BLOG

OptionVue Is Raising Their Prices

I stopped using OptionEtics Platinum in 2006 and switched to OptionVue software.

It wasn’t cheap.

I think I paid over $3000 with the annual maintenance. The BackTrader software was a one-time purchase versus the annual fee it is today. I was happy to only have to pay the $399/year STAR maintenance package to keep my software humming along with delayed quotes.

Dan Harvey told me a few days ago in our trading group that OptionVue was raising their prices on January 1, 2015. I didn’t get the email announcing this so I contacted Len Yates to get a copy, which they sent to me. I pasted the entire email in a forum post to discuss this price increase in our forums.

REPLAY: Round Table with Eugene Yashin – Investing in a Multidimensional Market

Eugene Yashin from Krasney Financial LLC presented “Investing in a Multidimensional Market.”

- Investment Regimes

- Anomalies Observed

- One Factor Based Equity Models – pros and cons

- Multifactor Based Equity Models – pros and cons

Enjoy the replay!

Join us in our free members web site to download all of the different formats of this video. The library has PDF files, MP3 audio files, MP4 downloads and more. Click here to join us.

The Round Table with Eugene Yashin on Thursday Dec 11th

Eugene Yashin, CFA and

Director of Equity Research at Krasney Financial, will speak on “Investing in a Multidimensional Market” on Thursday, Dec 11th at 4:30pm ET.

Eugene manages the firm's equity portfolios, conducting top down research and selecting investment securities, and trading stocks, exchange-traded funds (ETFs), and options. He provides monthly investment commentary to clients via newsletters and is available to speak with clients on their portfolios. Eugene is a member of CFA Institute and CFA Society of Washington DC. Eugene has been in the investment industry for over 14 years. Prior to joining Krasney Financial in 2014, Eugene was a portfolio manager for Signet Management USA.

Options Trading for Income with John Locke for December 8, 2014

This video originally appeared at www.lockeinyoursuccess.com.

A great way to improve your trading results is by keeping up to date with the latest trading techniques and current market conditions!

Click HERE and join me every Monday at 9 AM EST for our free “Options Trading for Income” Webinars! Where you get expert analysis of the markets and the opportunity to follow along with the best options trading strategies in the business.

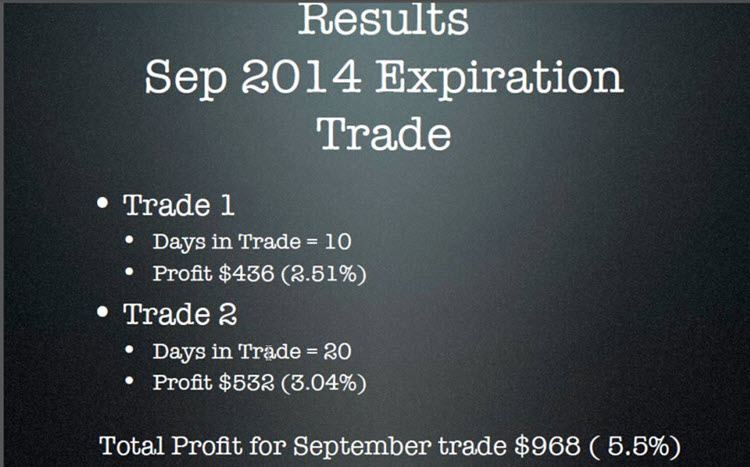

REPLAY: Round Table with Amy Meissner – The Queen of Iron Condors

Amy Meissner, also known as the Queen of the Iron Condor, presented “Weirdor – A Variant of the Condor.” Amy showed her trade guidelines and walked through her SEP and OCT 2014 live trades and answered many questions about her strategy. If you like the Weirdor trade, you have to watch this replay.

Amy Meissner, also known as the Queen of the Iron Condor, presented “Weirdor – A Variant of the Condor.” Amy showed her trade guidelines and walked through her SEP and OCT 2014 live trades and answered many questions about her strategy. If you like the Weirdor trade, you have to watch this replay.

Enjoy the replay!

Join us in our free members web site to download all of the different formats of this video. The library has PDF files, MP3 audio files, MP4 downloads and more. Click here to join us.

The Round Table with Amy Meissner on Thursday Nov 20th

Amy Meisnner will present “Weirdor – A Variant of the Condor”. Amy is known as the “Queen of the Iron Condor” and has changed her trading style in the last few years to her version of Dan Harvey's Weirdor. In this presentation, Amy will show you her trading guidelines and walk through several examples of how she is trading now.

REPLAY: Round Table with Seth Freudberg

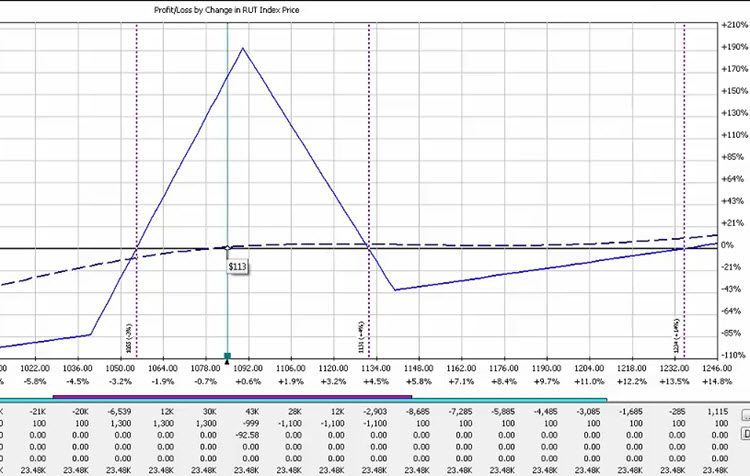

Seth Freudberg, from the Options Tribe, presented “Becoming an options trading professional.” Seth talked about what it takes to be a professional trader and his observations from running the SMB option trading desk. Seth showed the speeding weirdor trade, which is a modification of the Dan Harvey Weirdor.

Enjoy the replay!

The Floater Trade

Jim Riggio put an SPX trade on about two months ago when the SPX was at 2000. Jim put a 90-day (DEC expiration) 1975/2000/2025 butterfly on. Nothing fancy or unbalanced. I put the same trade on the next day.

Jim and I took two different approaches to managing the trade

But what does this have to do with that duck?

Loving the M3

I remember back in the day when I was learning “income trading”. I used to trade the “not so” mighty iron condor strategies. Yes, the very same strategies that have regained popularity in the low volatility markets over the last 2 years. I can still recall how everyone loved these strategies back then and how I jumped on board just in time to experience the change in market conditions that took all those traders out. What a mess!

It was at that point I said “never again”! Never again will I blindly follow some trading system that someone else tells me is great. Never again will I be in a system I don’t understand. Never again will I trade a strategy that isn’t adaptable to market conditions.

My massive failure sent me on a quest to develop a way to trade profitably in any market condition. And after thousands of trades and hundreds of hours I finally did it…

The Round Table with Ricardo Sáenz de Heredia on Thursday Nov 6th

Ricardo Sáenz de Heredia from Option Elements will present “Scaling Into Short Vega Monthly Positions”. Ricardo will use his current trade to show how he scales into his trades and why. Ricardo runs the Spanish division of Option Elements but the presentation will be in English, his native language.