Many traders use straddles and strangles in their options trading plan. Today's article will give a synopsis of the setup of each of these strategies, as well as outline some of the key distinctions between the two.

What is a Straddle?

A straddle is an options strategy composed of a long (or short) call, and a long (or short) put. Both options have the same strike price and the same expiration.

The components of a straddle include:

- Buying or selling a call and the corresponding put simultaneously

- Same underlying

- Same strike price

- Same expiration date

- One-to-one ratio

- Strategy bias – either direction at the same time

When you purchase a long call and a long put, you have a long straddle. When you sell a short call and a short put, you have a short straddle.

The margin requirements for the short straddle can be quite significant, so the focus of this article will be the long straddle.

What scenarios might warrant the use of a straddle?

The straddle is a strategy that a trader can use when a large move is expected in the underlying in either direction. The purchaser of a straddle is looking for the underlying to make a significant move, resulting in an increase in volatility. The trade has the potential to profit with a significant move in either direction.

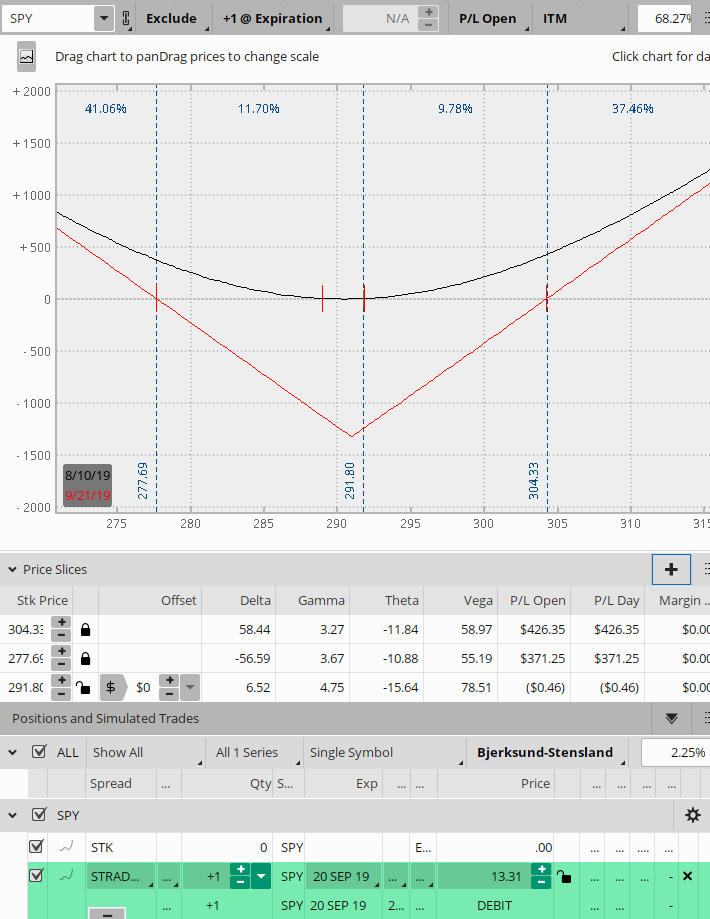

The graph below in Figure A illustrates a long straddle position on SPY for the 20 Sep 2019 expiration. With SPY trading at 291.80, the straddle consists of buying one long call and one long put, both at the 291 strike, with an approximate cost of 13.31.

Figure A. SPY Long Straddle for 20 September 2019 Expiration

For newer traders unfamiliar with reading a risk graph, this video may be helpful to you:

https://tickertape.tdameritrade.com/tools/risk-profile-tool-message-bottle-15906

The risk graph has a “V” shape. The center of the risk graph represents the strike price of the long call and long put. The position will profit if the price of the underlying moves up or down beyond the expiration breakeven prices. There is unlimited profit to the upside; the underlying could potentially rise to infinity. Profit is limited to the downside; the profit is limited to the point where the underlying price reaches zero.

There is limited risk with a straddle. The risk is limited to the cost of initiating the trade.

The expiration breakeven for the straddle is calculated by adding the cost of the straddle to the strike price (upper breakeven), or subtracting the cost of the straddle to the strike price (lower breakeven). The breakevens in Figure A for the example shown above are approximately 277.69 and 304.33, calculated as follows:

Upper breakeven: 291.00 + 13.31 = 304.31

Lower breakeven: 291.00 – 13.31 = 277.69

Because the straddle is often used when a trader is expecting a large movement in the underlying price, it is often used around an earnings event. The example shown in Figure A is for the 20 September 2019 cycle with 41 days until expiration as of this writing. It is a trader's choice when to exit the position. If the straddle is purchased ahead of an expected news/earnings event, some buyers may want to take profit or limit losses shortly after the news is released.

Another time to purchase a straddle is when you feel volatility will increase. A straddle has two options which work together. Therefore, the effect of volatility will double with an increase in volatility.

Because the straddle is a negative-theta position, time decay begins to erode its value quickly. Like volatility, the effect of decay also doubles because the straddle has two options working together. A delay in taking profits, or limiting losses may affect the position as time goes on.

What is a Strangle?

Conceptually, the long strangle is identical to the straddle. However, as explained above, the straddle has a single strike as its center. The strangle has the two different strikes, which produce wider breakeven points. The strangle is also less costly to enter than a straddle. The components of a straddle include:

- An out-of-the-money call, and out-of-the-money put

- The same underlying

- The same expiration date

- A one-to-one ratio of number of options purchased (calls:puts)

What scenarios might warrant the use of a strangle?

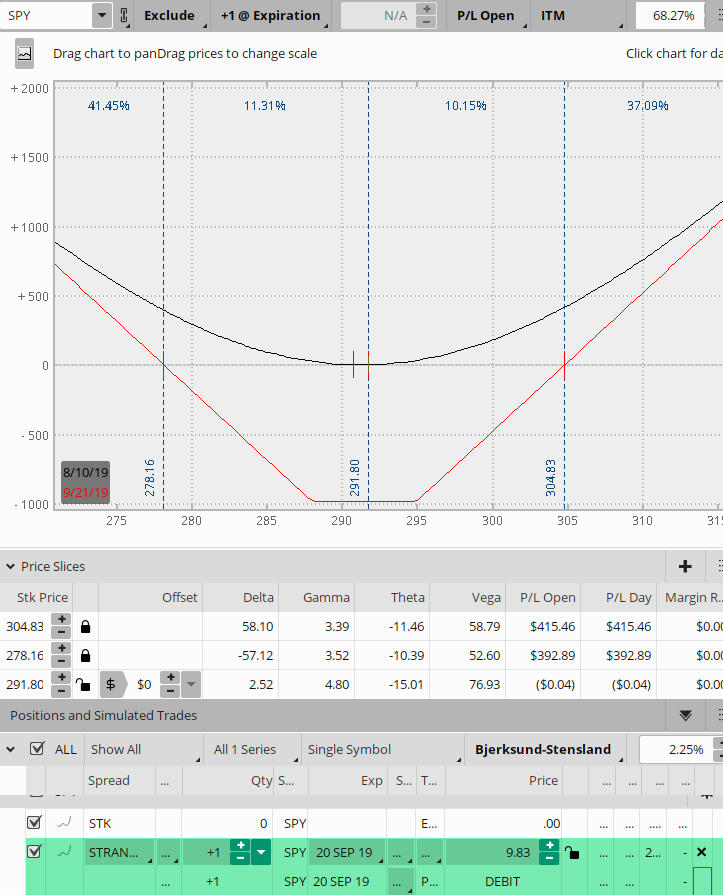

Strangles can be used in similar situations as the straddle; the purchaser of a long strangle is expecting a large movement in the price of the underlying, or an increase in volatility. The illustration below illustrates a long strangle position on SPY for the 20 September 2019 expiration. With SPY trading at 291.80, I have set up the straddle with the long call strike at 295, and the long put strike at 288. The cost at the time the example was set up is $9.83.

The approximate upper expiration breakeven for the strangle is calculated by adding the cost of the straddle to the long call strike (upper breakeven). The approximate lower expiration breakeven is calculated by subtracting the cost of the strangle to the long put strike price (lower breakeven. In the case of the illustration below, the expiration breakeven on the upside is 304.83, and 278.16 on the downside.

Figure B. SPY Long Strangle for 20 September 2019 Expiration.

As you can see from the above illustration, the value of the strangle increases as SPY moves away from the upper call strike or the lower put strike. The closer SPY is to the area between the two strikes, the lower the value of the strangle at the 20 September 2019 expiration.

Why use a Strangle over a Straddle?

The benefit of a long strangle is that it will cost less than a straddle, hence less risk. But, like all risk/reward scenarios, less risk equates to less reward. The buyer of the long strangle has a tradeoff for the lower cost and less risk. The underlying must move significantly more than the straddle in order to reach its potential profit.

Why purchase a straddle or strangle rather than a long call or put?

In order for a long call or long put to be profitable, you need to feel confident that you have picked the right direction for the move. With a straddle, you do not have to have a directional bias, you need price movement and/or volatility.

The straddle has the same risk/reward as a long call or put; both have an unlimited reward and limited risk. However, the price of the straddle can almost be double the cost of a long call or put which is certainly something a trader should consider.

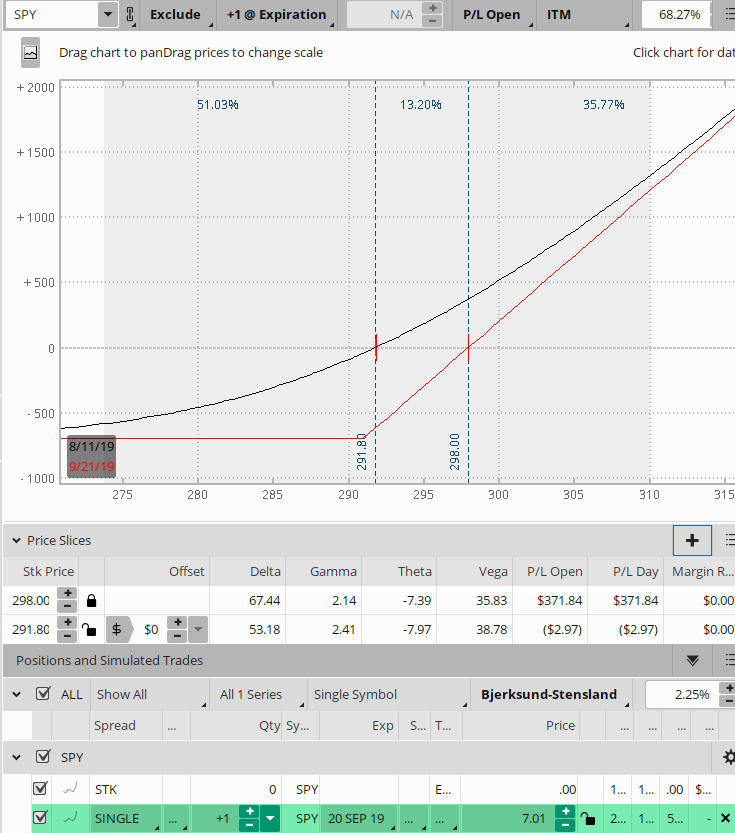

Using another example on SPY, a long call purchased at the same strike as the straddle is shown below:

Figure C. SPY Long Call for 20 September 2019 Expiration

The long call will reach its maximum profit if SPY moves above the expiration BE of 298.00, versus 304 for the straddle or the strangle shown in the examples above. While the maximum profit is reached a bit sooner with the long call over the straddle, you must be right on the direction of the move, as mentioned earlier.

Putting it all together …

- In summary, a straddle and strangle are strategies when a large move is expected in the underlying and/or an increase in volatility. As with any strategy, however, the trader must be vigilant on how the position is affected by time decay. The trader must be nimble to exit in order to lock in profits and eliminate further risk of substantial time decay.

- The first factor affecting the profitability of a straddle or strangle is, of course, the price of the underlying. The further away the underlying moves from the long strikes, the more the straddle and strangle values increase.

- A second factor that affects the pricing on a straddle and strangle is implied volatility. As implied volatility increases, the profitability of both increase. Straddles and strangles feel an increased effect with an increase in volatility because the strategies employ two options working together, and not against each other. When a strategy uses two options working against each other, the effect of implied volatility is the difference of its effect on each option. This is NOT the case with a straddle and strangle. Because these two strategies have options that are working together, the effect of implied volatility on each option is added together.

- Lastly, time decay is another major factor affecting the profitability of straddles and strangles. Time decay can take its toll on all options. Its effect is even more pronounced on the straddle and strangle. The strategies are combining two options in the same time period.

As with any options strategy, it is important for a trader to be aware of all the risks and rewards involved when considering the use of a straddle or strangle. They both can be used as an alternate to a purchasing a directional long call or long put when a large move is expected in the underlying.

I hope this article has been informative in how you may want to incorporate a straddle and/or strangle into your trade plan.

Feel free to comment below.