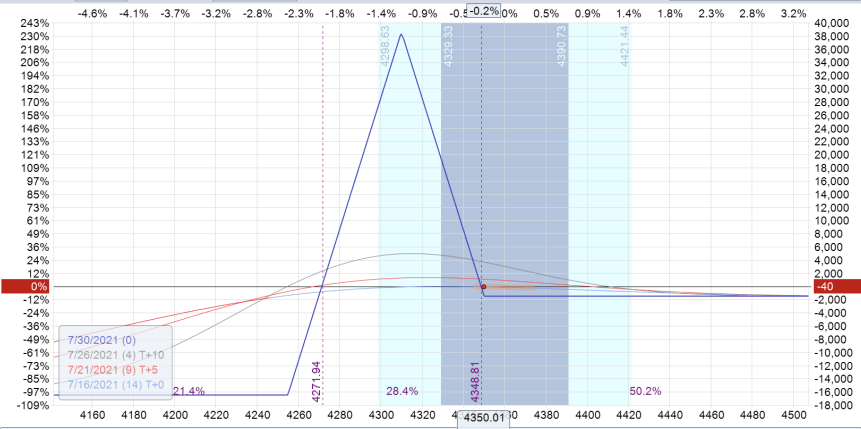

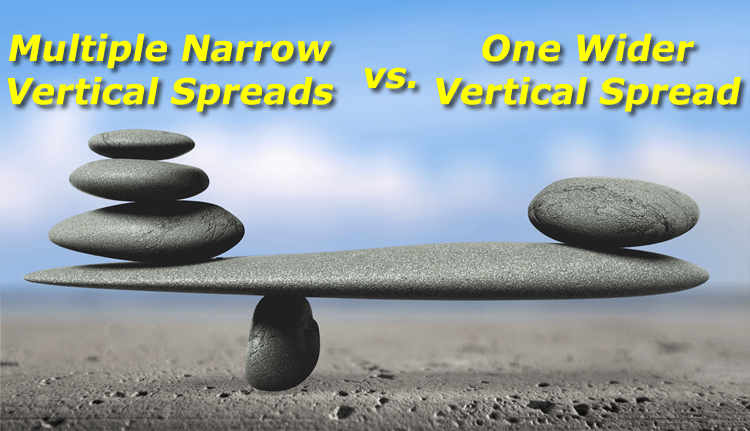

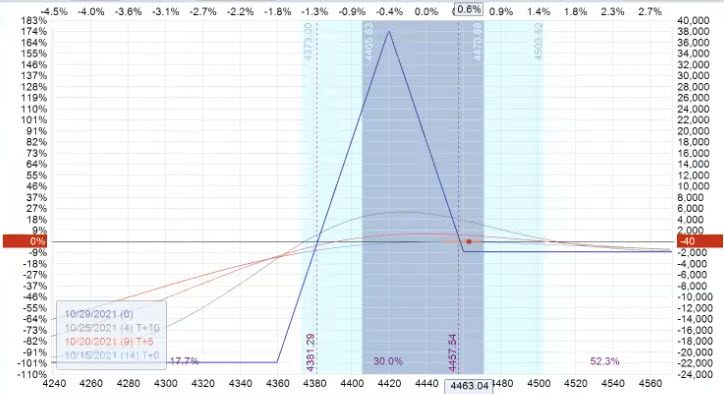

The Trade-Offs of Using Wide and Narrow Vertical Spreads

Many options traders sell put credit spreads. They can sell them alone or in combination with other spreads to create more complex spreads like an iron condor. First, let’s define what a put credit spread is. A put credit spread (also known as a short put spread) is...

Amy Meissner’s New A14 Weekly Option Strategy

Amy Meissner more than tripled a trading account in 15-months trading non-directional option strategies. Amy is well known for teaching several trading systems including: The Asymmetric Iron Condor (aka “the Weirdor”)The Nested Iron CondorThe Timezone...

Timezone Trade Alerts

Amy Meissner is bringing her Timezone Trade to Aeromir starting next week! The Timezone Trade is one of Amy's more popular trades. It is a short term trade with positive Vega and good performance. Amy presented on the Round Table last week. Here's the recording: Amy's...

Wayne’s Market Commentary for the Week of March 16th

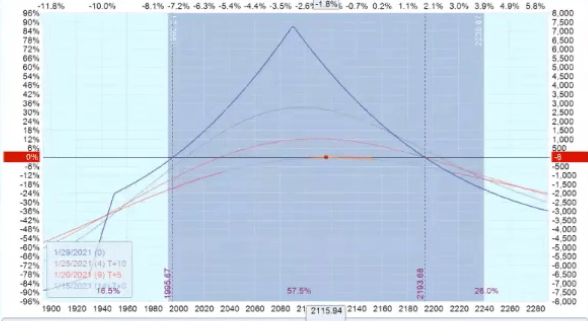

Housing in the US… Many nearly retired or planning to be retired people have profited greatly from decades of dropping mortgage rates and loosening of credit requirements for home purchases. The burning questions many are asking… What is this pandemic going to do to...