by Tom Nunamaker | Jan 1, 2020 | Futures trading, Trading

Topstep Trader is a proprietary trading firm that you can trade futures with firm capital. Topstep Trader has some demanding rules to trade their capital though. You can only trade allowed products, which is a subset of the Chicago Mercantile Exchange (CME) Futures...

by Tom Nunamaker | Dec 30, 2019 | General, Trading

These shortened urls are available for your convenience. Enjoy! URL Description Aeromir URLs Shortcut to this page https://aeromir.com/orc Option Risk Calculator https://aeromir.com/yieldcurve Bond Yield CurvesClick on “Government Bond Yield” near the...

by Tom Nunamaker | Jan 21, 2018 | News, Trading

As many of you know, I have been following Adam Grime's work at Waverly Advisors for nearly two years. Adam has fantastic market insights and I've benefited greatly from his market opinion in the last two years. I asked Adam a long time ago if he could produce an...

by Tom Nunamaker | Jul 16, 2017 | Options trading, Trading

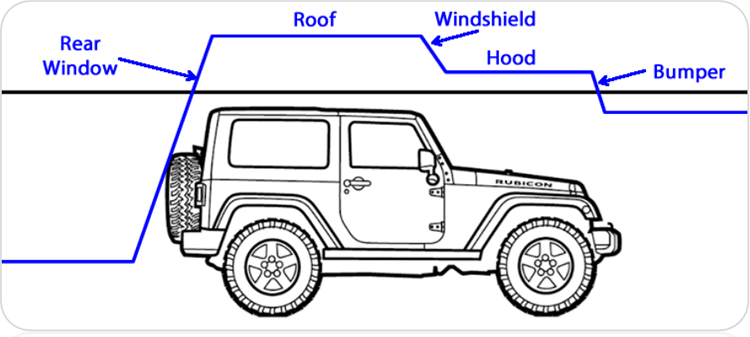

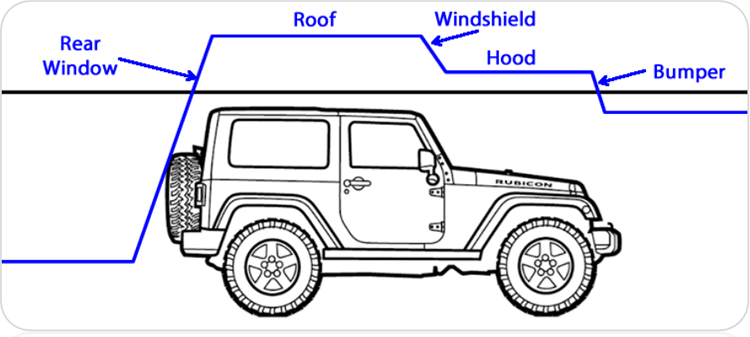

Dan Harvey, the Iron Condor supertrader, created the popular Weirdor trade several years ago. Jim Riggio, Paul Demers and others modified Dan's Weirdor with different trade management rules. This variation was named the Jeep trade to distinguish it from Dan's Weirdor....

by Tom Nunamaker | Dec 23, 2016 | General, Trading

Winning traders don't underestimate the psychological part of trading. Although you certainly cannot trade profitably without adequate capital or reliable trading strategies, your personal psychology also plays a significant role. Consider what master traders have...

by Tom Nunamaker | Nov 6, 2016 | General, News, Options trading, Trading

We all know the U.S. Presidential Election is on Tuesday, November 8th, just a few days away. We've seen how the S&P 500 has had nine straight days of losses, which hasn't happened since December 1980. The S&P 500 Let's take a look at the S&P 500 chart:...