BLOG

New Money and New Markets

Wayne discusses the internet revolution version two and how significant this will be world wide.

The FED Life Preserver

Wayne discusses the FED's life preserver to the economy.

Wayne's Market Commentary for the Week of March 16th

Wayne discusses the housing market and why home prices are still rising

Wayne's Market Commentary for the Week of March 9th

Wayne compares the Sleep Well Portfolio to RIsk Parity (RPAR) and SPY.

Portfolio Effects of Increasing Volatility

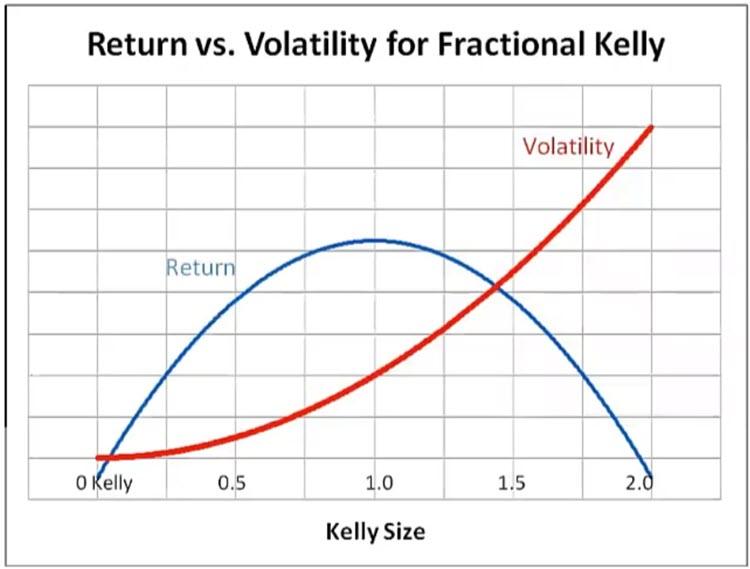

Wayne Klump presented how increasing volatility effects portfolio performance on the Round Table. Wayne compared two portfolios with different win percentages and returns. Wayne talked about the Fractional Kelly Criterion and how to apply it.

The Every Day Calendar

Turn resolutions into habits by using small incremental changes and the Every Day Calendar to help stay on course.

Forex Basics Quiz

A short quiz on some of the basics of trading foreign currencies (forex).

Order Entry Quiz

Take our short order entry quiz to see how much you know about different order types at your broker.

The Boxcar Trade

Dan Harvey created the Boxcar Trade. He showed it to us on March 24th and again on April 7th in Trading Group 1. This is a video compilation of those two meetings.

Recent Big Moves and Intra-Day Swings with Night Owl™

Mark Ansel discuss using Night Owl™ to trade big moves and big intra-day swings.