Rhino Trade Alerts

Rhino Trade Alerts Brian Larson's popular Rhino trade is very forgiving in large market moves. It was designed to have minimum adjustments over the life of the trade so it is suitable for traders who have full time jobs and can't be at their computers during the...

Round Table with Tom Nunamaker – The Reverse Harvey

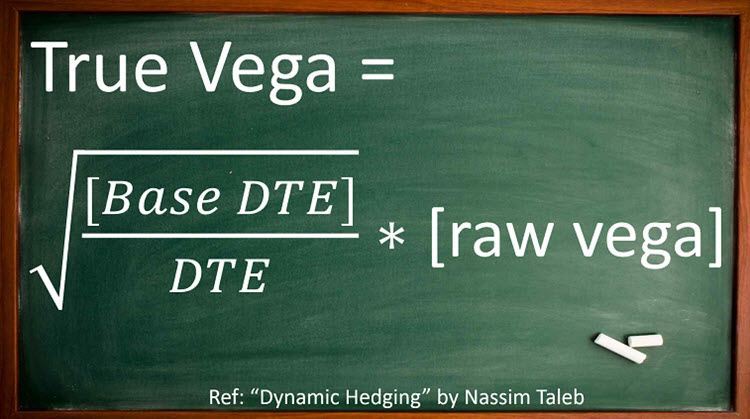

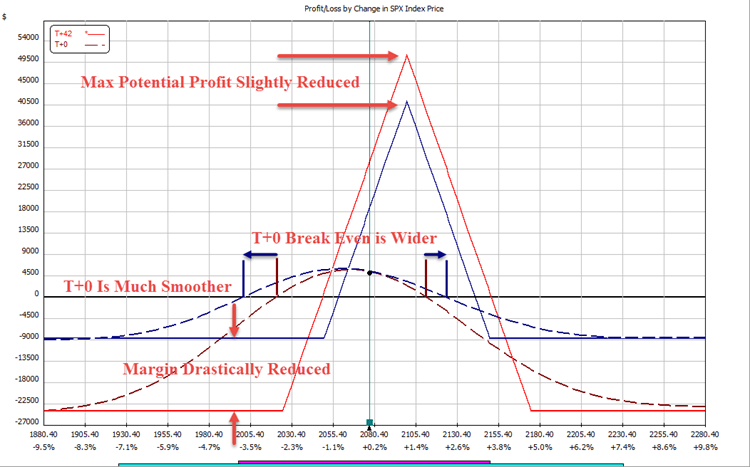

Tom Nunamaker is presenting the Reverse Harvey on the Round Table this week on Thursday at 4:30pm ET. The Reverse Harvey is a great trade adjustment technique to use as your trades are making money. The Reverse Harvey Reduces margin, sometimes by over 50% Flattens the...

Beginner Trading Group

If you're getting started with option trading, or want a refresher, check out our new Beginner Trading Group. Jerry Furst, from Trader's Education Network, hosts the group and does a great job teaching option trading concepts and answering your questions. Join the...

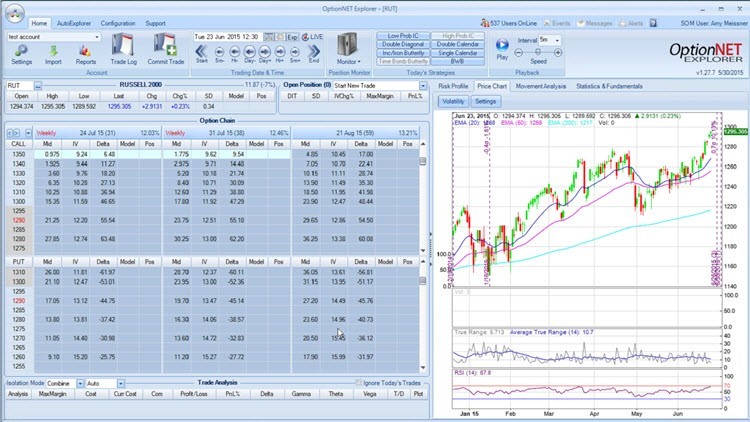

Round Table Replay with Amy Meissner – Pitfalls of Complacency

Veteran trader Amy Meissner presented “Pitfalls of Complacency”. Amy covered several good lessons we should all remember while we're trading. We talked about black swan events and some things to do to protect your trading account from blowing up. Enjoy the...