The Round Table: SPX Broken Wing Butterfly and VXX/UVXY Trades

The Round Table meeting had two parts. Tom showed the SPX Broken Wing Butterfly trade he's been trading. Then Jim showed his VXX and UVXY volatility based trades he's been doing. We recorded this event and it is posted in our free members area. Get your free login...

SPX Aug 23 (W4) Broken Wing Butterfly

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Aug 23rd with 33 days to expiration. The ten lot of puts are at 1945/1920/1860. The 1920's were about a -19 true delta (in OptionVue). I sold two lots at a $1.90 credit and eight lots at a...

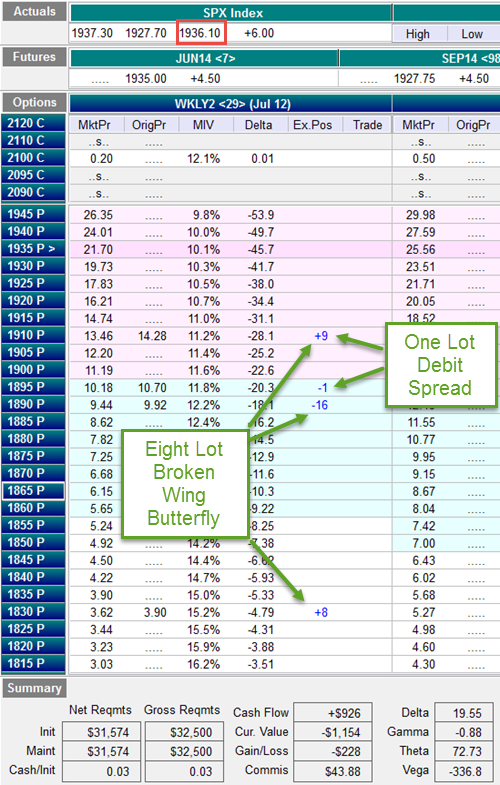

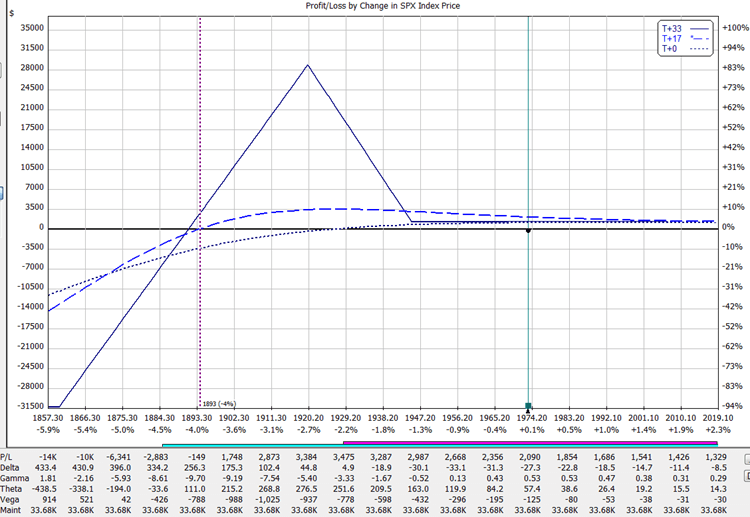

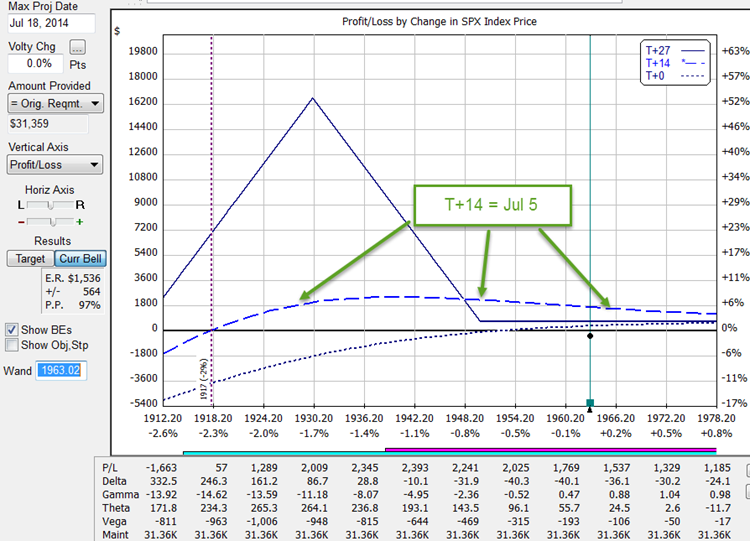

SPX Jul 17 Broken Wing Butterfly

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Jul 17th with 28 days to expiration. The eight lot of puts are at 1950/1930/1870. The 1930's were about a -22 delta. The trade was put on with a little smaller credit than I like, but it's...