BLOG

SPX All PUT Flat Fly Class

Mark Fenton released an update to his popular SPX All PUT Flat Fly class. Mark's Income Trade Alerts trades the Flat Fly as one of several trades

Mark Fenton's Opening Bell and Trader's Lounge & Help Desk

Former Sheridan Options Mentoring 16-year mentor Mark Fenton is bringing his Opening Bell, Trader's Lounge and Help Desk to Aeromir!

Easy Peasy Iron Condors

Tom Nunamaker is teaching a class next week about his Easy Peasy Iron Condor, which is a 0 DTE SPX iron condor strategy.

New Trade Planner for Option Traders

New trade planning tool for option traders. Calculates units, profit target price, maximum loss price, commissions and fees and yield on allocated capital.

A14 Weekly Option Strategy Workshop for 2023

Amy Meissner taught her A14 Weekly Option Strategy Workshop about 18-months ago. Before that class, she tripled her account in 15-months. Amy codified a set of rules for others to trade in a similar manner. The original workshop was a huge success with many traders...

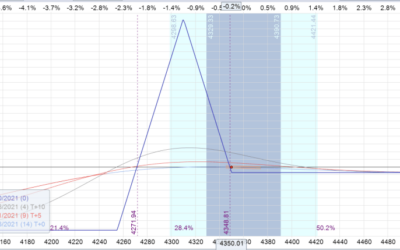

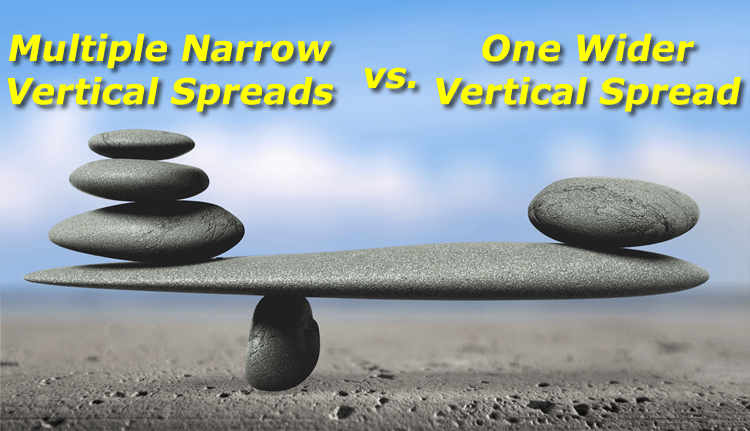

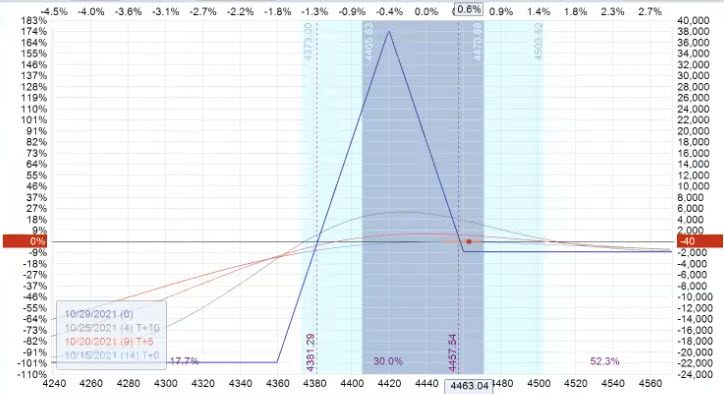

The Trade-Offs of Using Wide and Narrow Vertical Spreads

Many options traders sell put credit spreads. They can sell them alone or in combination with other spreads to create more complex spreads like an iron condor. First, let’s define what a put credit spread is. A put credit spread (also known as a short put spread) is...

Trading In For A Better Life

Tom did an interview explaining how he started Aeromir and his philosophy.

Amy Meissner's New A14 Weekly Option Strategy

Amy Meissner tripled a trading account in 15-months. The A14 Weekly Option Strategy embodies the methods she used to triple her account.

Timezone Trade Alerts

Amy Meissner's Timezone Trade is coming to Aeromir.com on Thursday!

Are we Loose or Tight?

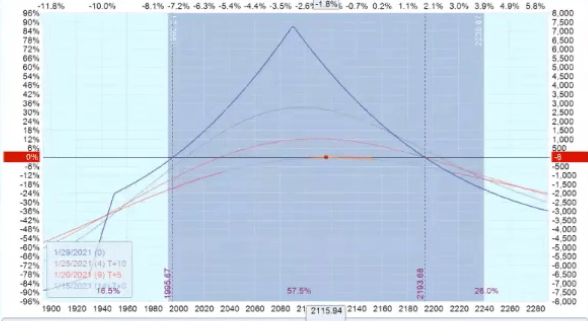

Wayne discusses the internet revolution version two and how significant this will be world wide.