Today you will learn about the risk reversal. It can be used to protect or hedge your stock, position, or portfolio. A risk reversal can be useful to guard against a major market move. Risk reversals can also be used as a directional position.

A risk reversal can be structured so you do not have to take on a lot of risk.

A risk reversal is a position that makes use of a call and a put option, or a call spread option and a put spread option. This can change or flip the risk of the position from bullish to bearish or vice versa. The risk reversal is sometimes referred to as a combo.

Risk reversals are very flexible, and can be a good tool to use for your trading.

How the Risk Reversal got its’ Name…

Legend has it that large institutions that were long stock and wanted to hold the stock when the market moved against them, would buy put options and sell call options to provide a hedge.

The risk reversal would offset the loss on the long stock if the stock continued to fall in price. To help pay for the option that was bought they would sell a call option to collect premium. It was a good method to temporarily get some short delta without upsetting the portfolio of stocks they owned.

They were reversing the risk of their long stock. Therefore, the market makers began to call this strategy a “risk reversal”.

Here’s a risk graph showing AAPL Long Stock…

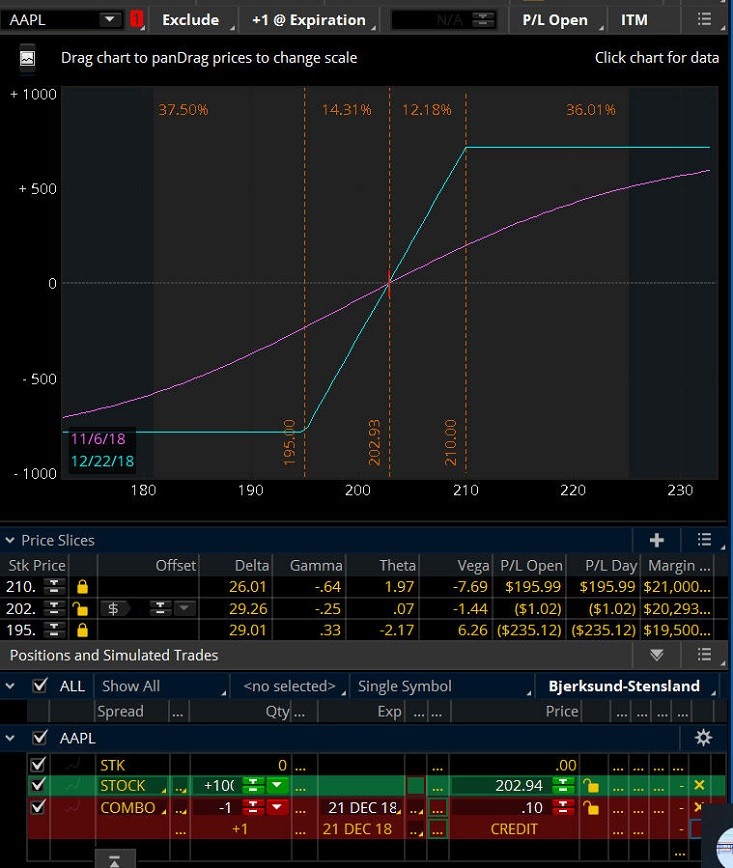

Figure A. 100 Shares of AAPL Long Stock

To understand how a risk reversal works, it is important to know what a risk graph looks like showing a long stock position.

AAPL is trading at approximately 203.00.

The red line on the risk graph indicates as price goes up, the value of the stock will increase.

The red line on the risk graph also indicates as price goes down, the value of the stock will decrease. There is unlimited risk to the downside.

The margin to enter this position is $20,311.00

Do you want to learn more about the risk graph? Here’s a risk graph tutorial from Think or Swim .

Here’s a risk graph showing a long stock position with a risk reversal…

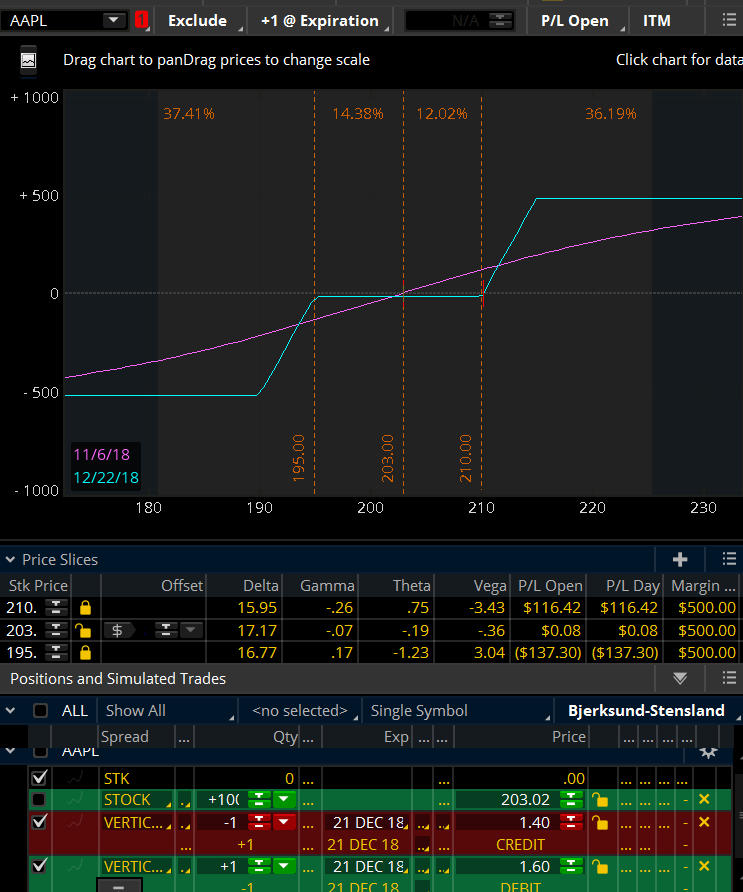

Figure B. Long 100 Shares AAPL with a Risk Reversal using short call and long put

Figure B is showing that the price of AAPL is approximately 203. The risk reversal is constructed by buying a 195 put option and selling a 210 call option.

The risk reversal is entered for a net credit of .10 less commissions. As you can see, the long stock is protected and has limited risk to the downside. The upside potential profit has been reduced because a call option has been sold.

The margin to enter this position is $20,293.00.

Pros and cons of using single options to create risk reversals…

When institutions sell options, they have much less margin requirements than you as a retail trader.

An example of a disadvantage of selling a single put is: If you sell a 195 put and the price of the underlying goes below 195, you will start to lose money on the put and keep losing as the underlying price goes down. It could theoretically drop to zero. Therefore, your brokerage will margin your account in a big way.

If you selling a single call option and the underlying price moves above the option strike price, you will start to lose money on that call option. You will also create a good amount of margin by selling a naked call option.

An advantage to you when you sell or buy an individual option is it will usually fill more quickly. This can be helpful if you need a hedge or monies to pay for a hedge right away.

Market Reversals Can Affect Your Long and Short Options…

Have you ever been worried about your position when there was a big move down? You saw your profits diminishing so you bought a put option to protect your positon? Most times I’ll bet you paid a big price to purchase the put on the down day.

When the market moves quickly to the downside, volatility tends to go up. This makes the price to purchase a put rise in cost.

After the market moves down, many times the market will reverse quickly to the upside and the volatility drops. This causes the value of the put you purchased when the volatility was high to go down dramatically. Now your position is not looking so good and possibly losing money. All because you did what you thought was the right thing to do by buying a put.

What a bummer; you protected your trade and you end up losing a lot of the value in the put the very next day. Sometimes the market reverses as soon as you purchase the put, which can be even more frustrating.

If the market reverses quickly and you sold an option to help to pay for the option you bought, it also starts to lose money.

Risk Reversals Using Option Spreads as a Hedge…

As you know, single call and put options can be expensive for you. Single options can cause large margin requirements. As an alternative, you can create a risk reversal using call and put option spreads to reduce your margin and risk.

If you have a long position and would like protection, you could a buy put option spread and sell a call option spread on the same underlying. This can help to hedge your position if the price of the underlying position moves in the wrong direction.

One of the advantages of a risk reversal composed of option spreads is if the market reverses, the option spread will tend to lose less than using single put or call options.

The risk in an option spread is determined by the width of the spread. If your option spread is structured buying one 210 strike call and selling one 215 call option and the price of the underlying moved beyond 210, your risk on the spread would be limited to $500.00 plus commissions. This is calculated by taking the distance between 210 strike call option 215 call option which equals 5 points (5 points times 100 contracts) or $500.00 plus commissions.

Here’s an example of a Risk Reversal using Option Spreads

Figure C. Long 100 Shares AAPL with a Risk Reversal using Spreads

In Figure C 100 shares of long stock is shown by the red line. This risk reversal has been constructed using option spreads. The call spread is short 1 210 call option and long 1 215 call option for a credit of 1.55. The put spread is long 1 195 put option and short 1 190 put option for a net debit of 1.45. This risk reversal is entered for a net credit of .10 (1.55 credit minus 1.45 debit) less commissions.

Look to the left side of the risk graph. The blue line has a small flat area which shows the protection from the long put spread. The option spread offers some protection, but not as much as the single long put which is shown in Figure B.

The margin to enter this position is $20,257.00.

The Directional Option Risk Reversal Position….

Stock or an underlying position is not required to create a risk reversal. A directional risk reversal can be created using just put and call options.

The risk reversal can also be used as a bullish or bearish directional trade. If you are correct in your directional assumption, you will profit.

If you are bearish you can enter a bearish risk reversal position. You would buy a put spread and sell a call spread.

If you are bullish you can enter a bullish risk reversal position. To do this you would sell a put spread and buy a call spread.

The goal with a directional risk reversal is to make a profit then take some of the profits off the table. You can then play with the house money to hopefully gain even more profit.

Here’s a risk graph of a bullish risk reversal using option spreads…

Figure D. AAPL Risk Reversal using only Option Spreads

Figure D is showing a bullish risk reversal with option spreads. The AAPL call spread is long 1 210 call option and short 1 215 call option for a debit of 1.60. The put spread is short 1 195 put and long 190 put for a debit of 1.40. The cost to enter this risk reversal is .20 plus commissions. The margin is the width of the spread which is $500.00

Adjustments can be made to a Risk Reversal…

Risk reversals are very flexible when it comes to adjustments to match your market opinion.

A position can start out as a risk reversal and then be adjusted to accommodate the position as the underlying price movement changes. One adjustment strategy is to take one side of the risk reversal and turn it into a broken wing butterfly.

If the market does not cooperate with your directional bias the position could be adjusted to hedge off some of the upside risk.

What’s a good time to take off your risk reversal?

If your market opinion changes it can be a good time to take off your risk reversal. If you have made an adjustment, you probably have hedged off your risk, so it could be a good idea to take off your risk reversal.

For a good discussion about risk reversals and advanced risk reversals offered by Aeromir, go to this Round Table with Scott Ruble on Risk Reversals.

In Summary…

Risk Reversals have advantages; some of those are:

- Low cost to enter the position

- Risks can be low

- Profit can be good

- Fits a variety of trading methods

- Numerous methods to adjust

- Can be implemented with or without stock

- Can offer portfolio protection

Risk Reversals have disadvantages; some of those are:

- Required margin can be high

- Large risk for the short leg

Good Trading!

P.S.

Please feel free to leave a comment below. Tell us and share your likes and dislikes about the risk reversal strategy.

Hi Joanna.

Thanks for your post.

Would you mind explaining with more detail how to turn one side of the spread into a broken butterfly? (“One adjustment strategy is to take one side of the risk reversal and turn it into a broken wing butterfly”)

Could you please put an example?

Many thanks in advance.