BLOG

Exposure Fee at Interactive Brokers

I had a few short SPX puts on the other day and I received an email telling me about the exposure fee at Interactive Brokers. The email was titled:

Charges to Accounts with Very High Worst-Case Loss Exposure

The fee doesn't start until July 17th and my four naked puts would have had a daily fee of $1.13, which isn't a lot if you consider I sold them for an average of $2,100 each. The options expired in just over 70 days so the total fee would be around $79, assuming the fee was the same each day.

Is Your Trade As Safe As You Think It Is?

One measure of risk that is common for option traders is to use standard deviations of movement. I built a popular Standard deviation calculator to calculate the range of movement for a given set of numbers. It was accessed nearly 500 times in the past week! An option...

Announcement: New Gold Membership

We are pleased to announce the roll out of our new Gold Membership at Capital Discussions. The new Gold Membership will be in effect on Friday, June 26, 2015 at 4:30pm Eastern Time.

We will always have the core part of our community be free. The Gold Membership adds enhancements to the core features. We are using a participation model. There are two ways to get a Gold Membership:

- Participate in the Capital Discussions community as

- A trading group leader or trading group assistant leader

- A Round Table speaker in the last six months

- A subscriber to any of our experts

- An active one-on-one mentoring student

- Pay a small fee to contribute financially to keep the web site running.

($12.50 per month or $125.00 per year)

REPLAY: Round Table with Ricardo Saenz de Heredia

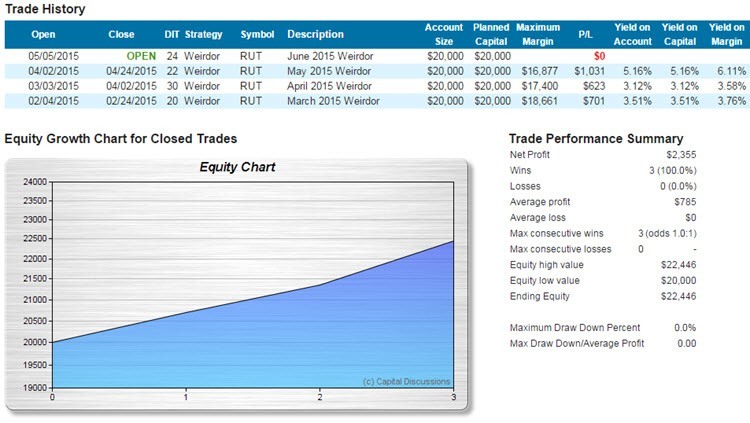

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade performance, how her window expands for adjusting over time and answered questions.

Learn more about Amy's Weirdor alert service.

Enjoy the replay!

REPLAY: Round Table with John Locke

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade performance, how her window expands for adjusting over time and answered questions.

Learn more about Amy's Weirdor alert service.

Enjoy the replay!

REPLAY: Round Table with Amy Meissner

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade performance, how her window expands for adjusting over time and answered questions.

Learn more about Amy's Weirdor alert service.

Enjoy the replay!

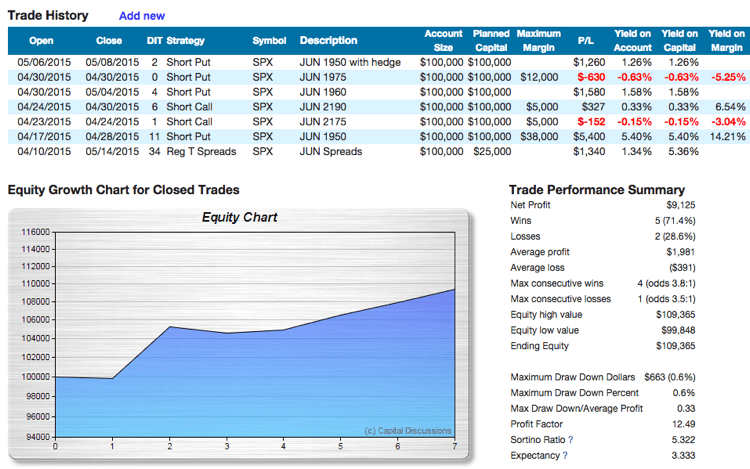

REPLAY: Round Table with Bill Ghauri

Bill Ghauri presented “The VIX Sniper”. Bill showed how he makes his trading decisions using the VIX and technical analysis. Bill reviewed his recent trades and how he uses risk and money management to get such a great Expectancy.

Learn more about Bill's Alpha service here.

Enjoy the replay!

Alexa Rankings Scoreboard

We just added a new scoreboard for Alexa rankings for option related web sites. The scoreboard only includes web sites with an Alexa ranking under 4,000,000. The scores are similar to golf: lower is better.

See the current scoreboard

The scoreboard is updated every six hours

A Trade I Like…

>

Have you seen option gurus writing articles or doing videos about trades that they like? A typical article might mention how high or low the VIX is and present a possible trade, including strikes, credits/debits, margin, risk and perhaps even break evens.

Do people put these trades on?

Unfortunately yes.

While trade ideas are interesting, they are seldom actionable for several reasons:

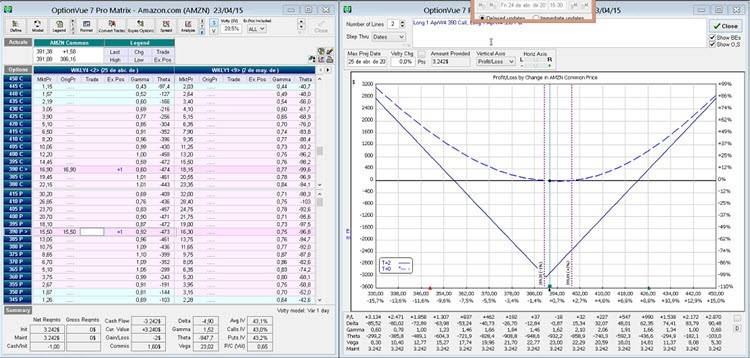

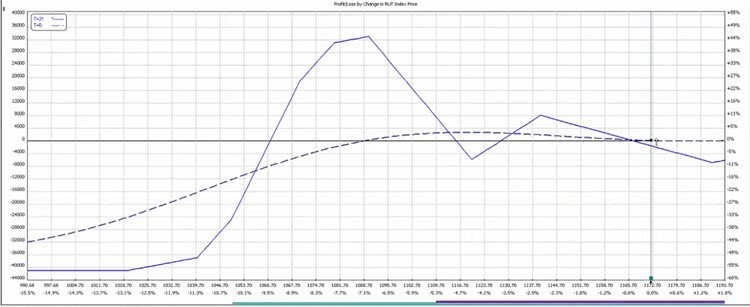

Market Analysis for May 4, 2015

Jerry Furst from Traders Education Network hosted the meeting. Jerry reviewed his outlook for the markets, including the upcoming economic events. Himanshu Raval agreed with Jerry's assessment of the SPX and RUT. Near the end of the session, Jerry demonstrated how he uses the spread finder in OptionVue and talked about repairing a long put position that is in trouble.