I've traded more iron condors than I care to count. Thirty days to expiration, weekly, even same-day 0 DTE trades. The iron condor looks attractive on paper. High win rate. Defined risk. Collect premium and wait.

Here's the problem nobody talks about until it happens to them.

You win 90% of the time. Feels great. Then that 10% loss shows up and wipes out months of accumulated profits. Sometimes more. The reward-to-risk ratio on traditional iron condors is, frankly, horrible. And the whole time you're in the trade, your capital is locked up in margin while you hope the market cooperates.

Hope is not a trading strategy. I learned that the hard way.

How Professional Traders Actually Think About Risk

Years ago, I took an advanced Optionetics class taught by George Fontanills. George was a retired hedge fund manager and co-founder of Optionetics. Brilliant guy. During that class, he said something that stuck with me:

“When someone presented a new trading idea to me, the first question I asked was how much can I lose?”

Not how much can I make. How much can I lose.

That's the professional mindset. Retail traders obsess over profit potential. Professionals obsess over risk. They think about the exit before they think about the entry. They want to know exactly what happens when things go wrong, not just when things go right.

This is why I've been working with Tomas Byron for several years now. His options knowledge is extensive. I've been in this industry for over 17 years, and his ATM Weekly Options Workshop is the most in-depth options workshop I've seen. Tomas has been a professional trader for decades, and it shows in how he approaches every single trade.

The Condor Nest: A Different Way to Trade SPX Options

The Condor Nest strategy doesn't start as an iron condor. That's the key difference.

You begin with a time spread structure that generates theta from day one. The position is flexible. You can adjust it. You're not locked into hoping the market stays in your range. Then, when conditions are right, you convert the position into an iron condor.

But here's where it gets interesting. By the time you make that conversion, you've already captured enough profit that the resulting iron condor is essentially risk-free. Your worst case scenario? You make less money than your best case. You don't give back months of gains in a single bad trade.

The philosophy is simple: open a trade, hedge off the risk as soon as you can lock in profit, and remove the possibility of a catastrophic loss. That massive drawdown that traditional iron condor traders eventually experience? It doesn't happen with this approach.

Capital Recycling: Using the Same Money Multiple Times

One aspect of the Condor Nest strategy that really impressed me is the capital recycling component.

Think about traditional options spreads. You put up $2,000 or $3,000 in margin. That capital is tied up until the trade closes. You're sitting there waiting, watching, hoping things work out while your money does nothing else.

With the Condor Nest approach, something different happens. You might use $1,000 to $3,000 to open your initial time spread position. But after you adjust and convert the trade into a risk-free iron condor, the margin requirement drops to near zero. Sometimes actually zero.

That original capital is now free. You can use it to open another position. The same $2,000 that funded your first trade can now fund a second trade while the first one is still working. Do this a few times and you're running multiple positions with capital you would have had locked up in a single traditional iron condor.

This is how professional traders think about capital efficiency. Your money should be working, not waiting.

Typical Trade

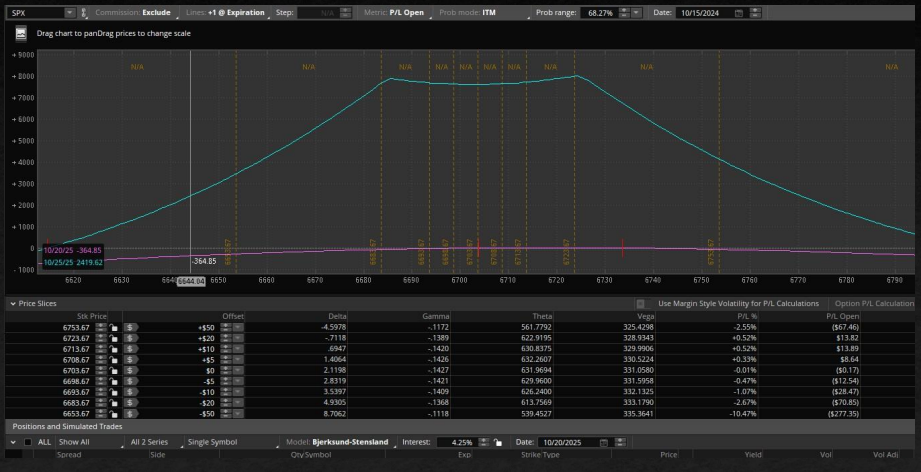

Opening Trade

Initial time spread position with defined risk on the wings. Notice the curved P/L profile – you have exposure if the market moves sharply in either direction.

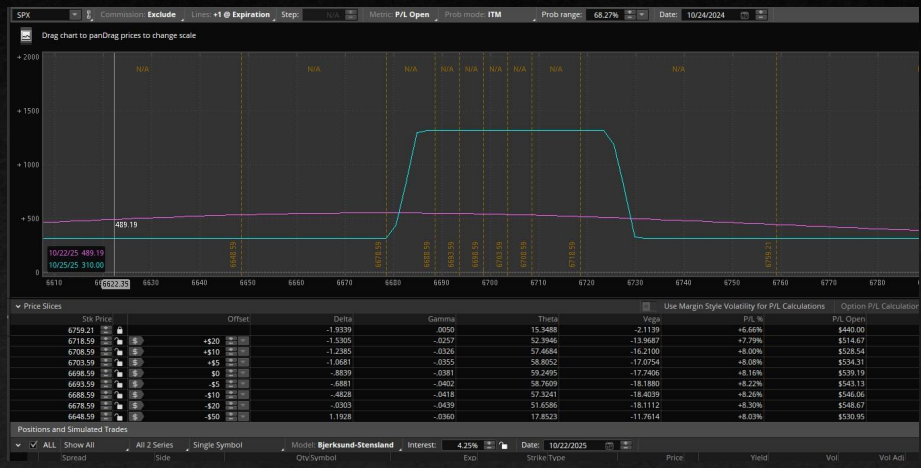

Final Position

After adjustment – notice the flat P/L line across the entire range. Risk is eliminated while profit potential remains. Your margin requirement drops to near zero.

What's Inside the Workshop

The ATM Condor Nest Options Workshop is a recorded course that covers the complete strategy from start to finish. Tomas walks through exactly how to implement these trades on SPX options, including entry criteria, adjustment triggers, and the specific steps to convert your position into a risk-free iron condor.

The workshop includes four main classes covering everything from volatility risk premium concepts to practical trade execution. There are quizzes to test your understanding, time spread modules that go deep on calendar and diagonal structures, and lessons on topics like VIX correlation and forward testing.

Students also get access to the GOAT spreadsheet, which I built specifically for managing these types of options positions. It handles order creation for both Interactive Brokers and ThinkorSwim, tracks your Greeks, and lets you copy orders directly into your trading platform with one click. The basket trader integration alone saves a ton of time when you're managing multiple positions.

All the strategies are IRA compatible, use defined risk, and work with daily expiration SPX options for maximum flexibility. The profit targets run between 5% and 20% of the debit paid to open the position, and most trades close the same day they're opened.

Is This Right for You?

If you're an intermediate or advanced options trader frustrated with traditional iron condor results, this is worth looking at. If you've ever had a single loss wipe out months of careful trading, you understand the problem this solves.

Students are getting solid results with this approach. The structured methodology takes the guesswork out of adjustments and gives you a clear plan for every scenario.

The workshop is $599 and includes lifetime access to all the recorded material, tools, and ongoing updates.