Steve Spencer at SMB posted a video of how to use options for swing trading. Steve used a synthetic stock position with a split strike, done for a credit. The video was posted at https://www.youtube.com/watch?v=nMq1TZFBToE

Is that the best trade we can put on?

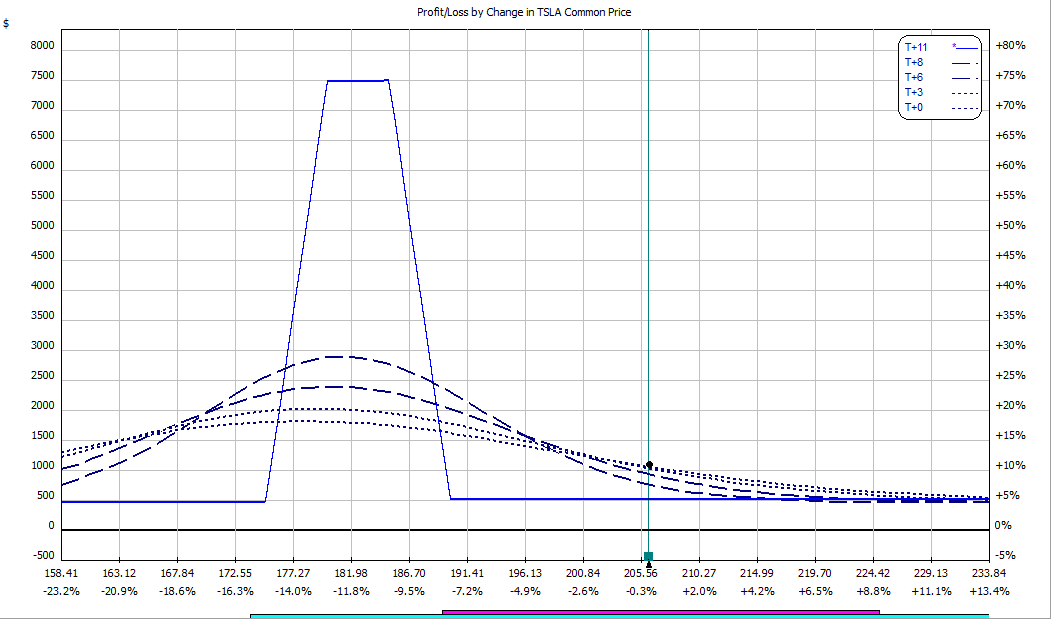

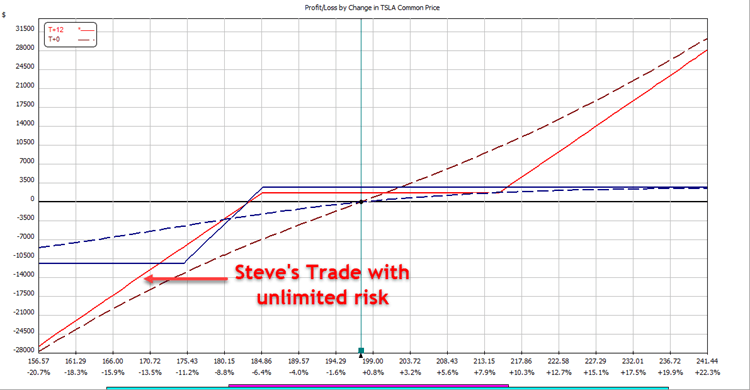

Steve's trade uses $26,000 of margin. In the video, Steve says he received a $4 credit but it was really only $2.60. On 10-contracts, that's a +$2,600 potential profit. Here is what the trade looks like visually:

How about using a vertical spread?

One problem with Steve's idea is that he is buying a call after the stock price has fallen. This usually means that volatility has increased.

As the stock rises, you are making money with the short put but your call is fighting decreasing volatility. Delta is helping the call of course, but why not use a vertical to minimize the effect of Vega on the trade?

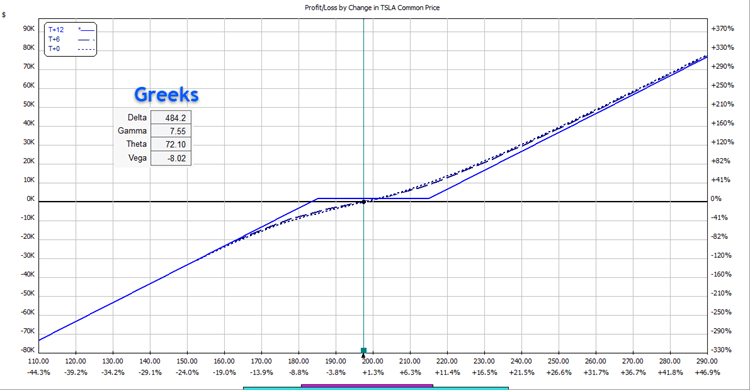

To have roughly the same Delta of the position, I did a 14-lot short put spread (a put credit spread). Recall that a short put spread is identical to a long call spread. This spread has the same +$2,600 potential if the stock sits as Steve's trade:

Here's how Steve's trade and this one compare:

The two trades have roughly the same profit potential if the stock expires above 185 and below 215.

Steve's trade has about $170,000 of risk if TSLA goes to $10. It can happen. Remember Enron? My trade has $11,400 of defined risk on the down side.

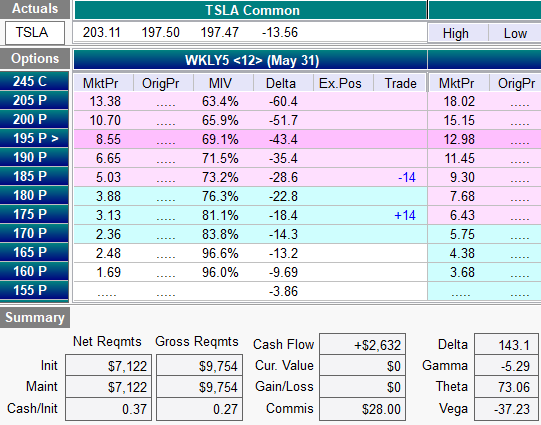

Steve adjusted with the stock $10 higher than his entry. Let's do that with the vertical spread.

Vertical spread adjustment.

We have many possible adjustments. Here are three choices:

- We could buy the 200/185 Put spread for $2.65. This creates a split strike butterfly with the maximum risk reduced to $1,100 (up or down) and a max profit potential of $12,870. Expected return three days before expiration is +$1,449.

- We can buy the 195/185 Put spread for $2.01. This creates a butterfly with a maximum risk of $266 and a maximum profit potential of $13,780. Expected return three days before expiration is +$1,249.

- We can buy the 190/180 Put spread for $1.49. This creates a narrow condor with a $460 credit. We are playing with house money at this point! Expected return three days before expiration is +$1,107.

We can get creative and buy 10 200/190 Put spreads to create a broken wing butterfly with no risk on the upside but -$4,086 risk on the downside. Expected return three days before expiration is +$1,711.

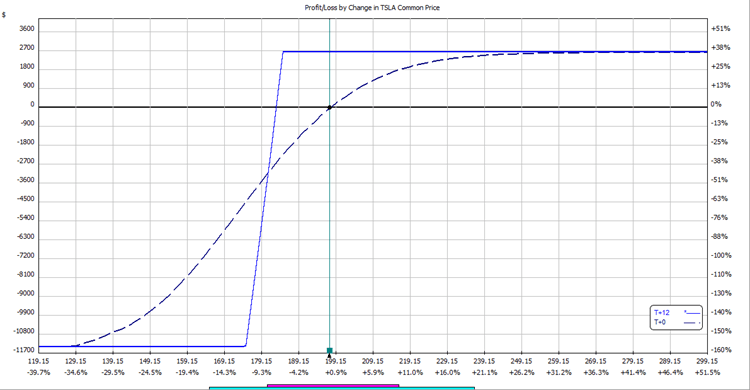

Option 3 looks like this:

We Can't Lose!

You can't lose on this trade now. While you could take the trade off, you have some nice profit potential if the stock moves lower. The only risk is giving up some of the unrealized profit.

Would you like to put a trade like this on for a $500 credit? I would.

End Result.

TSLA stock closed at 185.16 on May 31st. Steve's trade would have made a +$2,600 profit. With the market falling, the option #3 I show above, made about +$7,000. If you had gone with option #1, the $15-wide put spread you bought for $2.65 expired at $14.84, which is over a +$12,000 profit!

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

New Trade Alert service based on this trading style.

This style of trading of putting a directional trade on and spreading off the risk will be a new trade alert service soon. If you'd like to be on the list to get our free charter trial, please sign up at https://aeromir.com/tas

Do you use options to take directional trades? What type of trades do you do?