Many options traders sell put credit spreads. They can sell them alone or in combination with other spreads to create more complex spreads like an iron condor.

First, let’s define what a put credit spread is.

A put credit spread (also known as a short put spread) is an options trade that:

- Both puts expire at the same time

- The higher strike put is sold

- The lower strike put is bought

The seller of the spread receives a credit in their trading account equal to the difference in the price of the two puts.

The margin is the width of the spread minus the credit received.

For example, consider these two puts, which expire on 30 Jan 2023 (today is Sunday 29 Jan 2023):

If you sell the 4015 PUT for $1.95 and buy the 4010 PUT for $1.50, you will collect a $0.45 credit.

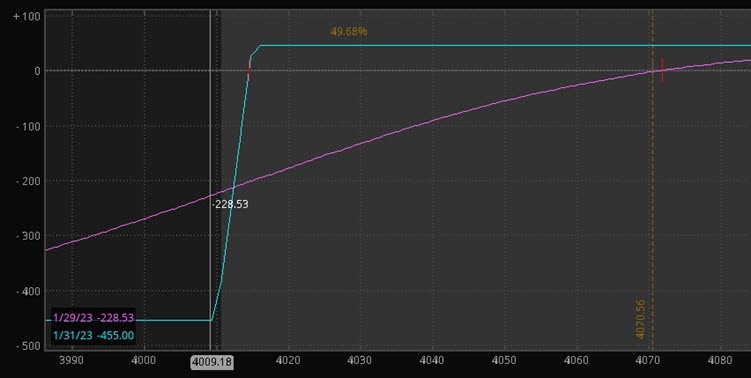

The spread is $5 wide (4015-4010). Your margin required is $5 minus the $0.45 credit received = $4.55 or $455 of margin required. This is what your risk chart would look like:

The short strike of this trade (4015) has a Delta of -0.0949, which means there is approximately a 9.49% chance that this option will expire in-the-money, or have some real value at expiration.

This also means that there is a 90.51% probability that the spread will expire worthless. If it expires worthless, you keep the entire $0.45 minus commissions that you pay your broker.

The probability of success makes this trade very attractive.

The downside is that the risk to reward ratio is 9:1. The underlying price (SPX in this case) only has to move a little bit against you for your loss to equal the credit you received:

Let’s compare using a 5-wide spread to a 20-wide spread.

Each spread will use roughly the same margin.

To do this, the 5-wide spread will use four spreads versus one 20-wide spread.

Let’s start with the 20-wide spread:

The margin required is $1865 with a $135 credit. Position Delta is +5.9468. SPX has to fall to approximately 4053.76 to have your unrealized loss equal to the credit received. If SPX instantly fell to your 4015 short strike, the position would be down approximately -650 (ignoring increased volatility).

The 4-lot 5-wide spread looks like this:

The margin required is $1820 with a $180 credit. Position Delta is +7.8661. SPX has to fall to approximately 4054.27 to have your unrealized loss equal to the credit received. If SPX instantly fell to your 4015 short strike, the position would be down approximately -750 (ignoring increased volatility).

Comparing the two:

Pros and Cons:

- The 5-wide spread has a bigger credit and higher Theta (time decay)

- The 20-wide spread has lower Theta (time decay) and lower Vega (volatility risk)

- The 20-wide spread has a slightly lower price to have the unrealized loss equal to the credit received.

- The 20-wide spread will lose less if the market reaches the short strike quickly.

- If the market closes 5-points below the short strike, the 5-wide spread has a maximum loss of -$1820. The 20-wide spread would lose approximately $780.

The 20-wide spread is equivalent to three spreads: 4015/4010, 4010/4005, 4005/4000 and 4000/3995. Three of the spread would expire worthless at 4010 so the only spread to lose would be the 4015/4010. - The 5-wide spread needs four contracts to be filled so the commissions are four times as much. For example, if you pay $1.24 per contract, to open and close four spreads, the commissions would be $1.24 x 4 x 4 = $19.84.

The 20-wide spread would be $1.24 x 1 x 4 = $4.96

Conclusion

The 5-wide spread may let you exit sooner by hitting a profit target with the increased Theta. If the market moves against you, the wider spread will lose money slower due to smaller Delta and Vega, and have a better chance of not incurring a maximum loss at expiration.