinsic value and cannot be exercised.

Please leave a comment below to add to the conversation.

If you are looking for someplace to share your trade ideas, participate in a Trading Group, or learn experienced traders, look no more! Join now.