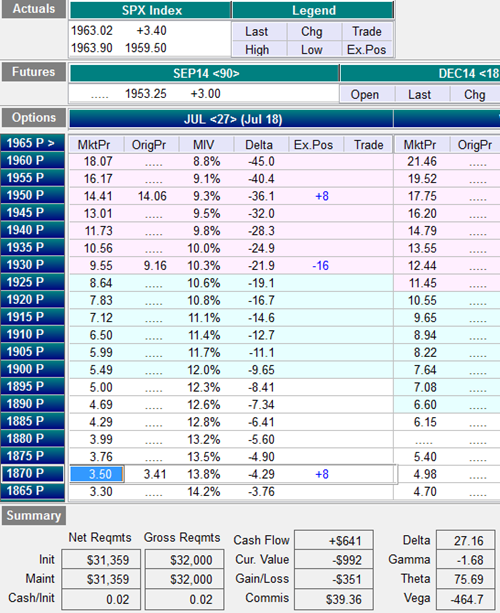

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Jul 17th with 28 days to expiration. The eight lot of puts are at 1950/1930/1870. The 1930's were about a -22 delta. The trade was put on with a little smaller credit than I like, but it's enough to work with at 0.85 credit per spread.

I put the trade on at the end of the trading day. My last two spreads were filled less than nine minutes before the close. I didn't have time to analyze which put debit spread I wanted to put on so I'll see where the futures are going Sunday evening and make my plan for Monday.

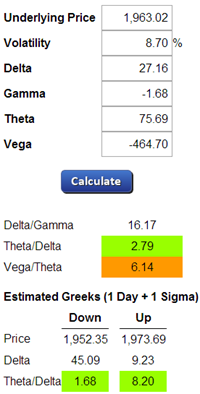

Because I didn't have time to get my put debit spread on, the vega is a little higher, which the greeks calculator is warning me about. I should fix that first thing on Monday.

OptionVue Matrix

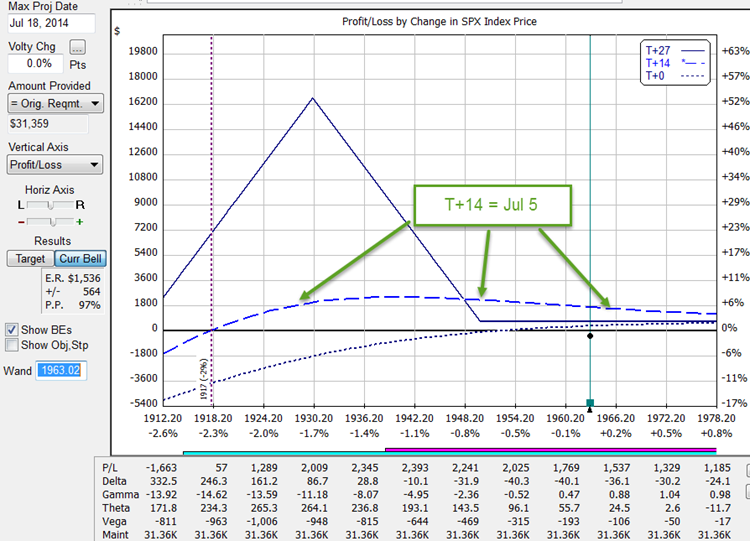

OptionVue Analysis Chart

Greeks Analysis

Interactive Brokers Trade Log

Summary

The T+0 line (today) isn't as flat as I'd like it to be due to the absence of the extra put debit spread. Hopefully SPX will open flat or higher on Monday so I can get that hedge on at a good price.

The margin used is about $30,000 but it's hard to tell exactly as IB doesn't split up the margin in a Portfolio Margin account by individual trade. Reg T margin is $31,359.

I'm hoping SPX stays around the price it is at now or drifts a little lower. In 14 days, the returns would be +4% to +7% in the 1935 to 1980 range assuming volatility doesn't change.

I'll post updates to the trade in this forum thread.

Tom, your postings are very much appreciated.