by Bill Burton | Sep 10, 2016 | Options trading, Trading

“We are programmed to receive. You can check out any time you like, but you can never leave!” Hotel California, The Eagles In my last blog post, I discussed the nuances of change in implied volatility (IV) leading up to earnings release and following the...

by Bill Burton | Aug 27, 2016 | Options trading, Trading

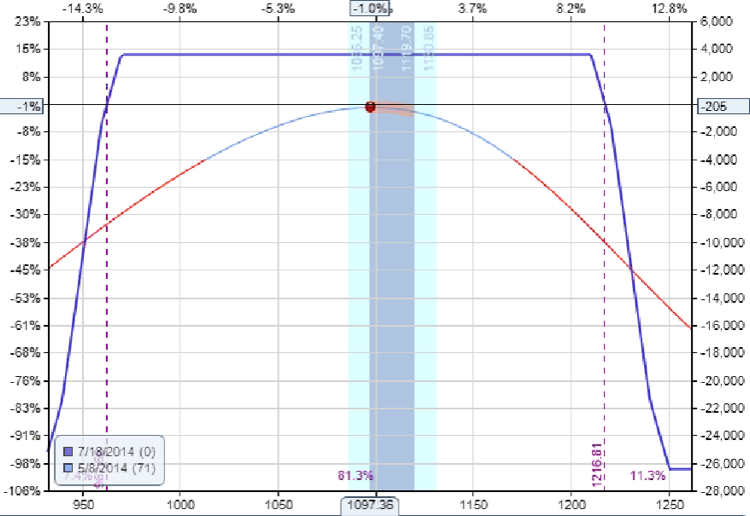

One of the advantages of an option based approach to trading is the ability to capitalize on trades that have a statistically well-defined high probability of profit. When events occur with predictable regularity, the knowledgeable option trader can effectively...

by Tom Nunamaker | Jun 18, 2016 | General, News, Trading

I remember during market crashes in the past, Interactive Brokers (IB) increased the margin for many products.There was a lot of complaining about it on certain forums but I personally was happy to see the increased margins. As an IB customer myself, I like knowing...

by Tom Nunamaker | Apr 6, 2016 | Options trading, Trading

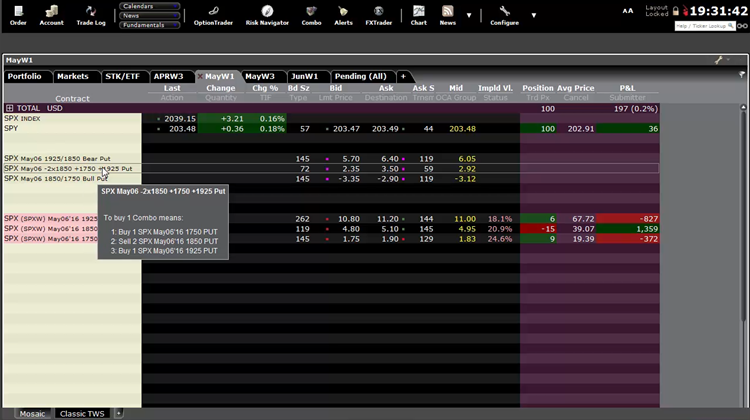

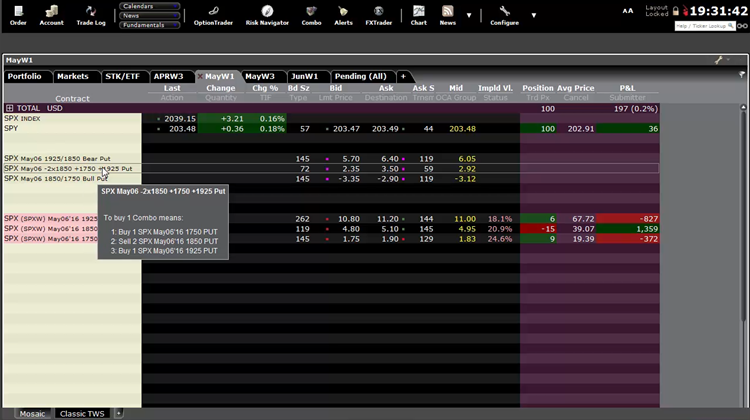

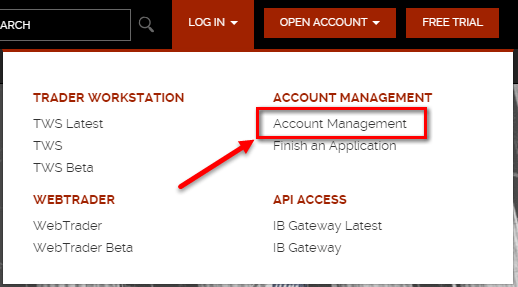

I've used Interactive Brokers for many years. I still prefer the Classic Trader Work Station (TWS) probably because I've used it for over 10 years. A friend of mine was telling me that he was making order entry mistakes of occasionally buying when he wanted to sell or...

by Tom Nunamaker | Feb 22, 2016 | Options trading, Trading

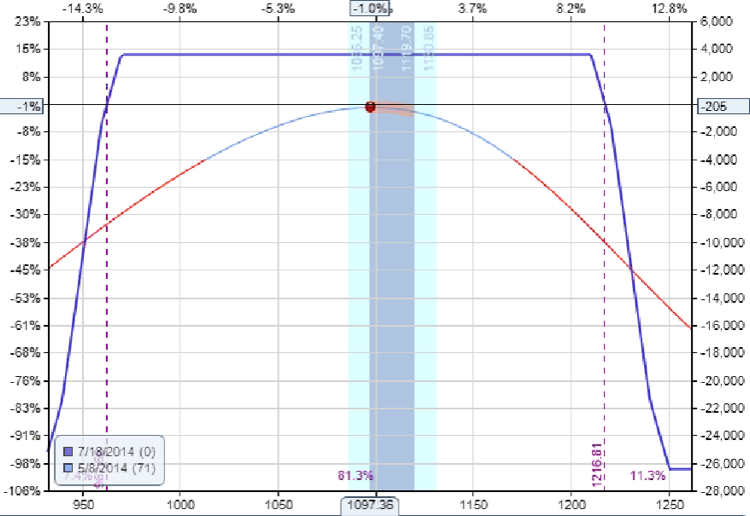

Amy Meissner will join us on Wednesday at 4:30pm ET for a special Round Table to discuss her nested iron condor strategy. Amy was written up in Technical Analysis of Stocks & Commodities magazine as the “Queen of the Iron Condor.” Click here to...

by Tom Nunamaker | Feb 12, 2016 | General, Trading

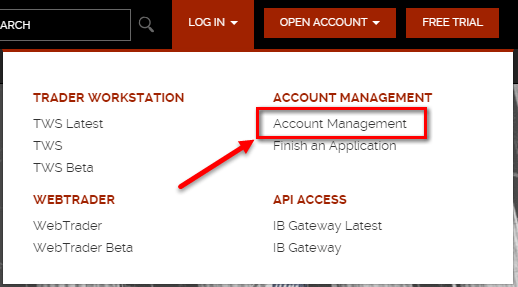

I've used Interactive Brokers for about 15 years. I was recently reviewing my Market Data Subscriptions and realized that there are a lot of choices for new users of Interactive Brokers to navigate. If you are an option trader who primarily trades the U.S. equity...