Put credit spreads, also called bull put spreads, are a very popular strategy used by many traders. The put credit spread is most often used when a trader expects a rise in the price of the underlying. It is constructed by selling a put option at a specific strike price, while at the same time purchasing an equal number of puts, at a lower strike price, in the same underlying and in the same expiration cycle.

Bull Put spreads can be used as a stand-alone trade, or as a hedge for a current position. A bull put spread can become profitable when the underlying moves higher after the trade is entered. It is also possible to profit from a bull put spread in a channeling market, but that will likely mean it will take more time in the trade to generate potential profit. Depending on where the spread is placed and length of time in the trade, they can also profit even if the price of the underlying moves down. But, if price of the underlying declines too much, or too quickly, it can lead to potential losses.

So what can be done to adjust Bull Put Spreads to potentially increase the probabilities of a profit, or reducing a potential loss?

Like most trading strategies, there are numerous ways to manage and adjust a put credit spread if it doesn't go as planned. These adjustments may allow you to increase your probabilities for profit, or lessen the potential loss, when the underlying moves against the spread. Adjustments to the bull put credit spread we will discuss are:

- Convert it to an Iron Condor by selling a Call Credit spread

- Roll down the spread to lower strikes to get further out of the money

- Roll the spread out further in time, keeping the strikes the same

- Convert the put credit spread into a Butterfly

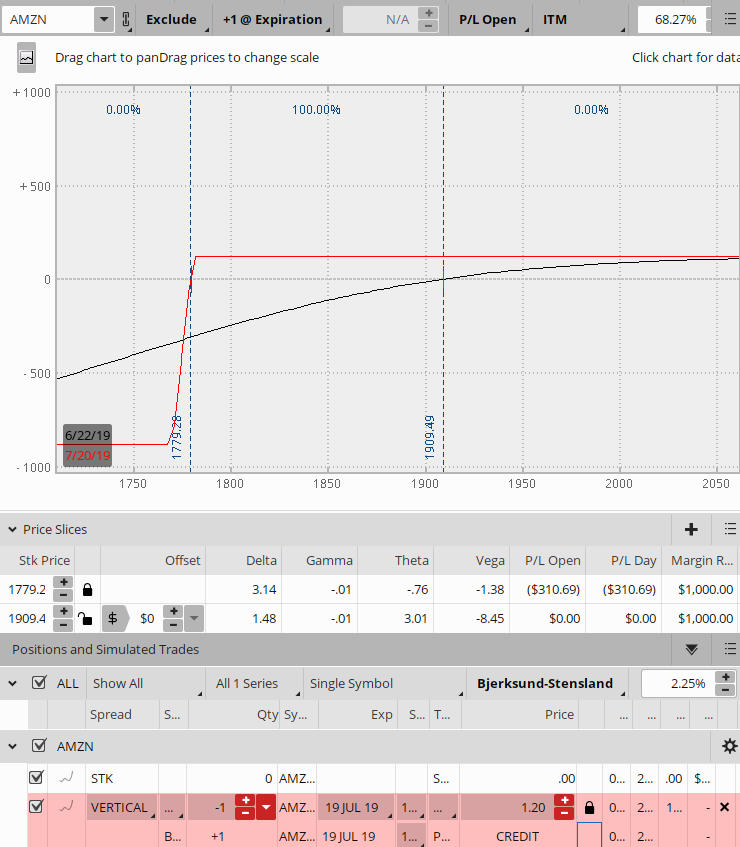

Let's use the example of a put credit spread on AMZN, opened 27 days prior to expiration, for the July 19 2019 expiration.

With AMZN trading at 1909, this example is using a -.15 delta short put, at the 1780 strike. The long strike was placed 10 points below the short at 1770. A credit of $1.20 was received.

Figure A. AMZN Put Credit Spread, -1780/+1770

A few things to note in Figure A:

- The maximum risk is calculated by taking the width of the wings (10 points), or $1,000, less the credit received ($120). So the maximum risk at entry is $880 (before commissions).

- The maximum profit is the credit received, or $120 (less commissions).

- The position is long delta (+1.48), so a move up would help the position.

You expect AMZN to rise in price and would like to take the full profit.

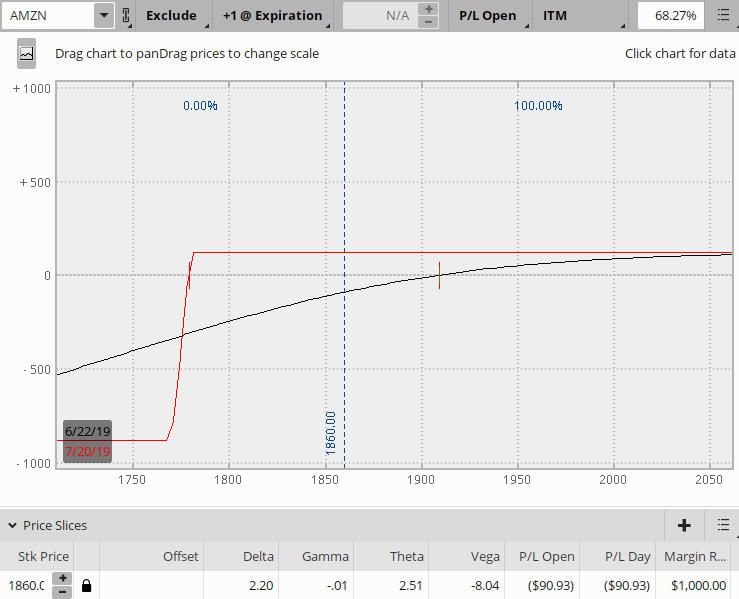

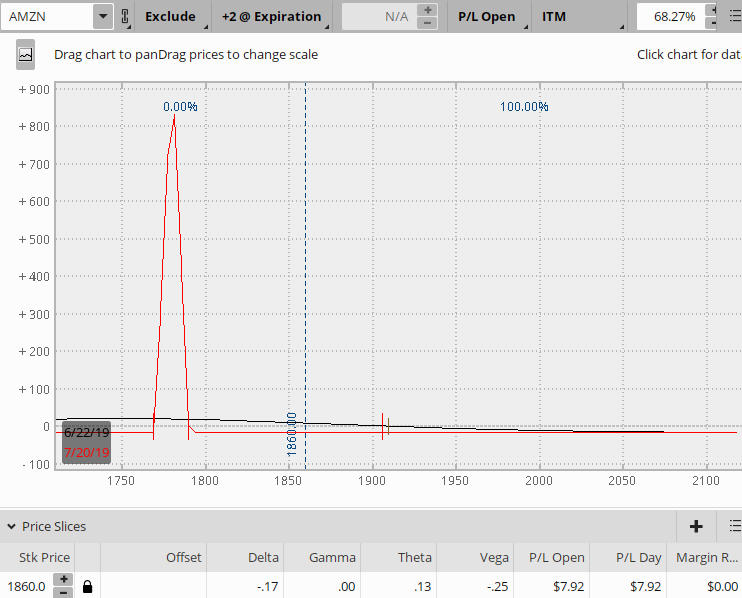

Rather than move up, AMZN begins to decline in price to a point where you are not comfortable holding a bullish position. The graph below is an example of the same credit spread, only AMZN has moved down in price to 1860 from the entry price of 1909. The position delta has increased to +2.20, and the P/L is down by ($90.93). This P/L represents 9% of the maximum risk ($880).

Figure B. AMZN Put Credit Spread at Potential Adjustment Point

Depending on your market opinion and your trade plan guidelines, you may choose to exit the trade, take the loss, and move on.

However, if you choose to remain in the trade, here are the four possible adjustments you may consider as an alternative to closing the position:

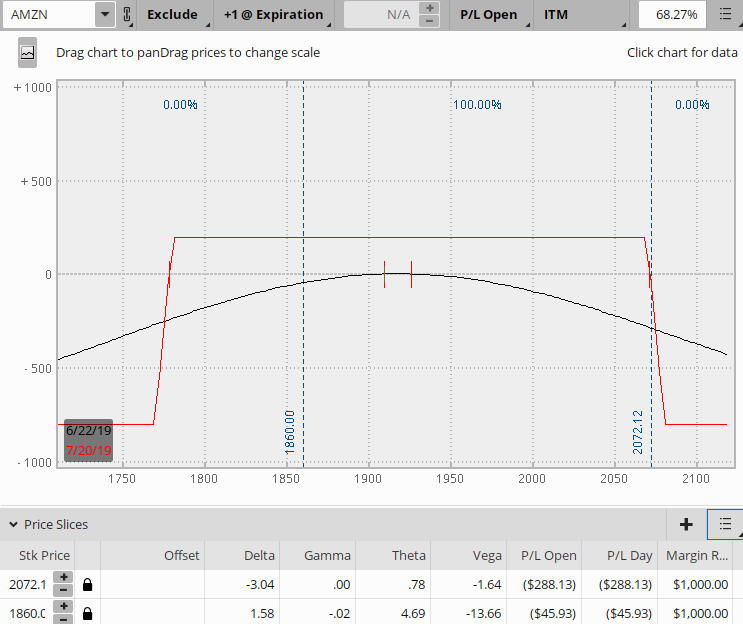

1) Convert the put credit spread into an Iron Condor by selling a Call Credit Spread

To help you understand this first adjustment, you may want to refer to the article published on 1/27/19 on Iron Condors. The article can be found here: https://aeromir.com/00357/introducing-the-iron-condor

Figure C. AMZN Put Credit Spread Converted to an Iron Condor, -1780/+1770 Put, -2070/+2080 Call.

The call credit spread strikes are placed at the short call strike of 20 with a delta of .10, and the long call strike at 2080. Selling the call credit spread creates the upper wing of the Iron Condor as pictured in Figure C. The credit for the call credit spread was $.75.

A few things to note in Figure C:

- The maximum risk is still the width of the wings (10 points), or $1,000, less the credit received for both puts and calls ($120 + $75). So the maximum risk after converting the put credit spread into the Iron Condor is $805 (1,000 less $195), before commissions. Most brokerages only charge margin on one side of an Iron Condor, but it's important to check with your broker to be sure that is the case on their platform.

- The maximum profit is the credit received, or $195 (before commissions).

- By converting the put credit spread to an Iron Condor, you now have risk on both sides rather than one.

- The position delta has been reduced to +1.58 from +2.20.

Converting the bull put spread into an Iron Condor may be a good adjustment to consider. There is one thing to keep in mind before making this adjustment: The natural tendency of many underlyings over time is to have a bullish bias. By adding a Call Credit spread, you are creating upside risk. This may or may not be relevant for the underlying you are trading.

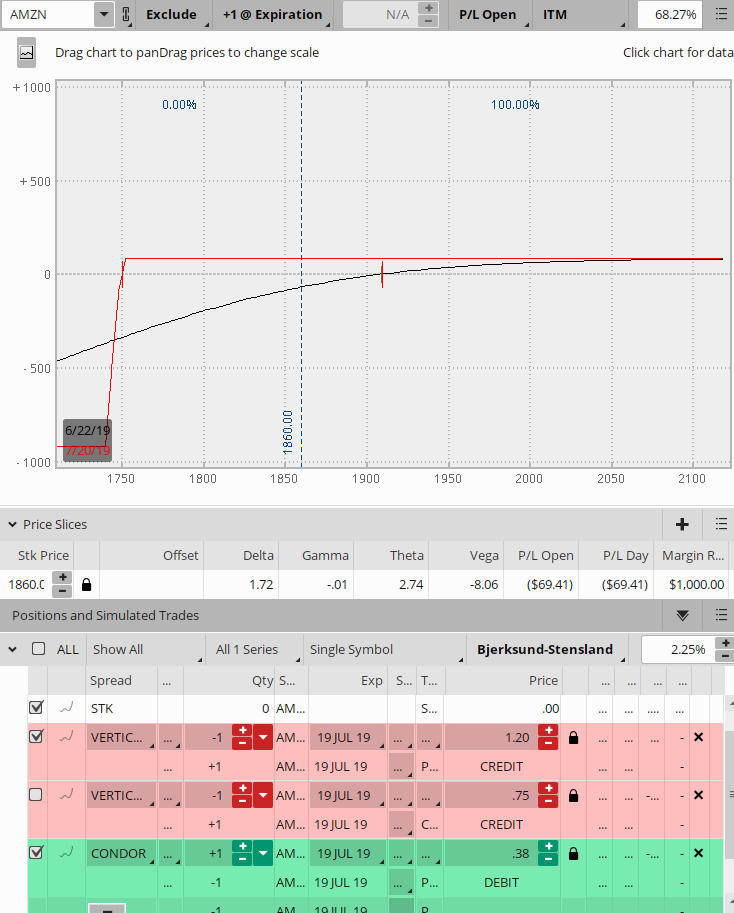

2) Another adjustment to potentially help a threatened bull put spread is to consider rolling the position down to strikes that are farther away from the money, using the same expiration cycle.

Using our same AMZN example, you could consider rolling down the -1780 put spreads 30 points lower, positioning the spread at -1750/+1740. This can be accomplished (based on the Think or Swim platform) by buying a “Condor Roll” as seen in Figure D below. The debit to make this adjustment at the present time is $.38.

Figure D. AMZN Put Credit Spread positioned with strikes at -1750/+1740.

A few things to note in Figure D:

- The maximum risk is still the width of the wings (10 points, based on margin on one side only), or $1,000. In our example, the roll created a debit of $.38 to roll down the short and long puts.

- The maximum profit is the original credit received ($120), less the debit to roll the spread down ($38), or $82 less commissions.

- The position delta is still long delta, but has been reduced from +2.20 at the adjustment point to +1.72.

- There is now just a little more room to the downside by making this roll.

3) The next adjustment to potentially help a threatened put credit spread is to consider rolling the position to an expiration cycle farther out in time, but keeping the strikes the same.

Figure E. AMZN Put Credit Spread, rolled out from 19 July 2019 expiration to the August 16 2019 cycle, same -1780/+1770 strikes.

A few things to note in Figure E:

Rolling the position out in time is called a “vertical roll”. In this example we have rolled the position from the July 19 cycle to the August 16 cycle, still with the same -1780/+1770 strikes. The roll in this example was executed for a credit of $1.17.

- The maximum risk is still the width of the wings (10 points based on margin on one side only), or $1,000, less credit received.

- The maximum profit is the original credit received ($120), plus the credit to roll to August 16 ($.1.17), or $237, less commissions.

- You have decreased the position's long delta, from +2.20 at the adjustment point to +1.65.

- You may choose to consider this adjustment if you feel that AMZN will rebound, but want to give it a bit more time.

4) Here's another strategy to potentially help a threatened bull put spread: convert the credit spread into a Butterfly.

This time, you don't really feel that AMZN will rebound and move to the upside, but still want to stay “in the game”. If that is the case, you may consider converting the put credit spread into a butterfly, thinking that perhaps AMZN “could” move down into the butterfly prior to expiration.

Figure F. AMZN position after converting put credit spread into a butterfly.

A few things to note in Figure F:

- To create a butterfly, we have added a debit spread at the put strikes of +1790/-1780 for a debit of $1.38. The greatest profit potential at expiration is when price is at around 1780, as seen in Figure F.

- The butterfly has two short strikes at 1780, one upper long at 1790, and one lower long at 1770.

- By converting the put credit spread into a butterfly, the $1,000 margin requirement is reduced to zero (verify with your brokerage). The maximum risk for this butterfly is the debit paid for the butterfly ($138), less the original credit received for the bull put spread, ($120). So you are now risking only $18.

- You have reduced the position delta from +2.20 on the original put credit spread at its adjustment point to -.17 for the butterfly.

- When considering converting your put credit spread into a butterfly, such as the one pictured in Figure F, keep in mind that IF the underlying were to drop to around 1780 into the “sweet spot” of the butterfly, it usually requires staying in very close to expiration to reap the benefits. This type of a butterfly is also called a “Time Bomb Butterfly”.

You may want to consider rolling the bull put spread into a butterfly when you do not think the underlying price will rebound.

In summary …

There are many, many strategies, and adjustments to consider which may help a threatened put credit spread. If you trade put credit spreads and are experienced with the strategy, you probably already have your “preferred” method of adjustment if the underlying moves against your position. For those who may be less experienced in trading credit spreads, hopefully this article will give some useful tips on adjusting them, rather than closing the position, if things don't go as planned.

If you have found a particular adjustment that has been beneficial to you, or one that may not be mentioned here, feel free to comment below.

Are you looking for a trading group, educational alert service, or perhaps a mentoring program? Look no more; join today! You will find a comprehensive list of programs that can be useful for any type of options trader.

Just noticed a typo in the butterfly adjustment

The greatest profit potential would be at 1780 not at 2780

Thanks for the catch, Mike – Corrected!

Rolling down & out will often slash the profit potential of the trade. Can also add some capital (i.e., more lots) to the trade when rolling in order to keep the profit potential worthwhile.

Thanks for your comment, Mark – Certainly adding additional capital is a viable consideration for some traders, thanks for sharing!

Why did you choose for a debit when turning the position into a Butterfly instead of collecting a credit and create an Iron Butterfly?

When turning the position into a Butterfly, does the Number of contracts matter?

It depends on what you’re trying to do. If the contracts are the same, you’ll have a symmetric butterfly. If you want to lean long or short, you can adjust the number of contracts to create a broken wing butterfly leaning in the direction you want to lean.

I’m sorry, if you trying to protect a credit spread and you have 10 contracts does the butterfly have to be 10-20-10 to cover?

I have entered fubo credit bull spread for exp Jan 15. 2021.

The stock is not staying above 42 which is my break even so I’m likely to lose my collateral which is over 7000.

How would you fix the trade and limit my loss at this point ?

Any inputs I could use. I have a few hours tomorrow to if I can fix it.

Sorry for the late reply. To get more timely answers to questions like this, please use our discussion forums at https://forums.aeromir.com/

To “fix” a losing trade, I’ve found the simplest way is to close it and move on. You should have a plan for what you will do if the underlying security gets to a certain price.

For example, the Parking Trade uses a guideline if your loss exceeds one or two times your credit, exit the trade.

Recently I had entered a Tesla credit spread -830/+795 for expiration of 19 Feb 2021.

The stock was closed at 796 yesterday 16 Feb.

How could I rescue this trade

What was your plan before you put the trade on? Do you have a maximum loss pre-determined? TSLA moves quite a bit and that’s a fairly narrow spread for TSLA. There is likely some time premium still remaining so you’re probably not at the maximum loss. Here are some things you could do:

In the future, please think about what you’re going to do in a trade if it goes against you BEFORE putting the trade on. That’s part of your risk management 🙂