by Tom Nunamaker | Jul 18, 2019 | Options trading

Ophir Gottlieb, CEO of Capital Market Laboratories, is speaking next week about their TradeMachine. I looked at the TradeMachine several years ago while it was relatively new. In the past several years, it has matured into a very powerful back trading and alerting...

by Tom Nunamaker | Jul 13, 2019 | Options trading

The Mini-POT trial has come to an end. Mini-POT subscriptions are now available! The POT trades in the last several weeks have performed really well. Here is the performance since June 25th. Mini-POT trade history from 25 June 2019 to 12 July 2019HYPOTHETICAL PAST...

by Tom Nunamaker | Jun 15, 2019 | Options trading

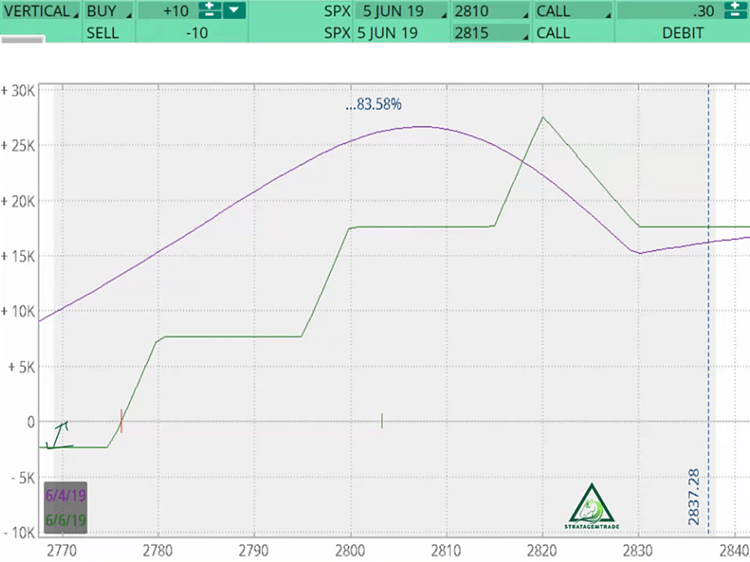

Scott Ruble (aka J.L. Lord) is starting a miniature version of his Practical Options Tactics, or POT class at Aeromir.com next week. What is POT? POT is Scott's flagship product at StratagemTrade.com that teaches options traders: How Scott trades with real-time trade...

by Tom Nunamaker | Jun 13, 2019 | Options trading

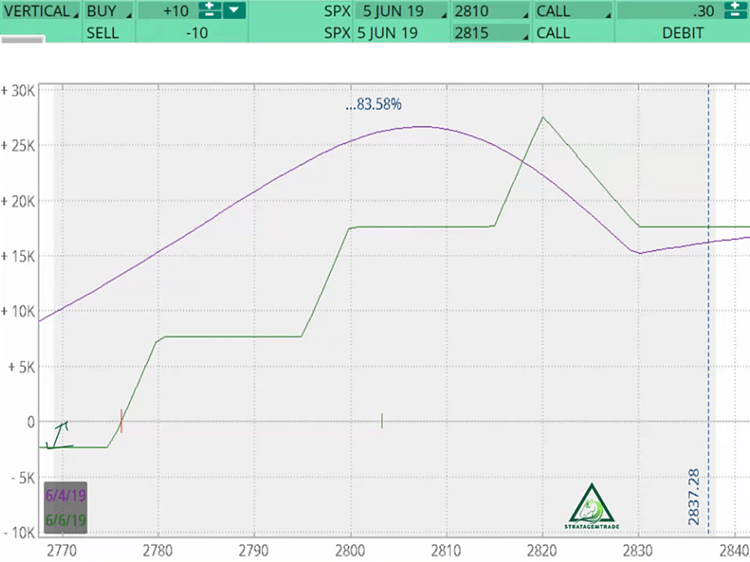

Scott Ruble (aka J.L. Lord pen name) from StratagemTrade.com is a successful former CBOE market maker who has been teaching Practical Options Tactics (P.O.T.) for many years. Scott's POT trades are already +91% in 2019. Scott has agreed to run a miniature version of...

by Tom Nunamaker | Jun 10, 2019 | Options trading

Two definitions of the word “synthetic” are: produced artificially devised, arranged, or fabricated for special situations to imitate or replace usual realities These definitions can describe “Synthetic Positions” in option trading. To understand synthetic...

by Tom Nunamaker | Jun 2, 2019 | Options trading

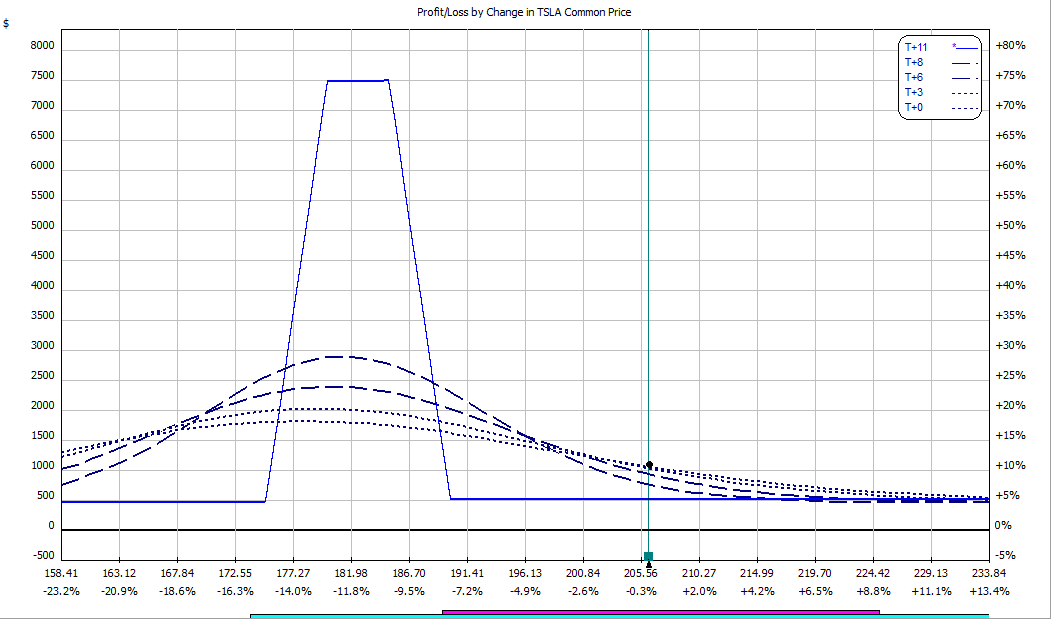

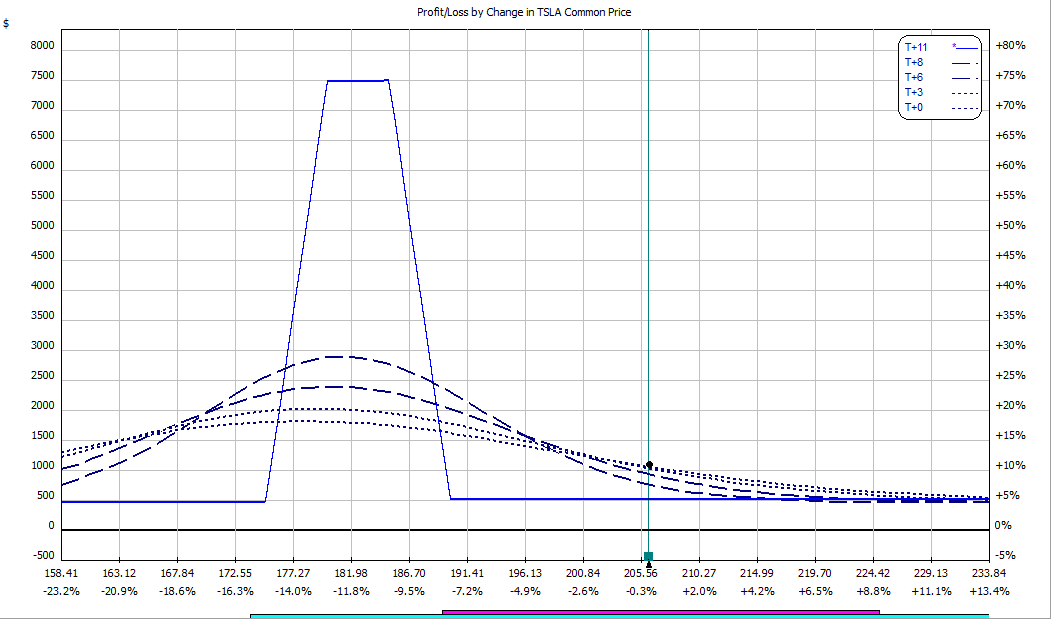

Steve Spencer at SMB posted a video of how to use options for swing trading. Steve used a synthetic stock position with a split strike, done for a credit. The video was posted at https://www.youtube.com/watch?v=nMq1TZFBToE Is that the best trade we can put on? Steve's...