A calendar spread is a strategy often referred to as a time spread. A calendar is a method which could benefit from the time decay of an option and changes in implied volatility.

For the most part a calendar concentrates on the movement of time and volatility more than the movement of the underlying asset. For this reason a calendar spread can be used for either stagnant or large movements in the underlying.

Like any strategy the calendar has advantages as well as disadvantages. The risk can be quite limited for the buyer; the seller can have a larger risk. To contain some of the risk, a seller can act on the position at the expiration of the near term option. There are also strategies which can be used to lessen the seller’s risk.

One of the advantages of the calendar strategy is the position can be entered with less of an investment than purchasing the underlying asset.

How is a Calendar Spread created?

A Calendar spread is constructed by purchasing one option and the sale of another option in different expiration cycles in a one to one ratio. Both options will have the same strike price. The calendar can be created by using either two puts or two calls. The longer out in time option has more time value and will cost more than the closer in time option.

How to construct a long Calendar…

If you think the volatility is at a low level, you can buy a long calendar. To create a long calendar, you would purchase one option with an expiration further out in time and sell one option with expiration closer in time. As an example, you would buy a February 50 Call option and Sell a January 50 Call option. Another example, would be to buy February 50 Put option and sell a January 50 put option.

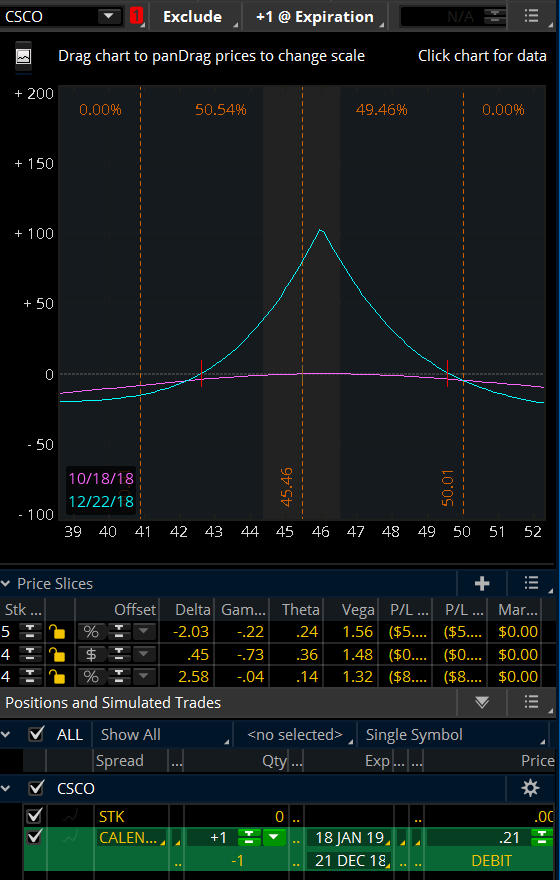

Figure A. Long Calendar Risk Graph from Think or Swim

As you can see in Figure A, the strike price of 50 is at the center of the risk graph. The highest profit potential is at the strike price.

How you could profit from the long calendar spread…

You can profit from a long calendar spread as time progresses and the price of the underlying stays favorable. The shorter term expiration will decay at a faster rate than the longer term position.

If the volatility increases the further out in time option will increase faster than the closer in time option. This will tend to increase the value of the calendar spread.

If you enter the calendar spread either in-the-money or out-of-the money and the price of the underlying moves towards the strike price, the position will gain in value.

How you could lose from a long calendar spread…

A decrease in implied volatility will decrease with the farther out in time option more quickly than it will decrease the value of the closer in time option. This will cause the position to lose value.

If the price of the underlying asset moves away from the calendar spread strike price, the calendar spread will decrease in value.

How to construct a short Calendar Spread…

If you have the assumption volatility is at high levels, you can create a short calendar. To create a short calendar, you would sell the farther out in time option and buy the nearer term option. For instance you would sell a February 50 Call option and buy a January 50 Call option.

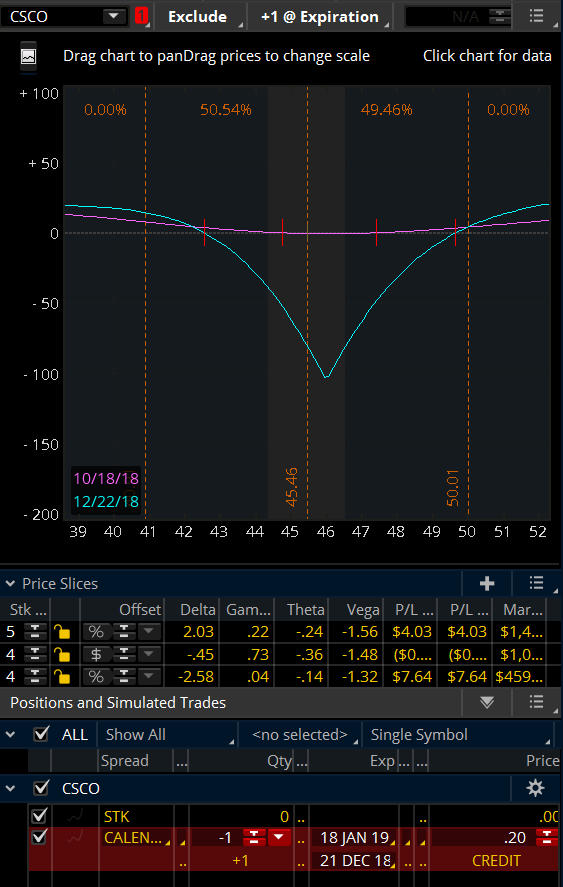

Figure B. Short Calendar Risk Graph from Think or Swim

As shown in Figure B, the short calendar profits more as the underlying moves away from the center strike of 50.

A word of caution concerning short calendar spreads. Shorting the longer dated option and buying the shorter dated option can be risky. The shorter dated option will expire before the longer dated option. This could lead to the seller of the longer dated option being naked that longer dated option. Therefore, the brokerage will most probably margin your account as though you are short the naked option.

How you could profit from a short calendar spread …

If implied volatility decreases, the further out in time option which was sold will tend to lose money more quickly than the closer in time option which was bought. This is due to the higher Vega in the further out in time option. This will tend to create an increase in value to the seller of the calendar spread.

If the underlying asset moves up or down, away from the strike price of the calendar spread which was sold in either direction, it will tend to increase in value for the seller of the calendar spread, as long as the time decay of the option does not outdo the movement of the price of the underlying.

How you could lose from a short calendar spread …

As time passes it will usually negatively affect the seller of a calendar spread. This is due to the nearer term option, which is the long option for the seller, decaying at a more rapid pace than the farther out in time option, which the seller of the calendar spread is short.

If implied volatility increases it will also affect the seller of the calendar spread negatively. When the volatility increases the longer term option which was sold increases in value more quickly than nearer term option which the seller is long due to the longer term options higher vega.

At-the-Money vs. Out-of-the-money and In-the-money options…

Many times calendar spreads are entered at-the-money due to at-the-money options having the greatest amount of extrinsic value. The extrinsic value of an option will decay as the option gets closer and closer to expiration. This can be beneficial for a calendar spread because the strategy is looking for time decay.

There are other calendar strategies which can be constructed using out-of-the-money and in-the-money options. It is your choice.

The decay rate of the option with the same strike price, which has a longer expiration date will be slower to erode than the decay rate of the option which is closer to expiration. This applies to an in-the-money option, out-of-the money option or at-the-money option.

Gamma’s Effect on the Calendar Spread…

Gamma can be defined as the rate of change of the option’s delta as it relates to the movement in the price of the underlying. It can be thought of as the delta of the delta.

Gamma tends to be highest with at-the-money options in the nearer term expiration. Gamma will tend to decrease the further the price of the underlying moves away from the at-the-money strike and as the expiration date moves further out in time.

The nearer term option expiration will move more quickly due to its’ gamma being higher.

How Does Volatility Influence a Calendar Spread?

It is important to monitor the change in volatility when using the calendar spread strategy.

The volatility of an option is measured by vega. Vega is an approximate measurement of how much an options price will tend to change with a one point move in implied volatility.

Vega is shown in dollars for a one tick move or change in volatility. Let's say an option is valued at $2.00 and has 45 implied volatility with a vega of .05. Then the volatility moves up one tick to 46. The option would now have an approximate value of $2.10.

This is calculated by multiplying .05 times 2.00 which equals .10 or 10 cents. Adding the .10 to the original value of the option which was $2.00 equals $2.10.

Key points about vega …

- The price of an option will change as volatility increases or decreases

- Vega will tend to decrease with shorter dated expiration options

- Vega will tend to increase with longer dated expiration options

- Vega tends to be greatest with at-the-money options

- Vega applies to the strike price both calls and puts

- Vega will tend to increase when volatility increases

- Vega will tend to decrease as volatility decreases

Wrapping up the Calendar Spread….

- Use two call options or two put options

- Use the identical strike price for both of the options

- Select different expiration periods for each option

- Create a one-to-one ratio

- Any two expiration periods can be used to create the calendar spread.

Usually, the calendar spread benefits when the price of the underlying is not moving too much and stays within a range.

If you have limited capital, the long calendar spread offers limited risk when entered as a debit. The risk is defined to the debit paid for the calendar.

You can use the calendar spread when volatility changes are expected.

As a seller of a calendar spread, you can take on potentially greater risk.

When the underlying price moves away from the calendar strike price, the buyer of a calendar will tend to lose money.

When the underlying price moves away from the calendar strike price, the seller of a calendar could increase profits as long as time decay does not surpass the movement of the underlying’s price.

If you have experience trading calendars, either long or short, and would like to share with the community, feel free to comment below.

Are you new to trading looking for mentoring, or an educational trade alert service? Or, are you a veteran seeking a trading group where you can interact with like-minded traders who share their experiences? Look no more. Join Aeromir today!