It's now been 6-1/2 months of live trading with ExperSignal and the results have been excellent.

The time weighted return from the original account I started live trading is now +57.74% in 6-1/2 months. The maximum draw down is -5.06%

Download the redacted broker statement

NOTE: Past performance is not necessarily indicative of future results.

As I have been using ExperCharts software, I have had a journey to learn the best way to extract new trading signals.

I started out trading futures options but didn't like a few things about them. Namely:

- As the options went further in to the money and closer to expiration, they became progressively less liquid and the slippage increased substantially.

- Futures options spreads priced over $5 are in $0.25 increments. Coming from trading SPX options, this was very annoying trying to get filled at the mid-price when the mid-price was not on a $0.25 increment.

- Liquidity during the overnight session can be low and fills difficult. Since I am trading a few friend's accounts, I knew this was going to be a problem going forward.

- Commissions were a problem with spreads and multiple legs priced at about $2.50/option or more.

So I switched to trading forex and futures.

The problem with trading forex was a few of my friend's accounts didn't have trading permission for forex.

This left me with trading just futures.

The advantages of trading futures are that they are extremely liquid and the bid/ask spreads are very tight. Commissions are also reasonable. At Interactive Brokers I pay $4.94 for most futures round trip.

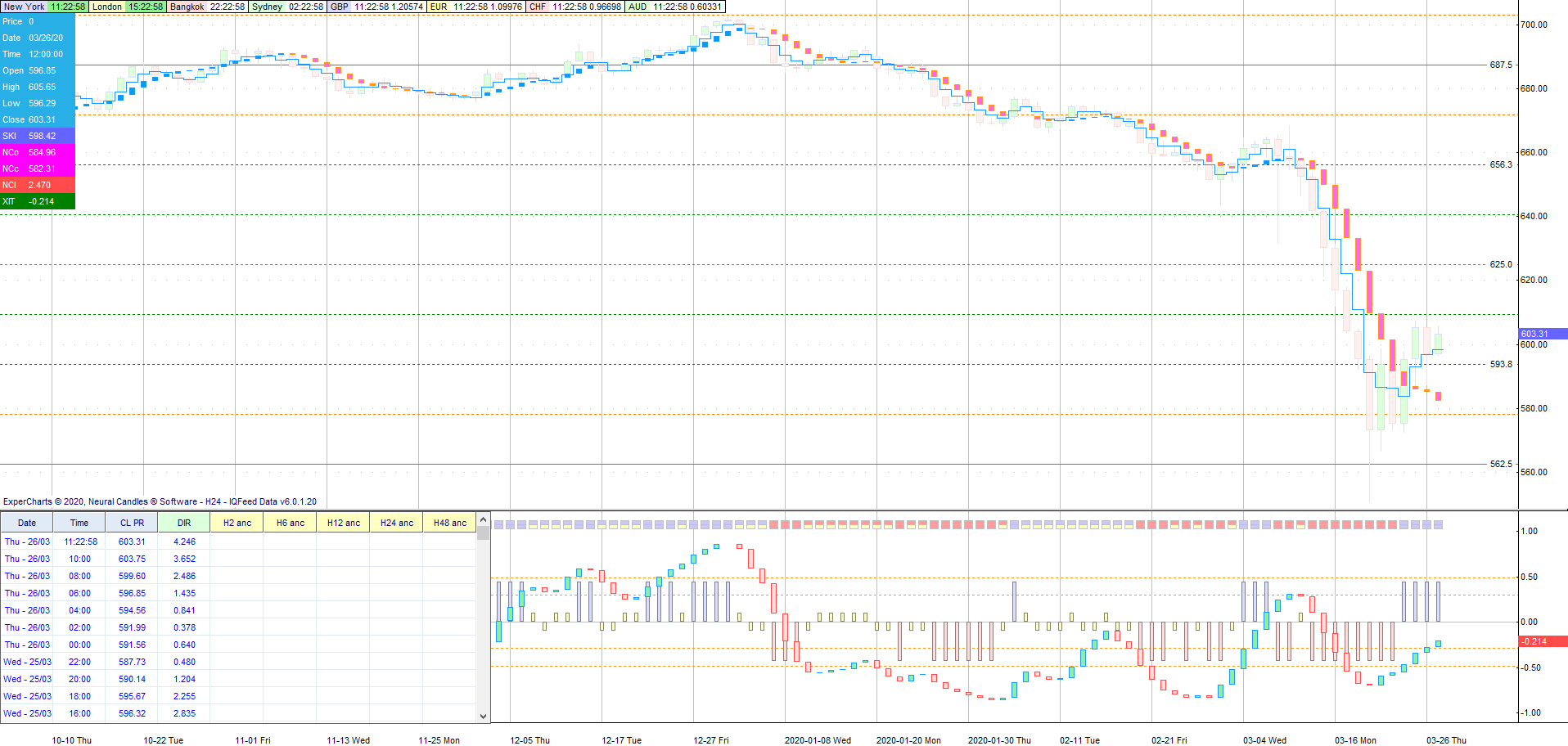

The initial training I had on how to use ExperCharts focused on the 2-hour chart. Daniel (the creator of ExperCharts) trades intraday and is used to short time frames.

Daniel later suggested a technique using the 6-hour charts, which helped but I still had some losing trades mixed in. More than I like.

Daniel recently suggested a modified approach that also uses the 24-hour chart.

- I start with a 48-hour anchor. This is the software's best guess for the next major turning point. This is based on five time frames.

- Once I have a new 48-hour anchor, I look at the 24-hour chart for the clues that the market is turning. Only after the 24-hour chart is showing signs that it has changed direction do I look for a new entry

- Now that I have a confirmed 48-hour anchor, I use the 2-hour chart to help time the entry.

I made a video showing the current method I use for finding a new trading signal:

The latest long signal on the AUDUSD is working out great so far. +136 pips as of the close on Friday. This one trade alone is +11% for the $25,000 units I trade.

The Results Have Been Really Good

This new method seems much easier to trade

The futures trades I had before this new method were much shorter in duration. Lasting hours or a day or two.

This new method that focuses on the longer time frame direction should be able to catch much larger moves.

Less trades with larger potential.

But How Hard is it to trade futures or forex?

I know I was a bit apprehensive about trading futures and forex but it's extremely similar to trading stocks. I made a video explaining the differences and talked about trading forex, currency futures and currency futures options here:

Do You Have to Trade Futures?

No. The signals are the underlying forex pairs; however, you can trade the signals in a variety of ways:

- The Spot forex market

- Currency futures and futures options

- ETFs based on the underlying currency. Either the ETF or options on the ETF.

I'd like to help our community during this COVID-19 period.

I have been resisting sending information out about the COVID-19 virus but I feel the pain as everyone else is. We are under a shelter-in-place order in Colorado.

I am going to reduce the price of ExperSignal for the first month for new subscribers to $15. This will pay for the SMS messages I have to send to you but it's essentially free.

I don't make anything at this price.

I just want to help everyone and I feel ExperSignal is something that can help a lot of people. You just have to try it.

If it's not for you, you're only out $15 and you've gotten some experience trading currencies.

To join me with ExperSignal for $15 for the first month, click on this button:

Summary

ExperSignal has been generating healthy returns. My friends and I have been very pleased with the results so far. I like the fact that ExperCharts self-adapts to the market so it should keep working for years.

I want to help as many traders as I can. Currency futures haven't had quite the extreme moves we've seen in the U.S. equity markets lately. It's a nice way to diversify any portfolio.

I hope you join me!

Hi Tom,

Do the signals sometimes come in the middle of the night and therefore not easy to keep up with ?

Thanks and hope you are staying well,

Sally

Hi Sally,

The signals do come at any time of day; however, you have plenty of warning that a signal is developing. Normally at least a day or two in advance.

Hi Tom

exper signal for which market, forex, future, stock and SPX?

If we sign up , we will got signal or we also got experchart software ?

The ExperCharts software only has two copies in the world to protect the intellectual property. I generate trading signals based on the software. The software I use currently is an end-of-day time frame with 2, 6, 12 and 24-hour bars. An intraday version is nearly ready that will use 5, 10, 15 and 30-minute charts. The software is also getting a major addition of engines that generate the trade entry and exit signals. The software is quite complex and issues are being resolved to the code and the feature space, but it should be ready in the near future.

Hi again Tom

expersignal that options selling and buying or direct buy future, buy forex, or stock?

Currently futures and forex. You could trade the currency ETFs like XFE but the liquidity isn’t terrific.