I had a few short SPX puts on the other day and I received an email telling me about the exposure fee at Interactive Brokers. The email was titled:

Charges to Accounts with Very High Worst-Case Loss Exposure

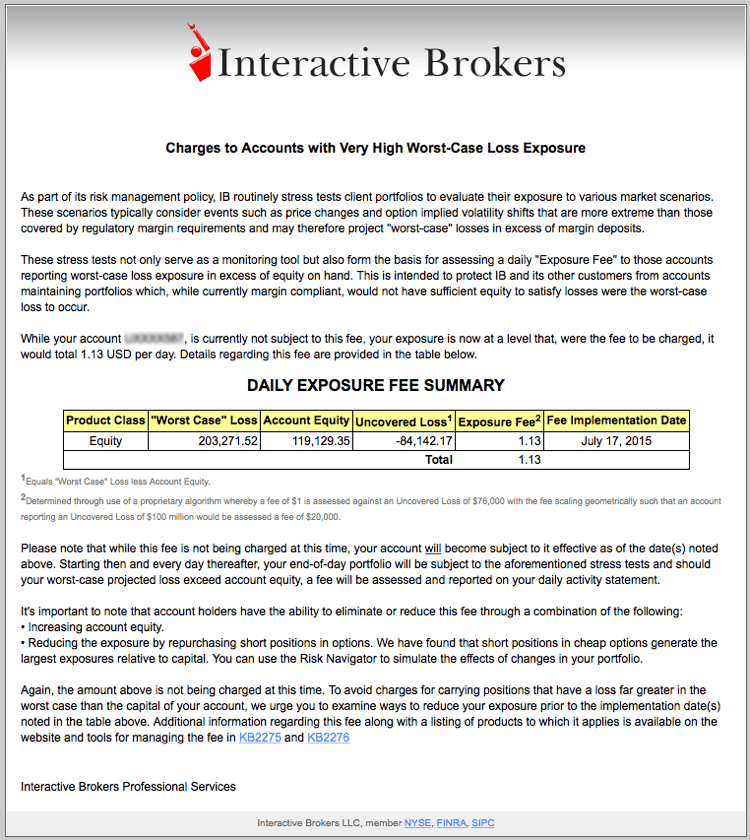

The fee doesn't start until July 17th and my four naked puts would have had a daily fee of $1.13, which isn't a lot if you consider I sold them for an average of $2,100 each. The options expired in just over 70 days so the total fee would be around $79, assuming the fee was the same each day.

Here's a copy of the email:

Avoiding the fee

It would be easy enough to reduce the worst case maximum loss on this trade by buying some very far out of the money puts so that the options wouldn't be naked. For example, I sold the SEP 1875 Puts for $21 and could have purchased some 1675 Puts for under $6 with a max loss of less than the account net liquidating value.

Summary

If you are selling naked options at Interactive Brokers, be aware that this new fee exists. It's easy to adjust your trade to avoid it. The fee applies to equities, crude oil and refined oil.

But the cost of the trade would make up the difference… Let say you buy 100 contact to lower your exposure fee. A $70 commission. And you save $1 per day on exposure fee. In the end is the same….

Dear Mr Nunamaker,

Thank you so much for your article. It was wonder full.

I had always believed Interactive to be the cheapest, now with their exposure fee it is the most expensive, including full service brokers.

I had one trade where I took in about $ 100.00, commission about $ 1.00 and exposure fee over the life of the option contract I sold $ 300.00. Seems unbelievable!

Needless to say I’m moving my accounts.

My exposure fees daily exceed $ 250.00. Over $ 100,000.00 per year.

Please keep writing!