What is the VIX?

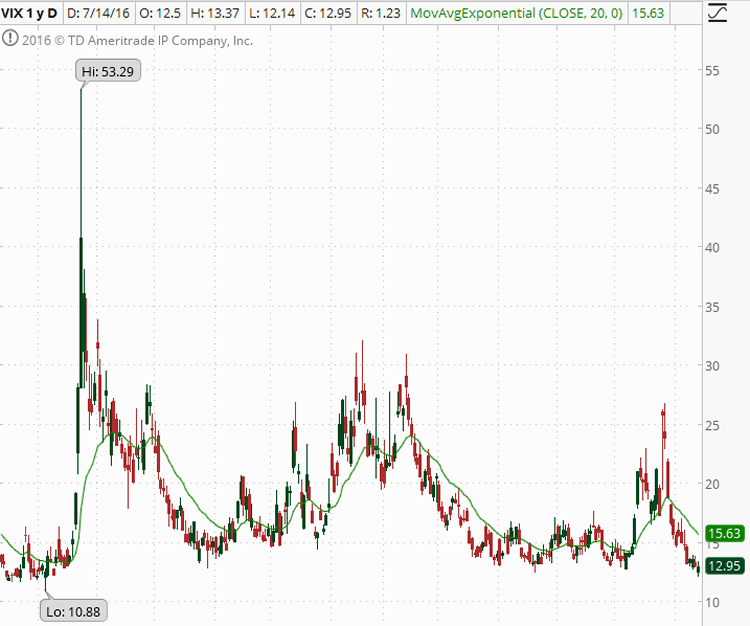

"The VIX Index is an up-to-the-minute market estimate of implied (expected) volatility that is calculated by using the midpoint of real-time S&P 500 Index (SPX) option bid/ask quotes. More specifically, the VIX Index is intended to provide an instantaneous measure of how much the market thinks the S&P 500 Index will fluctuate in the 30-days from the time of each tick of the VIX Index" as defined by the CBOE.

When the VIX was introduced in 1993 by the CBOE, it was a weighted average of the implied volatility of eight S&P 100 (OEX) at-the-money put and call options. In 2003, it was broadened to the S&P 500 index (SPX), in order to allow for a more realistic view of market volatility and the expectations of investors.

The VIX is derived from prices of options in the S&P 500 index, and can be a good indicator of the expected market volatility. Having said "expected", it is worth noting that the VIX is not representative of the actual volatility. The VIX is an overall assumption based on the premium of the options. The VIX is set by the results of millions of transactions by traders all across the globe. When there are more buyers the premiums increase; more sellers and the premiums go down. The VIX takes the weighted average of all the options prices in the S&P 500 Index.

Many traders view the VIX as a measure of risk in the market, and hence it is referred to as the "fear gauge." When fear develops in the market, many traders will purchase out-of-the-money options for use as hedges on existing positions, or some traders take directional plays. This increased demand causes the option premium to rise, and the VIX increases. As fear decreases, some of those traders who purchased these hedges will sell them, causing less demand, lower option premiums, thus a lower VIX.

In summary, the VIX gives a broad idea if traders are paying more or less for the right to purchase or sell the S&P 500 Index. As the price of SPX options rise, the VIX goes up. As the price of SPX options decrease, the VIX goes down.

How can you as a trader use the VIX to your advantage?

High volatility can indicate opportunities to sell. You expect volatility to decrease, thus the option you sell should decrease in price, making the position profitable. Some viable strategies when the VIX is high may include:

- Credit spreads. When you sell a credit spread, you will receive a higher credit when volatility is high.

- Iron Condor. When you sell an Iron Condor, you will also receive a higher credit when volatility is high.

- Butterfly. When you buy a Butterfly in a high volatility environment, your position will benefit as volatility drifts down, as long as the underlying price stays close to your short strike.

Low volatility can indicate opportunities to buy. You expect volatility to rise, therefore, the option you buy could become worth more. Some strategies to consider when the VIX is low may include:

- Long put or put debit spread. This trade can allow you to lower your cost and benefit from a spike in volatility

- Long Calendar spread. This trade could benefit from the back month volatility increasing while the front month options decay.

- Iron Condor. The Iron Condor tends to perform better in higher volatility markets, but can still do well in lower volatility markets.

There are many other strategies a trader can employ to take advantage of the VIX; if you have a particular method you would like to share, please feel free to comment below.