Housing in the US…

Many nearly retired or planning to be retired people have profited greatly from decades of dropping mortgage rates and loosening of credit requirements for home purchases. The burning questions many are asking…

What is this pandemic going to do to home values?

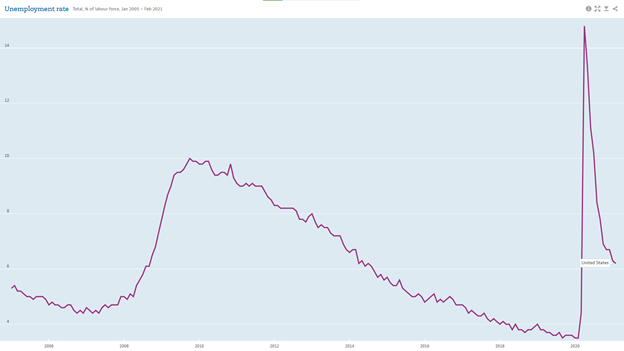

What is with the super low foreclosure rates while unemployment is as high as it was in the great recession?

Why are houses still going up?

At the heart of general home prices, we still are chained to the supply and demand laws. When the pandemic first hit everything happened so fast and it was portrayed that it was either nothing or that it would be over fast.

Sound familiar?

A year later we are finally starting to open back up and vaccines are the “Savior”. A fact that must be heard is, while unemployment is improving from the lows it is still as high as back in 2008 “The Great Recession”.

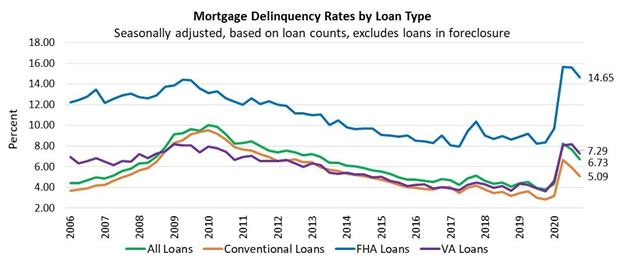

Intuitively we would think that high unemployment would lead to high mortgage delinquencies, right? We would be right.

The government has so far pulled off a miracle.

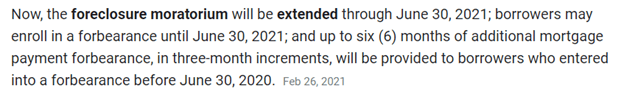

With allowing for federally backed mortgages to have forbearances and forcing banks to not start the foreclosure process do to the pandemic we have not seen a rise in foreclosures. This is creating a lack of supply that is typical when we see rising delinquencies.

Another factor helping prop up home prices is that the US government and central banks around the globe pushed down interest rates. This in turn helps push down mortgage rates.

When mortgage rates drop it provides those buyers that finance their home purchases a more expensive house for the same relative payment per month. The relative payment per home price helps sellers to retain there sales prices or even lift them due to increased affordability.

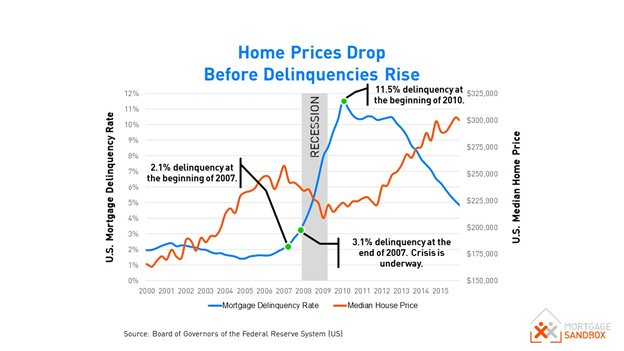

Put it all together and we get lack of supply and lower rates. Both lead to stable or lifting home values. But is it all peachy then?

Heck no!

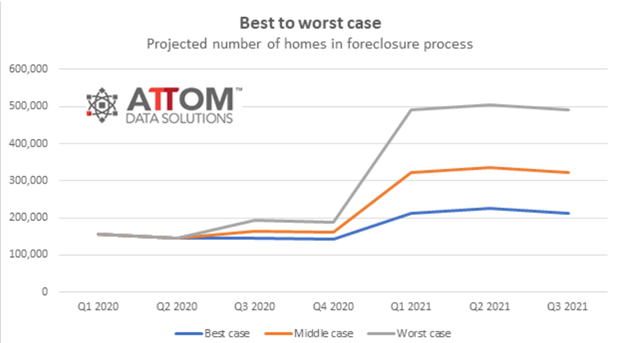

We have a build up of supply just waiting to dump onto the market when the foreclosure and eviction moratorium ends. Combine that with long term bond yield raising in expectations with rising inflation in the future and you have the perfect storm for a supply spike leading to a drop in home prices. Here is a projection ATTOM Data put out before the government once again pushed back the foreclosure moratorium see.

So, am I saying there is going to be a crash?

The governments of the world are very smart and have plenty of tricks up their sleeves. As it looks right now, we are poised to see strong headwinds to home prices over the coming years.

One thing that does keep a little glimmer of hope is that asset inflation could keep some opposing pressure along with home builders slowing production. Overall, there seems to be more downside risk than upside risk for home price, at least until after we see how the foreclosures impact the market.

Wrap Up

Asset inflation is coming through strong in stocks and other wealth storage assets like real estate. If you are lucky enough to have found the Sleep Well Portfolio over the last few months or have been intelligently invested you have profited from this fact.

The Sleep Well Portfolio continues to adapt accordingly to this unprecedented time of government stimulation. GDP to debt remains elevated and a similar future compared to the 1950-1980s is likely. Many assets go up when there is a detachment from the working class economy.

We continue to invest for maximum growth vs risk.

since 29 sep 2020

Wayne publishes market commentaries every week. Sleep Well Portfolio members have access to all of the market commentaries Wayne publishes.

You can get Wayne's market commentaries for free for 30-days with no risk.

If you like them and want to continue receiving them after 30-days, consider subscribing to the Sleep Well Portfolio at https://aeromir.com/sleepwell

Get Wayne's Market Commentaries for 30-days