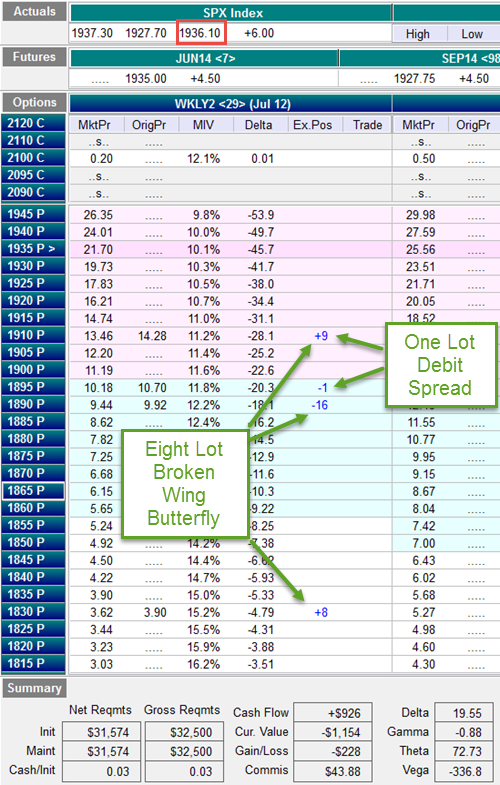

I put a new SPX Broken Wing Butterfly trade on yesterday with 29 days to expiration. It's an eight lot at 1910/1890/1830 with a put debit spread at 1910/1890 for a next credit of $926 on $31,574 of Reg T margin. That would be +2.93% in 29 days if held to expiration and SPX stays above 1910. If SPX sells off below 1910 and stays above 1867, it could have a much higher profit. Anything below 1867 at expiration would be a loss with the maximum loss of -$30,000 below 1830

The trade likely will not be held to expiration. The target for these types of trades is about 15 days into the trade, which has an excellent chance of being profitable. Here's how the trade looks:

OptionVue Matrix

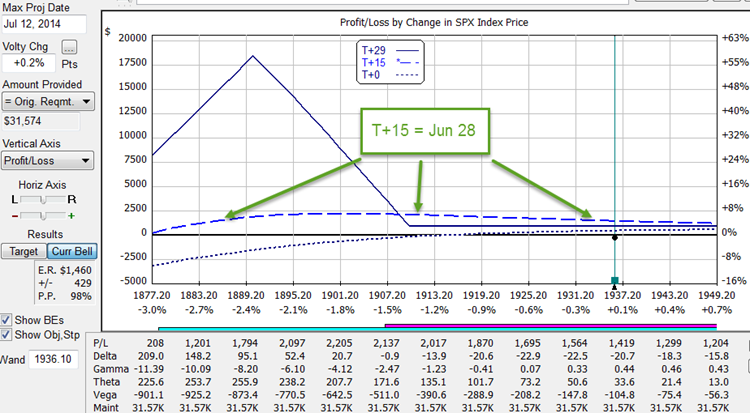

OptionVue Analysis Chart

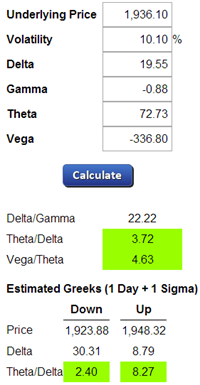

Greeks Analysis

See Option Position Greeks Calculator

Summary

The T+0 line (today) is pretty flat with the debit spreading helping a little if SPX sells off right away. The plan will be to add another put debit spread if SPX goes down too far. If SPX rallies, the put debit spread will come off (essentially buying a bullish credit spread) to bring in more cash on the upside. We'll try to bring in +3%+ if SPX stays above 1910.

The margin in use for two of these trade is $52,000 in a portfolio margin account but would be over $65,000 in a Reg T account. Putting these trades on every week could have three on at the same time, so I'm allocating $100,000 of capital for these trades. This trade by itself has a Reg T margin of $31,574 today.

I set a forum to post trade updates to this trade. I hope to see you there!