The Big Fish are Eating the Smaller Fish

According to Crain's Chicago Business, a New York private-equity firm is planning to take control of OptionsHouse LLC and TradeMonster Group Inc. by investing in both of them and then merging the two companies. General Atlantic LLC is purchasing OptionsHouse from...

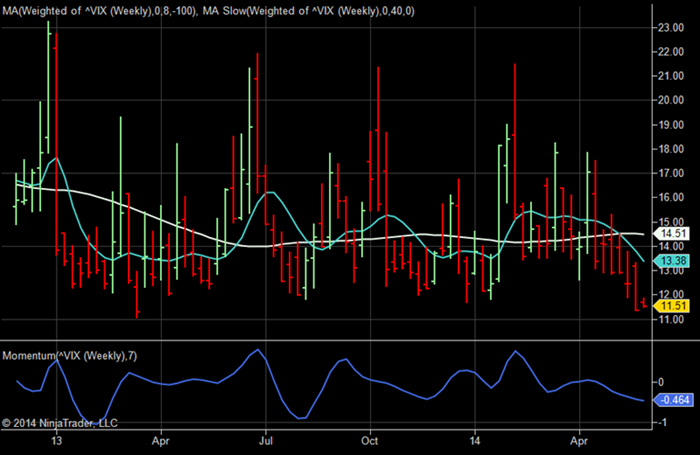

VIX Options to Add Half-Point Strikes in Near-Term Expiration

The CBOE announced they are adding half-point strikes for the CBOE Volatility Index (VIX) options. The half-point strikes will be listed for the near-term expiration month and in the strike price range of 10 to 15 (i.e. 10.5, 11.5, 12.5, 13.5 and 14.5 strikes). The...

Option Synthetics Primer

Let me ask you a question. Which position is more risky? Selling a Covered Call Selling a Naked Put Most people would say selling a Covered Call is a great investment strategy, but selling a Naked Put is terribly risky. If you understand Option Synthetics, you'll know...