by Tom Nunamaker | Apr 6, 2016 | Options trading, Trading

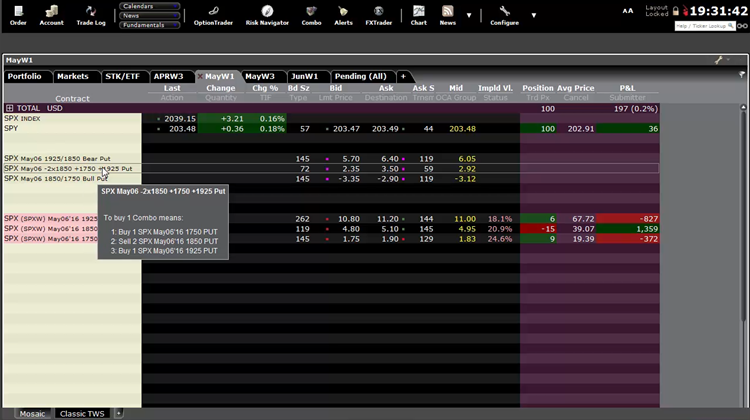

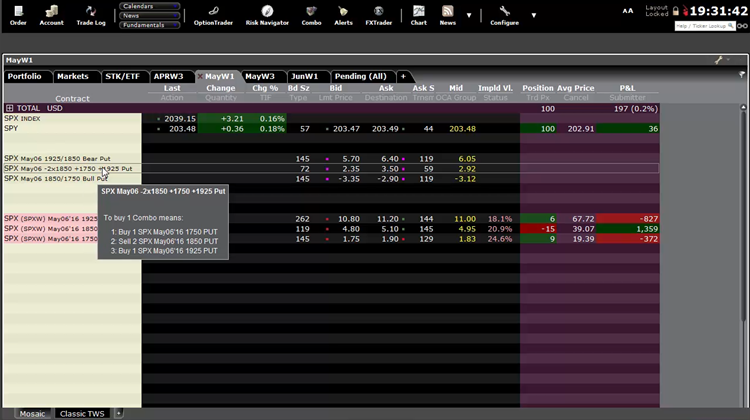

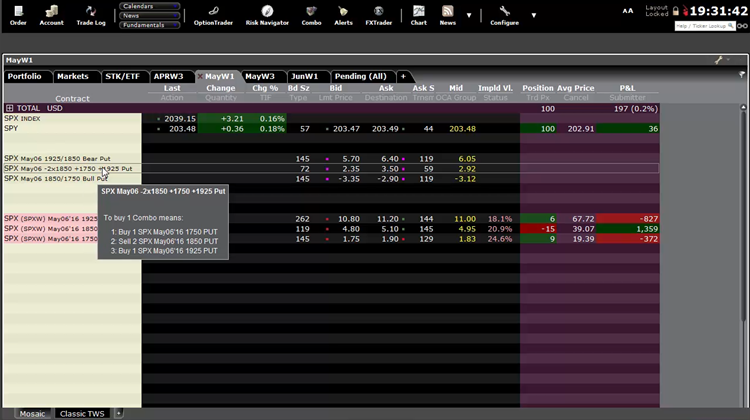

I've used Interactive Brokers for many years. I still prefer the Classic Trader Work Station (TWS) probably because I've used it for over 10 years. A friend of mine was telling me that he was making order entry mistakes of occasionally buying when he wanted to sell or...

by Tom Nunamaker | Feb 22, 2016 | Options trading, Trading

Amy Meissner will join us on Wednesday at 4:30pm ET for a special Round Table to discuss her nested iron condor strategy. Amy was written up in Technical Analysis of Stocks & Commodities magazine as the “Queen of the Iron Condor.” Click here to...

by Tom Nunamaker | Feb 12, 2016 | General, Trading

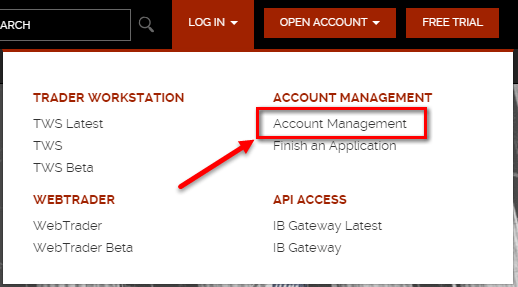

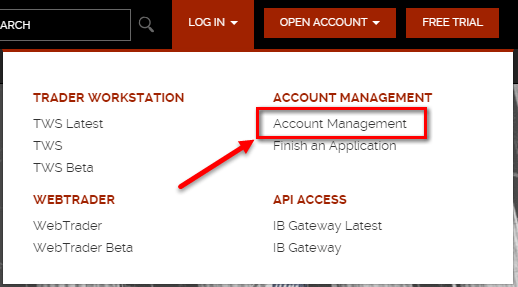

I've used Interactive Brokers for about 15 years. I was recently reviewing my Market Data Subscriptions and realized that there are a lot of choices for new users of Interactive Brokers to navigate. If you are an option trader who primarily trades the U.S. equity...

by Tom Nunamaker | Feb 6, 2016 | News, Options trading, Trading

I came across an interesting announcement from CBOE that they are adding a new SPX weekliy option that expires on Wednesdays! OptionVue and OptionNET Explorer have some work to add the new options into their software now! Here's the CBOE press release: CHICAGO, Feb....

by Mike Schwartz | Dec 30, 2015 | General, Options trading, Trading

As we come to the end of another trading year, it is that time when we make a few personal decisions. Will you reflect and review on your performance over the past year? Did you set goals for 2015 and if so, how did you do and why? Will you set new goals and a plan of...

by Tom Nunamaker | Dec 20, 2015 | General, Options trading, Trading

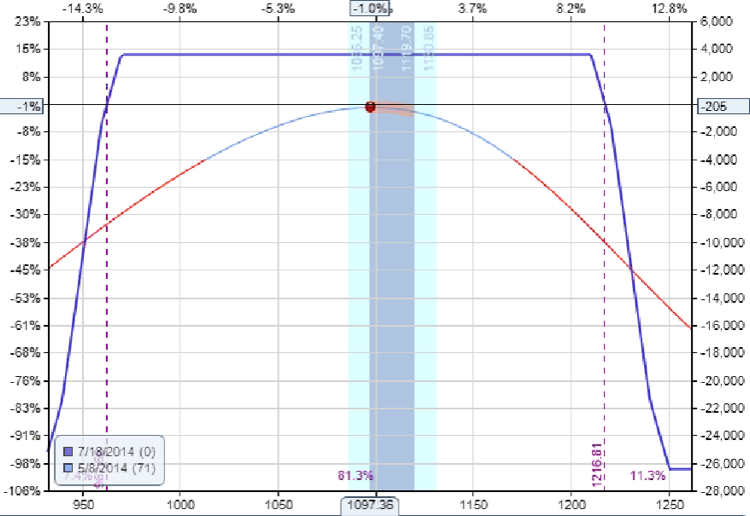

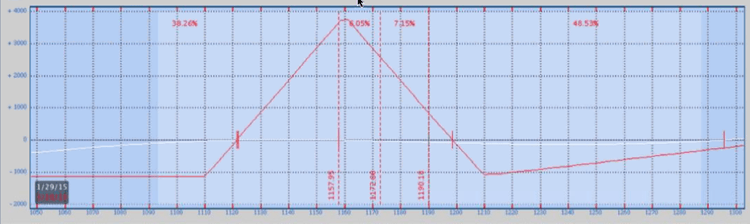

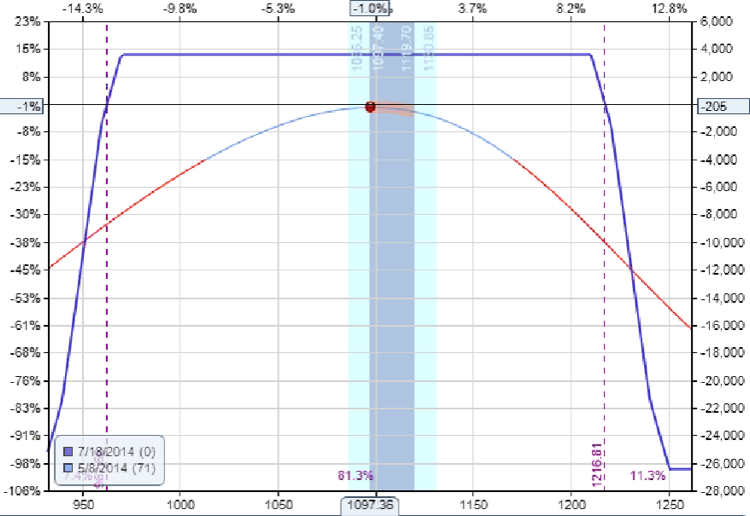

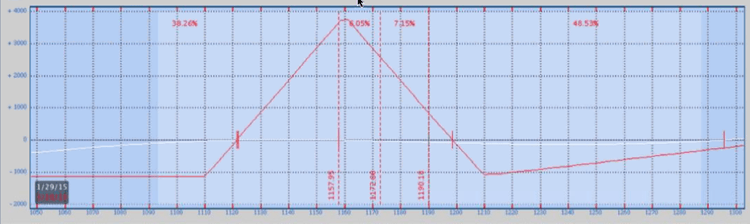

Dan Neagoy, from Theta Trend, presented his Core Income Butterfly (CIB) trade to the Capital Discussions Round Table yesterday. Dan covered lots of ground: His background The philosophy of the CIB trade Entry, Adjustment and exit guidelines An example of a recent...