Dan Harvey has a spreadsheet he uses to help guide his contract sizes and manage his Weirdor trades. I extracted the option Greeks portion of it and created an online version which is at https://my.aeromir.com/go/c.option-position-greeks-calculator

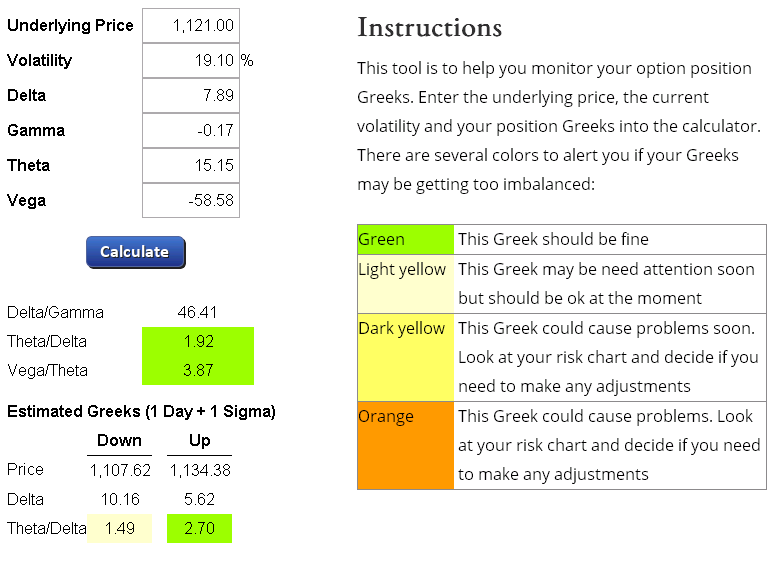

Here's a screen shot of it:

As the instructions say, you just enter in the price of the underlying, the volatility and your position Greeks. The calculator does the math for you and color codes certain fields if you are ok or need to monitor them more closely.

This tool is merely an aid to make you aware of when your option Greeks may be getting out of line. It is up to you to figure out if you need to wait or if you want to make an adjustment or not.

Be careful not to use the tool to over-adjust your trades. You need to give your trades some breathing room.

You can use this calculator for any option trade (such as Weirdors, Butterflies and Iron Condors) to get an idea if your option Greeks are skewed too much. The tool assumes you are trying to keep your delta's low and theta high, which is typical for non-directional option trades.

If you are a directional option trader, this tool likely won't help you as much.

Enjoy the tool.