Have you ever heard someone say “The VIX futures are in contango”? Or, maybe you have heard someone say “The VIXfutures are in backwardation”. Today we will be discussing a little bit about contango and backwardation. This will give you some knowledge about the meaning of these two terms.

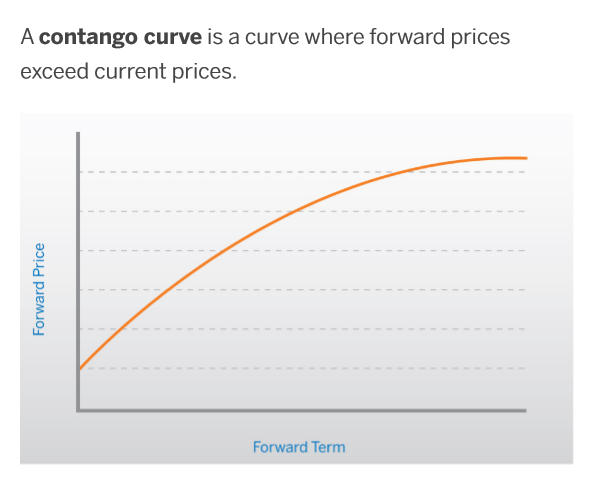

In general, contango occurs when the near term futures have a price which is lower than the longer term or forward futures.

Here is a graph representing contango, courtesy of CME Group:

Contango Curve, courtesy of CME Group

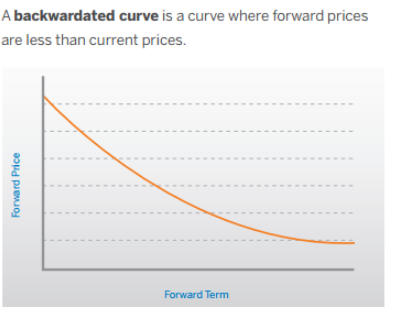

Backwardation occurs when the near-term futures have a higher price than the longer term or forward futures.

Under normal conditions, backwardation does not last all that long. Many times backwardation occurs when there is, or could be, a supply and demand crisis. This crisis could drive the price of the front month futures higher than forward (further out in time) futures.

Here is a graph representing backwardation, courtesy of CME Group:

Backwardation Curve, courtesy of CME Group

Futures prices are based on some important items. One is the cost to carry. Another determining factor is expected supply and demand concerns.

Many times when a market is somewhat normal, the futures will be in contango. This potentially means the price of delivering an asset in the future is higher than the price if it was delivered at the present time. The price of delivering the commodity three months in the future is higher than it is now. Six or twelve months in the future, the price of the commodity is even higher. One of the reasons this happens is because the producer is holding on to the product for a longer period of time. This costs him more money. His cost to carry is higher the longer he holds onto his commodity. There could also be supply and demand concerns influencing the price of the forward futures.

What is the cost of carry?

Cost to carry items contain expenses which may occur when holding a product such as a commodity. To hold onto a commodity such as coffee, the producer of the coffee would have to store it. Storing a commodity costs money. The producer of the coffee would incur expenses to rent or own a warehouse to store the coffee. He would have associated fees to maintain the warehouse, such as insurance and taxes. If the producer of the coffee is holding onto the coffee and waiting to sell 3,6 or 12 months in the future, he would not generate cash until a later date. If he sold the coffee now, he would infuse cash into his business. This cash could be deposited into an interest-bearing account. This would allow him to generate income from the interest earned on the cash he received from selling the coffee. If the producer of the coffee chose to sell the coffee at a future date, he would not be able to earn the interest. Therefore, this is another item which adds to the cost to carry. Transportation expenses could also add to the cost of carry.

Does the VIX have cost of carry?

VIX futures do not have the same cost to carry such as the commodity coffee we discussed above. The CBOE states “(b) There is no cost-of-carry relationship between the price of VIX futures and VIX. This is simply because there is no “carry” arbitrage between VIX futures and VIX as there is between a stock index future and the underlying index. VIX is a volatility forecast, not an asset. Hence you cannot create a position equivalent to one in VIX futures by buying VIX and holding the position to the futures expiration date while financing the transaction.” CBOE VIX Article.

Russell Rhodes created an interesting article about “The History of VIX Contango and Backwardation” on August 30, 2015. Go here to view the article:

History of VIX Contango and Backwardation

If you would like to explore in depth articles on the subject, here are two sources:

You have learned a little bit about contango and backwardation to increase your knowledge. The next time you hear the terms being used, I hope you will have a better understanding of contango and backwardation.

Are you looking for a mentoring program, trading group, or a group of like-minded traders to share both positive and negative trade experiences? Look no more, go to: Join Capital Discussions.

You will find a wide variety of educational services in addition to the trading groups that meet on a regular basis to exchange their trades and ideas.