by Tom Nunamaker | May 28, 2014 | Options trading

According to Crain's Chicago Business, a New York private-equity firm is planning to take control of OptionsHouse LLC and TradeMonster Group Inc. by investing in both of them and then merging the two companies. General Atlantic LLC is purchasing OptionsHouse from...

by Tom Nunamaker | May 28, 2014 | General

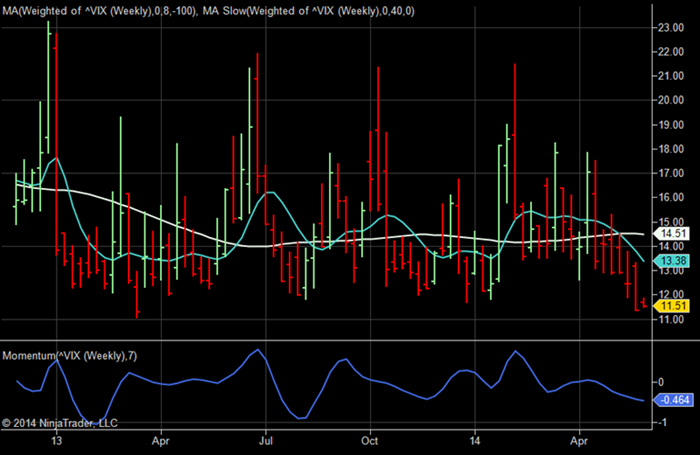

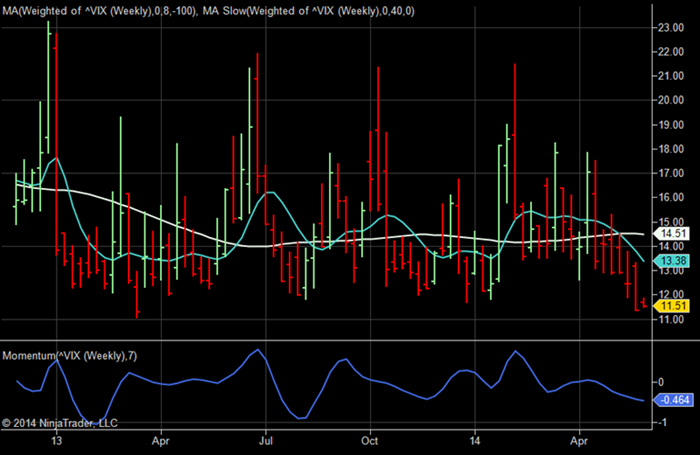

The CBOE announced they are adding half-point strikes for the CBOE Volatility Index (VIX) options. The half-point strikes will be listed for the near-term expiration month and in the strike price range of 10 to 15 (i.e. 10.5, 11.5, 12.5, 13.5 and 14.5 strikes). The...

by Tom Nunamaker | May 18, 2014 | Options trading, Trading

Let me ask you a question. Which position is more risky? Selling a Covered Call Selling a Naked Put Most people would say selling a Covered Call is a great investment strategy, but selling a Naked Put is terribly risky. If you understand Option Synthetics, you'll know...

by Tom Nunamaker | May 14, 2014 | General

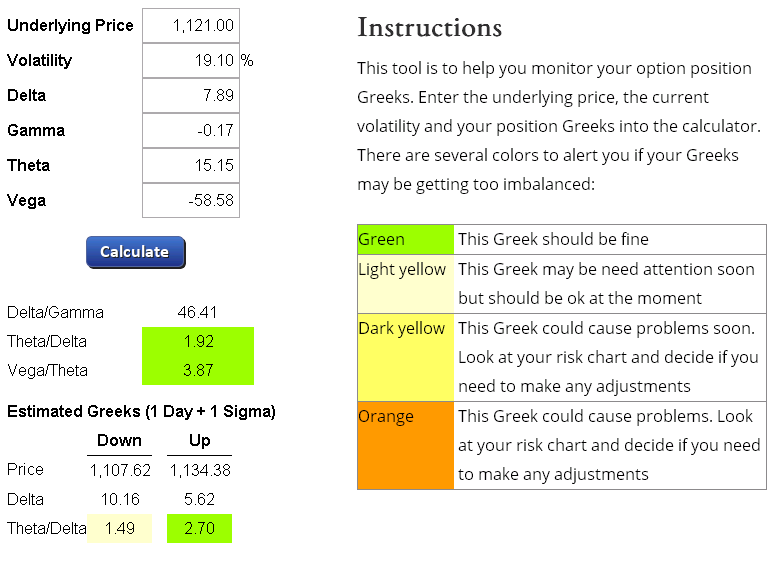

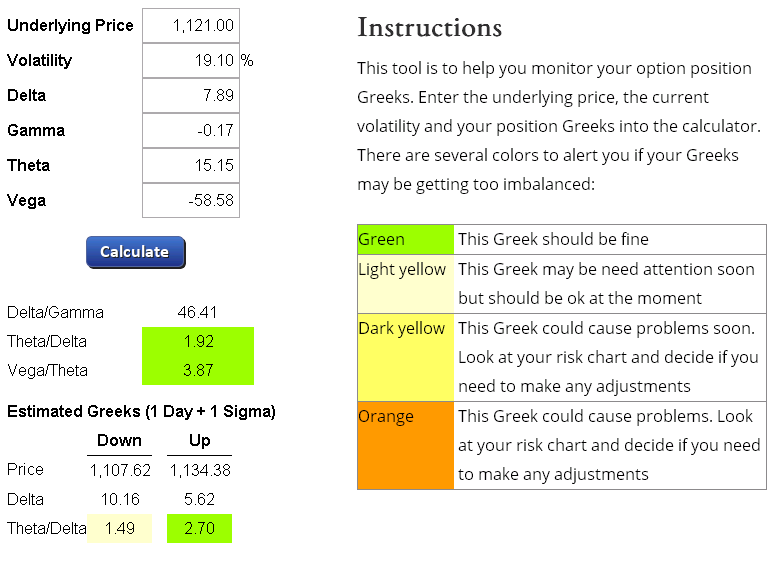

Dan Harvey has a spreadsheet he uses to help guide his contract sizes and manage his Weirdor trades. I extracted the option Greeks portion of it and created an online version which is at https://my.aeromir.com/go/c.option-position-greeks-calculator Here's a screen...

by Tom Nunamaker | May 10, 2014 | General

I started a June Weirdor/JEEP yesterday. We just moved the account I'm trading from ThinkOrSwim (TOS)to Interactive Brokers (IB) for several reasons: – Better execution and lower commissions – Opening the account through LiveVol will give access to LiveVol...