The Trade-Offs of Using Wide and Narrow Vertical Spreads

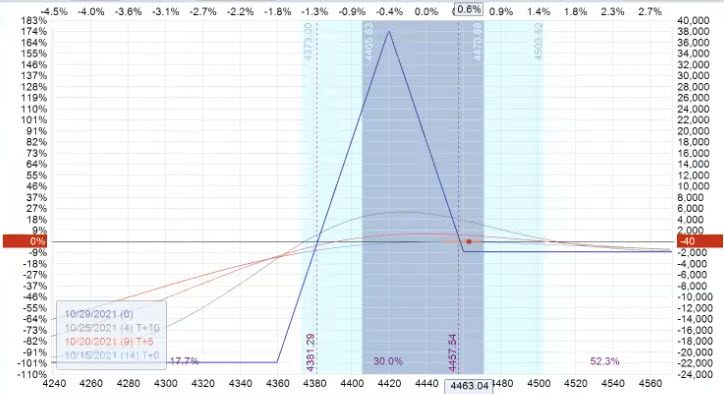

Many options traders sell put credit spreads. They can sell them alone or in combination with other spreads to create more complex spreads like an iron condor. First, let’s define what a put credit spread is. A put credit spread (also known as a short put spread) is...

Amy Meissner’s New A14 Weekly Option Strategy

Amy Meissner more than tripled a trading account in 15-months trading non-directional option strategies. Amy is well known for teaching several trading systems including: The Asymmetric Iron Condor (aka “the Weirdor”)The Nested Iron CondorThe Timezone...

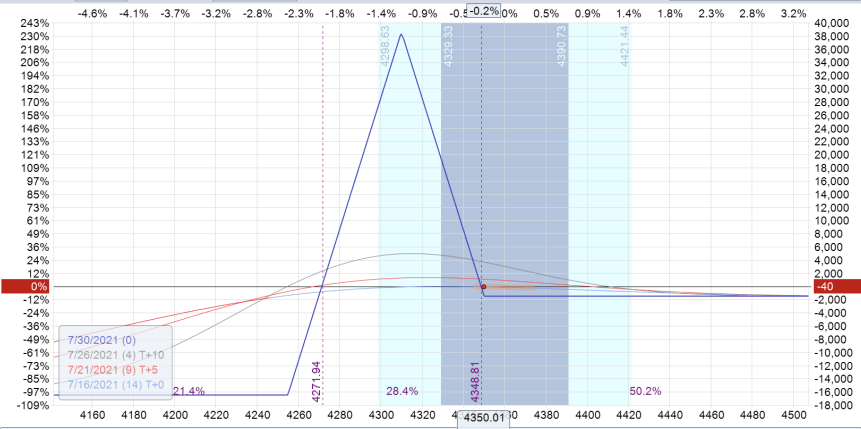

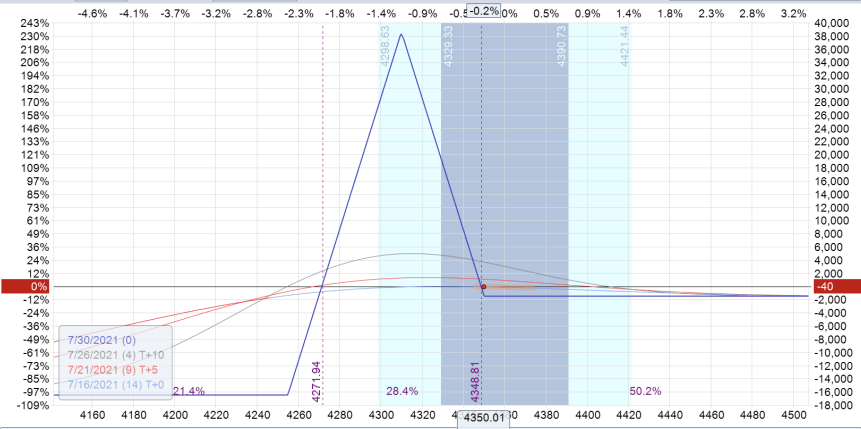

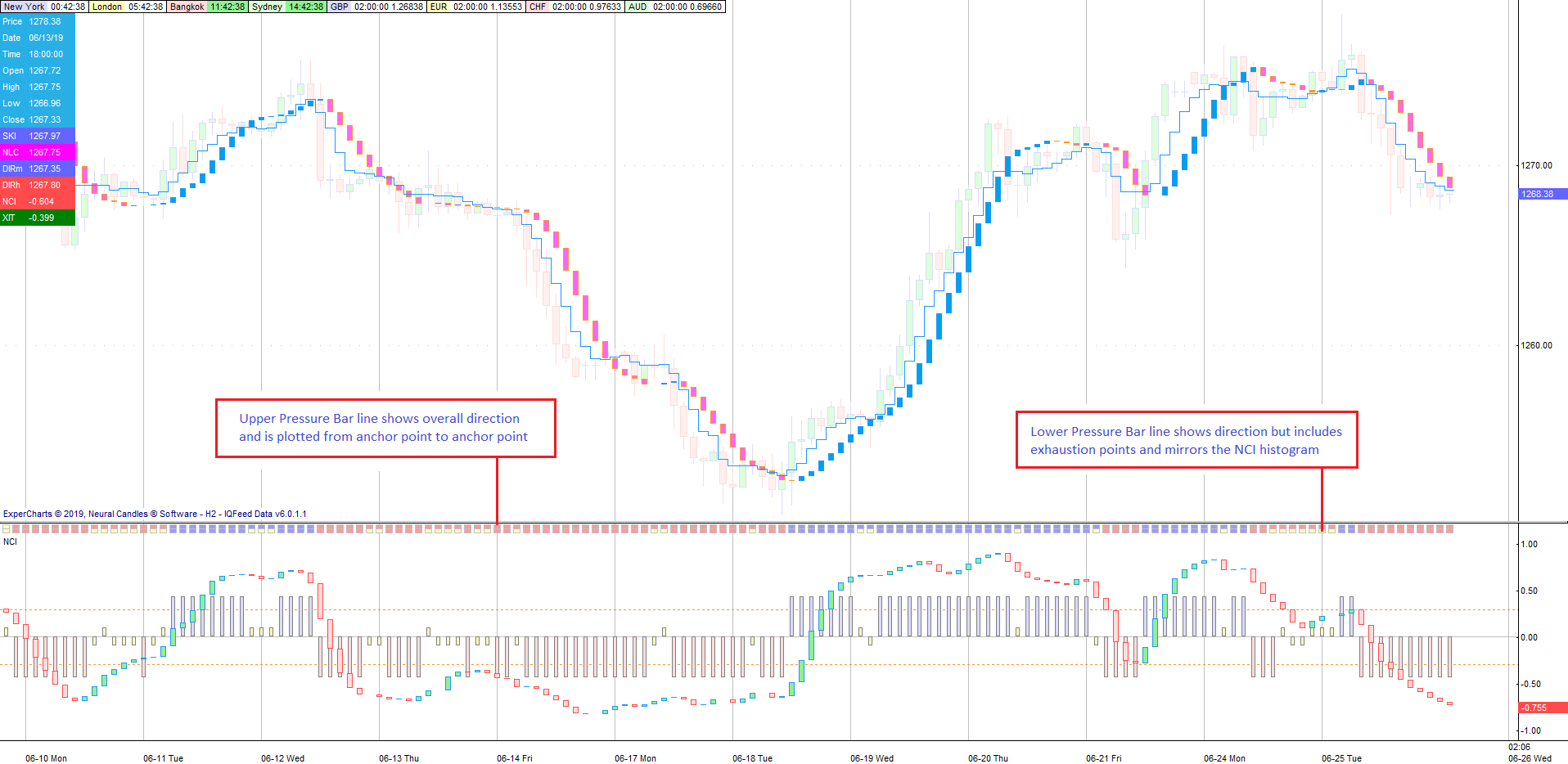

ExperSignal Update

I wanted to let you know how ExperSignal is progressing. Dr. Daniel Lyons is a long-time friend and the creator of ExperCharts software, which I'll be using to generate signals for the ExperSignal trade alert service. Daniel has PhDs in Cosmology and Applied...