One of the myriad of strategies available to traders are credit spreads. Two popular types of credit spreads are the Bear Call spread and the Bull Put spread. Today's article will cover the basics of these spreads … how they are constructed, how much can be gained, as well as the risk involved and how much capital can be lost.

What is a Credit Spread?

Credit spreads are made up of two options with two different strike prices. One option strike is bought for a debit, and the other option strike is sold for a credit. This results in a net credit for the spreads. Both options are in the same expiration period.

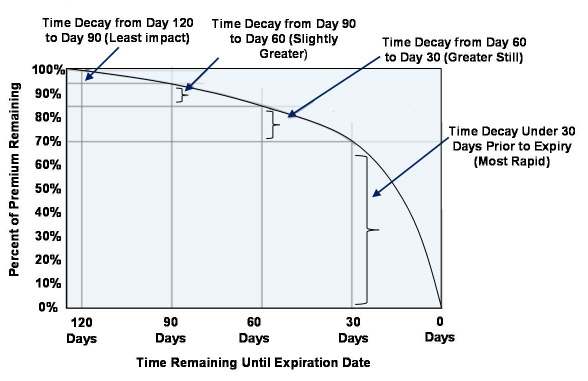

Credit spreads often take advantage of time decay, also called theta. Theta is the measurement of how much the value of an option will lose or gain each day as it gets closer to expiration. Knowing the potential time decay can allow you to use the decay to develop your strategy.

Time decay is not linear – the theoretical rate of decay accelerates as the option gets closer to expiration. The best way to explain time decay is to show a visual. The graph below (courtesy of tradermentality.com) shows how time decay/theta increases as the option approaches expiration.

Figure A. Time Decay Graph (courtesy of tradermentality.com)

Let's talk about these two popular types of credit spreads:

Bear Call Spreads explained …

The bear call spread, or call credit spread, is generally used when a decline in the price of the underlying is expected. It is constructed by selling a call option at a specific strike price, while at the same time purchasing the same number of calls at a higher strike price (further out-of-the-money), in the same expiration cycle.

Bear call spreads can be used many ways. Two examples are a stand-alone position, or as a hedge for a current position.

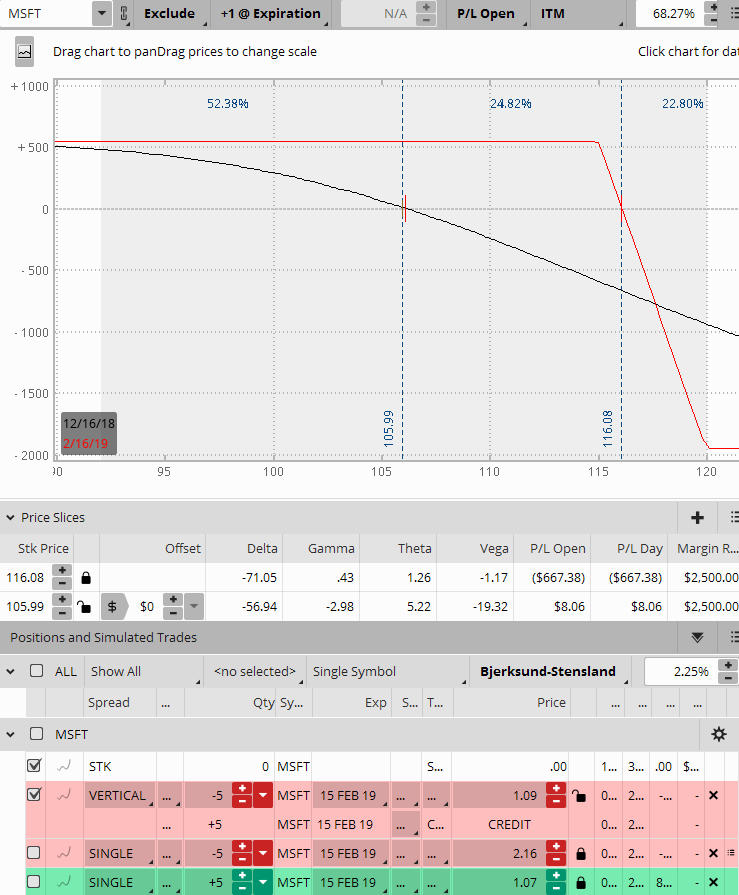

Below is an example of a bear call spread on MSFT opened 61 days to expiration, with the price of MSFT at 105.99.

Figure B. Bear Call Spread on MSFT

The bear call spread in Figure B was opened as follows:

- Sold (5) 115 Calls at 2.16 credit

- Bought (5) 120 Calls at 1.07 debit.

Net credit: 2.16 credit less 1.07 debit = $1.09 credit per lot, or $545 total credit for the 5-lot position.

How much profit or loss is in this Bear Call Spread?

If you entered this position and chose to take it to expiration with the expectation that MSFT will remain below the short call strike of 115, you would enjoy the full profit of $545, less commissions. Taking spreads to expiration presents a risk many traders choose not to have in their trading plan. However, the point of this example is to show the maximum profit potential for the spread.

Next, how much could potentially be lost on this position? Because the credit spread is five points wide (each point equates to $100 margin x 5 points = $500) and there are 5 contracts, the gross margin for the position is $2,500. A credit of $545 was collected when the trade was opened, reducing the overall margin requirements to $1,955 (Gross margin of $2,500 less credit received of $545). The total risk, or total loss potential, is $1,955 plus commissions.

What about the expiration breakeven?

The expiration breakeven in Figure B is calculated by taking the short strike of 115 plus $1.09 credit received which equals $116.09. (Note that Think or Swim is showing $116.08 on Figure B; most likely due to rounding of the prices in the calculation.)

Bull Put Spreads explained …

The Bull Put spread is often used when a trader expects a rise in the price of the underlying. It is constructed by selling a put option at a specific strike price, while at the same time purchasing an equal number of puts at a lower strike price in the same underlying and the same expiration cycle.

Bull Put spreads can also be used in several ways; two of them being as a stand-alone trade, or as a hedge for a current position.

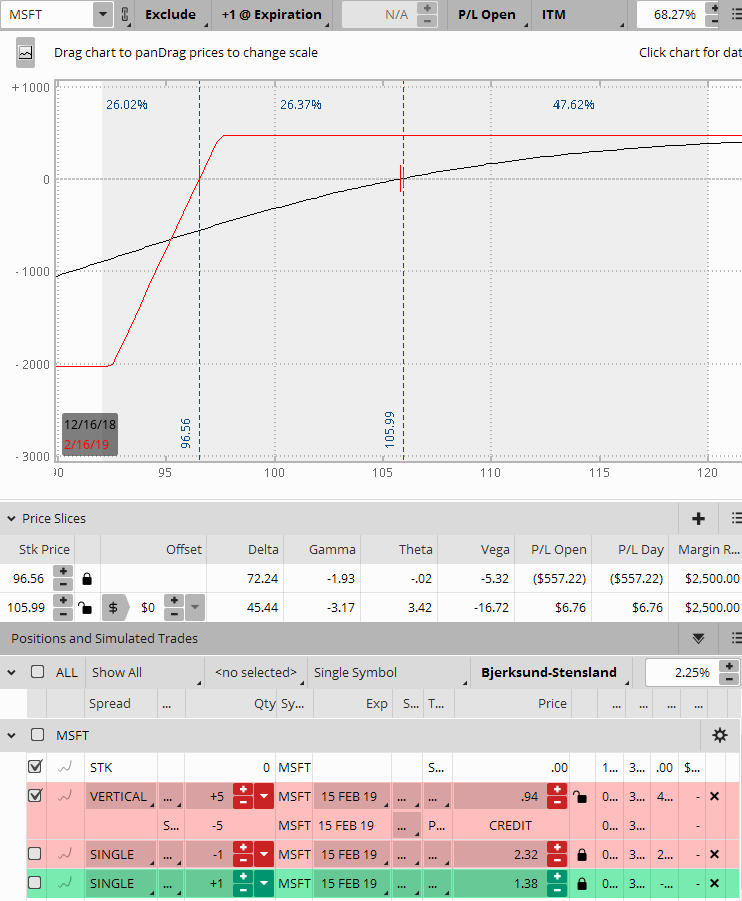

Below is an example of a Bull Put Spread on MSFT opened 61 days to expiration, with MSFT selling at 105.99.

MSFT Bull Put Spread

The bull put spread was opened as follows:

- Sold (5) 97.50 Puts @ $2.32 credit

- Bought (5) 92.50 Puts @ $1.38 debit

- Net credit: $.94 per lot, or $470 total credit for the position ($94 x 5)

How much profit or loss is in this bull put spread?

If you entered this position and chose to take the spread to expiration expecting MSFT to remain above the short put strike of 97.50, you would enjoy the full profit of $470, less commissions. However, as with the calls, taking spreads right to expiration can be outright dangerous at times so it is not a strategy generally employed by conservative traders.

The potential loss on the position is calculated in a similar manner to the bear call spreads. Because this spread is five points wide (each point equals $100 of margin x 5 points = $500) and there are 5 contracts, the gross margin is $2,500 . A credit of $470 was collected, reducing the overall margin requirement to $2,030. So, the potential loss if a trader did nothing and MSFT gapped below the expiration breakeven, the entire $2,030 loss would be realized ($2,500 less $470 credit) (plus commissions).

The expiration breakeven is calculated by taking the short strike of 97.50 less $.94 credit = $96.56 as shown on the graph in Figure C.

Where to place the short strike in a credit spread …

It is a trader's choice where to place the short put in a vertical credit spread when opening the trade, depending on your market opinion and strategy for the position.

There is a balance between the risk:reward with regards to the placement of the short strike. The closer the placement of the short spread is to the price of the underlying, the better the credit will be. However, going along with the higher potential reward is the greater risk of getting into trouble. On the other hand, when the short strike is placed farther away from the money the credit will be lower. The lower credit also lowers the potential risk of the position.

Summing up Credit Spreads …

Vertical spreads such as the Bear Call and Bull Put Credit Spreads offer traders a limited risk strategy, along with a limited profit potential. This strategy can be used by directional traders as well as traders who see the underlying trading in a range.

Both types of spreads can be used as a position/portfolio hedge if you are expecting a major market move in either direction.

The Bear Call and Bull Put Spreads can also be combined to create an Iron Condor, a popular non-directional strategy that we will cover in an upcoming article.

As always, it is important to back test any new strategy thoroughly and begin with a very small number of contracts when you are ready to begin with live capital.

If you would like to learn other ways spreads can be used, you might want to listen to this informative webex:https://www.youtube.com/watch?v=knYrmO76LdE&feature=youtu.be

Are you looking for a mentoring program, trading group, or a group of like-minded traders to share both positive and negative trade experiences? Look no more, join Aeromir today!