Self-Adapting Trading Signals

How often have you found a good trading system only to see it degrade as time passes?

We see this all of the time.

Iron Condors worked great a few years ago, but stopped working a few years later. Bearish Butterflies became popular but they too struggled in recent years.

Besides the price movement you see in a market, the underpinning structure of the market is evolving over time. Because the structure is changing, any trading system's parameters have a decaying usefulness.

Does this mean we are doomed to constantly searching for the next new trading system that is working now?

ExperSignal‘s trading signals are derived from the ExperCharts and NetPipsFX software written by Dr. Daniel Lyons, who is a dual PhD in applied mathematics and cosmology. The engines are very advanced analysis engines. ExperCharts/NetPipsFX retrains itself over time and adjusts itself to the current market conditions.

What is ExperCharts and NetPipsFX?

ExperCharts and NetPipsFX are event classifier trading technologies using neural network algorithms. They use multiple software engine sets to identify and confirm real-time turning points in markets that are constantly changing.

The engines use cross-validation to avoid over-fitting data. The data is divided into three data sets:

- A learning set

- A testing set

- A validation set

The three sets are subjected to successively harsher examination and determine if parameters can migrate or adapt within the three data sets. The objective is to reject false relationships.

The software examines sets of pivot points. Let's look a little deeper.

[bne_testimonials custom=”4164″]

Pivot Patterns and Turning Points

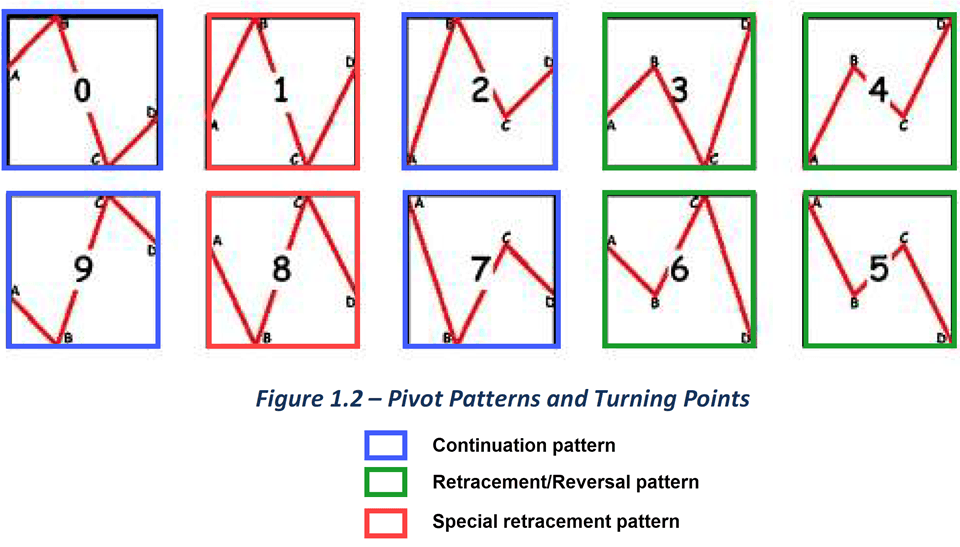

Every individual turning point in a market can be described in 10 equations called pivot points. Half of the pivot patterns are bullish and the other half are bearish. They mirror each other:

ExperCharts groups four pivot point sequences to form a maximum of 140 specific patterns. These patterns are analyzed to determine the type of move in place.

30 of these 140 patterns can be grouped into three specific turning patterns which occur on a daily basis. These particular patterns exhibit very specific characteristics that can be detected by recognition techniques and timing entry/exit points more accurately.

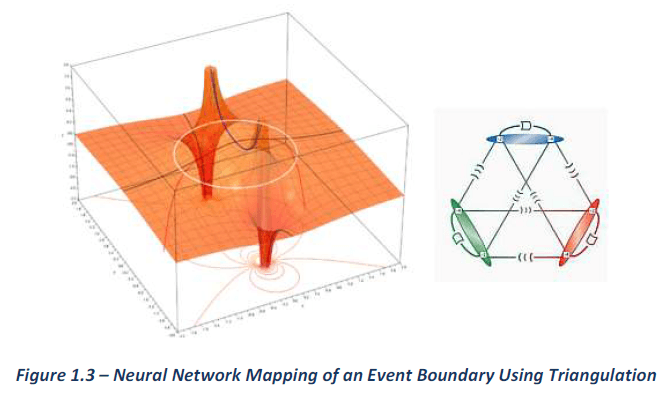

The engines use a process of triangulation to pinpoint critical events and turning points. Traditional programs tend to use a single domain such as time or frequency. These are normally a rework of price and not considered optimal. Subscribe Now

ExperCharts processes inputs in at least three domains, across multiple timeframes and in parallel to prepare data correctly.

For example, suppose you are in a fighter jet chasing an enemy. You have to hit your target with your laser beam.

For example, suppose you are in a fighter jet chasing an enemy. You have to hit your target with your laser beam.

You can use triangulation to map the trajectory of your target jet. Despite the target's ability to speed up, slow down, veer left, right, up or down, you can use parallel calculations to generate a series of curves or waves which will allow you to track the target jet very accurately.

It is possible to reach a point that the resulting trajectories may reach a point where the target jet can't defy the laws of physics. This is when your target reaches an event horizon, or boundary of potential impact.

Your target jet won't be able to alter its flight path quickly enough to avoid being hit by your laser beam given you now have coordinates of a confirmed trajectory .

The markets are no different when mapped as wave forms and trajectories. Prices rise and fall but behave in a way that can be mapped with enough accuracy using multiple domains that potential turning points will enter an event horizon or boundary which can be classified by one of the 10 pivot patterns.

At this point, market momentum will present a profitable opportunity.

[bne_testimonials custom=”4188″]

ExperCharts/NetPipsFX Triangulation

ExperCharts and NetPipxFX use three child neural networks. Each specializes in classifying a particular turning point cluster. The children networks are monitored by a mother neural network to make a final decision

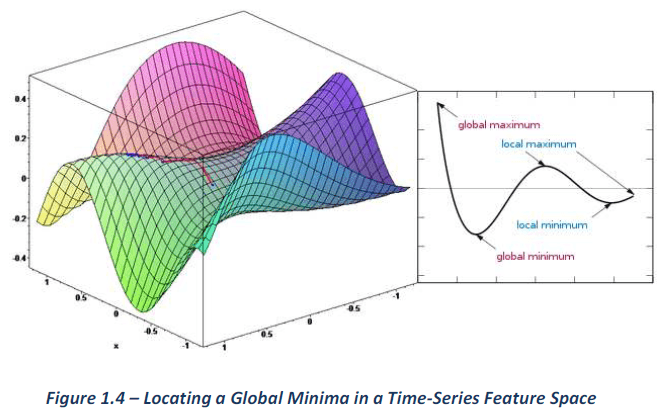

Each child network seeks minima's within defined feature space which correspond to specific pivot points. The mother network adjusts the spatial position of each child (relative to each other) to gain perspective for identifying global minima or a true turning point.

The mother network approach ensures the final decision is not taken in isolation, which is the case in a rule based program.

ExperCharts and NetPipsFX Data Preprocessing

Much effort has focused on developing data pre-processing routines to minimize end-point-distortion and other errors to correctly classify as close as possible to ideal in real-time.Subscribe Now

All data is normalized during pre-processing

Normally in a financial time-series, an end point can be affected up to n bars (often 16 or more) into the future due to the Heisenberg Uncertainty principle. ExperCharts and NetPipsFX reduces this distortion to 1-2 bars which allows visual indicators to be designed as leading and not lagging type indicators.

Data normalization in ExperCharts and NetPipsFX do not require any user defined inputs as data is manipulated by way of Kohonen networks and perceptrons in a self organizing process.

The decision classifiers are trained specifically to identify three key groups of turning points and are very accurate in doing this. Provided the same type of inputs are used and normalized correctly, it doesn't matter what market is processed.

ExperCharts and NetPipsFX will behave exactly the same in any market.

The behavior and event classification will be performed in exactly the same manner without any need to adjust input factors. Only the price scale changes. This is vastly different to how most systems are designed and work.

[bne_testimonials custom=”4190″]

Development History

ExperCharts and NetPipsFX started in the 80's with a company providing OCR for checks for banks. Eight PhD Mathematicians worked on hand print recognition algorithms.

Eventually, these algorithms were applied to the financial markets.

The software currently has over 1 million lines of code and does millions of calculations per second.

ExperSignal and NetPipsFX was conceived in 2003 but it has taken 18-years to get the software to where it is ready for a signal service.

ExperSignal and NetPipsFX Symbols

ExperSignal uses these symbols:

- GBPUSD

- EURUSD

- AUDUSD

- USDCHF

We are providing the ExperCharts and NetPipsFX market turning points but you can trade these signals in many ways:

- FOREX currency pairs. This has the most granularity.

- Futures based from the currency pairs (6B = GBP:USD and 6E = EUR:USD). Futures have higher margin requirements than FOREX.

- Futures options. Can have liquidity problems when options get deep-in-the-money and have more slippage than FOREX or the underlying futures contract. Great way to define risk.

- ETFs based on the currency pairs. The ETF itself has enough liquidity but options on the ETFs have minimal open interest and are not recommended except while learning.

The trading block will trade futures and/or futures options. Trade examples made in the service will either be from the trading block or from live private accounts being traded, which could include FOREX trades.

[bne_testimonials custom=”4191″]

Trading Forex, Currency Futures and Currency Futures Options

Tom made a video explaining the differences in trading the Forex, currency futures and currency futures options to help you understand the differences.

Frequently Asked Questions

Do you provide trade details so we can follow along in our trading analysis software?

Yes. We have a tab with all open positions trade messages. The open positions tabs also shows the adjustment history.

What is the margin required for one trade?

A typical options trade can be one futures option contract, which should be a few hundred dollars. One futures contract is about $8,300 of initial margin. FOREX has 50:1 maximum leverage in the United States. You could trade $100,000 of currencies for $2,000 with most brokers. You can trade small amounts of FOREX with corresponding smaller margin.

If I trade futures, should I use stops?

You can but intraday we don't use stops as we are watching the markets during any open trades. Not placing protective stops also shields you from other market participants knowing what your stop price is.

Can I get filled at your trade alert filled prices?

Most likely. We often don't get the best prices. Since these are longer term trades, you can put a GTC order in and let it sit at a better price. You can often get filled at better prices than we do.

Are you front running the trades?

No. We have been running trade alert services for several years. The standard way we do trades is to

- Send subscribers a trade message of our working order

- Transmit our order to the broker after we send our subscriber message

- Send subscribers a trade message with our fill prices

Are the trades based on real trading or simulated trading?

ExperSignal's main product is the change in market direction. It is either long or short.

Trades sent to subscribers are live trades at either Interactive Brokers or Striker securities with friends accounts Tom is trading.

Are the trades recorded?

All trades are fully documented and available to you as long as you are a subscriber.

Trade Alerts Are For Educational Purposes Only. Past performance does not necessarily predict future results.

The purpose of ExperSignal is to provide information about when we think the markets are changing direction. The trade examples are live trades at either Interactive Brokers or Striker Securities. They are intended to be examples for you get ideas for your own trades.

Example trades in this service are made in real time in live accounts at Interactive Brokers or Striker Securities using Reg-T margin.

[bne_testimonials custom=”4192″]Looks good! What is my investment?

There are two ways to participate with ExperSignal

- Traditional Trade Alert Service.

- Join the trading block at Striker Securities

Traditional Trade Alert Service

You pay only $50 for the first month.

We will likely increase this over time as we build a longer track record and add more symbols. Your price will never increase as long as you maintain your subscription.

ExperSignal is $150 per month

Prices may increase soon due to the new signal generator.

Subscribe nowYou Don't Want To Do the Trading Yourself?

Join the trading block at Striker Securities

The Striker Securities trading block is a collection of individual accounts that are traded with one trade. The trade is allocated to each individual account after execution.

You decide how much capital you want traded.

We will trade futures and possibly futures options in the trading block.

Subscription price is $150/month for every unit of $25,000 of capital traded, rounded down.

For example:

- $0 to $49,999 is $150/month

- $50,000 to $99,999 is $300/month

- $100,000 to $124,999 is $450/month

- $125,000 to $149,999 is $600/month

You pay the commissions but there are no other fees. No admin fee and no performance fee.

Billing is done at Aeromir.com.

Trading block customers also have access to the ExperSignal Trade Alerts page!

Contact Dan Neenan at Striker Securities for details of how to join the trading block at 312-987-0043 or d.neenan@striker.com