How to evaluate the Sleep Well Portfolio (SWP)?

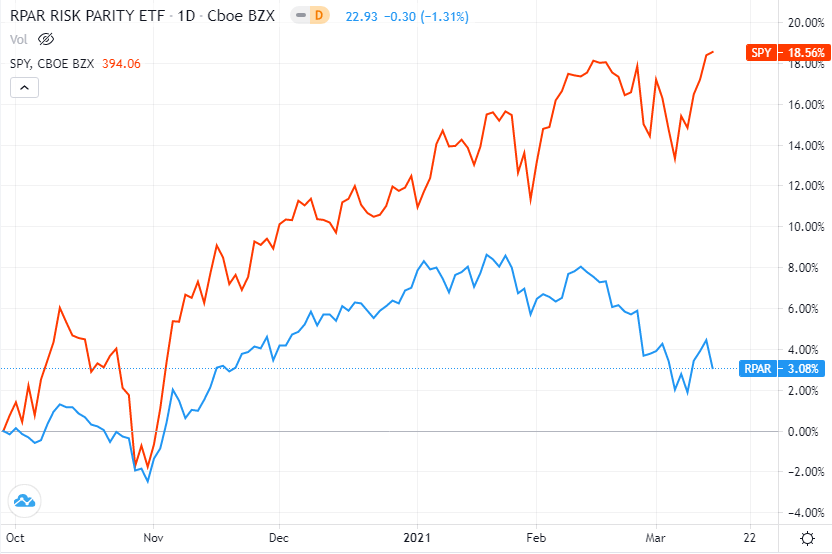

The closest thing that I draw comparison to is the Risk Parity approach to portfolio construction, AKA All Weather Portfolio. Luckily, there is an ETF called “RPAR” that is reflective of the All-Weather Portfolio.

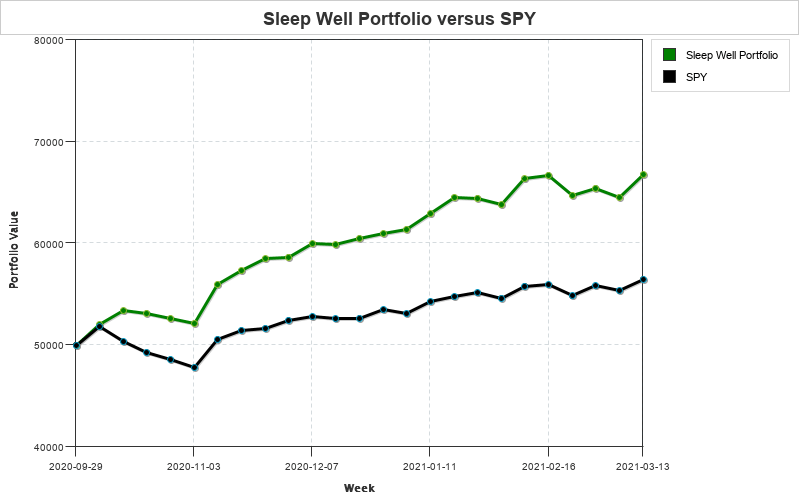

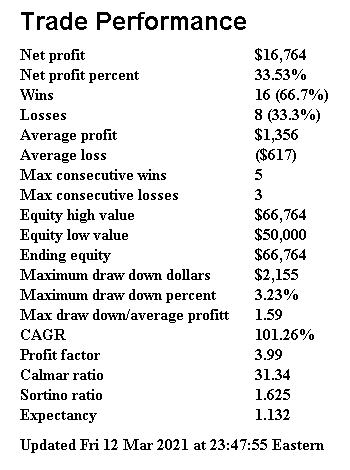

RPAR is significantly underperforming the S&P 500 and the SWP and had a nasty correction over the last few weeks. A measly +3.08% in the same timeframe as the S&P +18.56 and the SWP +33.53%.

since 29 sep 2020

RPAR uses the traditional static allocation models that plague modern finance. Having bonds and gold in this last pullback in equities really shows how much correlated risk can drag down a portfolio, without giving the return needed to balance it out.

RPAR will absolutely do better at reducing daily swings due to having allocations to all assets all the time, but it suffers from the illusion that low daily swings = lower risk.

This is the furthest from the truth.

True correlation on longer time frames is the real risk.

The Sleep Well Portfolio is still invested heavily in equities and after this recent pull back, it slid into the more volatile assets. Sometimes we use SPY as a volatility buffer and during a pull back we push assets over to the assets that have higher upside to downside potential. That is exactly what is happening this week.

Wayne publishes market commentaries every week. Sleep Well Portfolio members have access to all of the market commentaries Wayne publishes.

You can get Wayne's market commentaries for free for 30-days with no risk.

If you like them and want to continue receiving them after 30-days, consider subscribing to the Sleep Well Portfolio at https://aeromir.com/sleepwell

Get Wayne's Market Commentaries for 30-days