Exchange Traded Funds (ETFs) are funds that track indexes such as the S&P 500, Nasdaq 100, Dow Jones Industrial Average, Russell 2000, etc. When an investor buys shares of an ETF, they are actually buying shares of a portfolio that tracks the yield and return of the related index. By purchasing an ETF, investors get the diversification of an index fund, but at a much lower cost. Some ETF shareholders are also entitled to a portion of the profits, usually paid quarterly, in the form of dividends. The use of ETFs is a popular choice among traders.

Today we will talk about a family member of the traditional ETF, Inverse ETFs. We'll cover just what inverse ETFs are all about, and how traders may use them in their trading.

What is an Inverse ETF?

Similar to traditional ETFs, Inverse ETFs also track indexes such as the S & P 500, Nasdaq 100, etc., but they are comprised of multiple derivatives designed to benefit (profit) from a decline in the value of the underlying benchmark. This is the opposite of traditional ETF's. Inverse ETF's are also referred to as a “Bear ETF”, or “Short ETF”. Inverse ETF's are mainly used by traders that either day trade, or hold onto the position for only a few days. Some traders use them as a short-term portfolio hedge, others who day trade may take a speculative trade on an Inverse ETF if they anticipate the underlying to decline.

There are many Inverse ETFs available to traders. A list of all Inverse ETFs currently available in the USA can be found here: Inverse ETFs

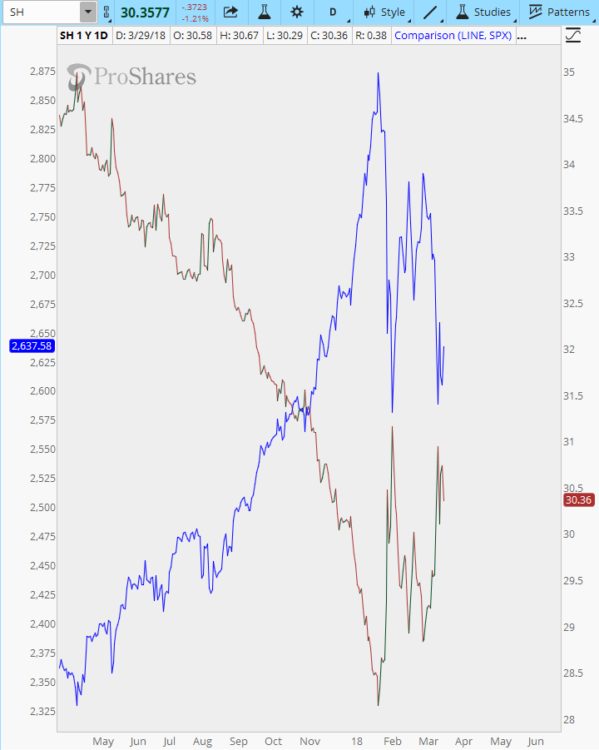

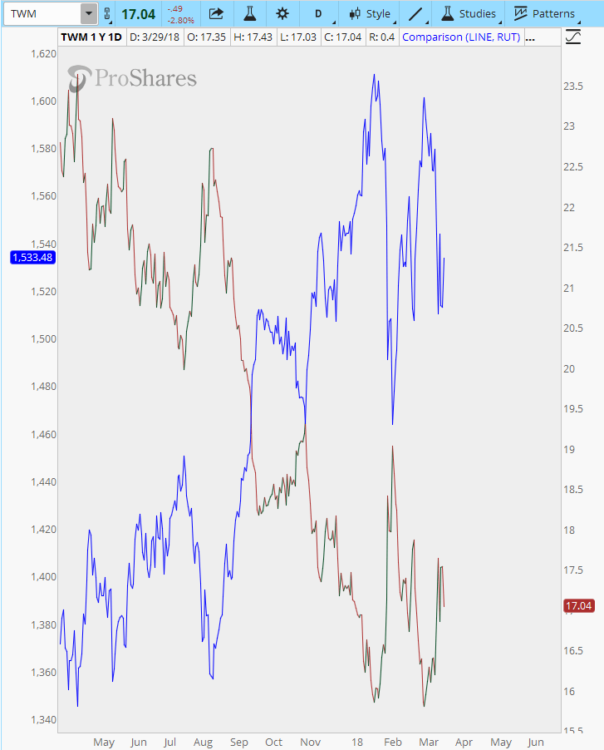

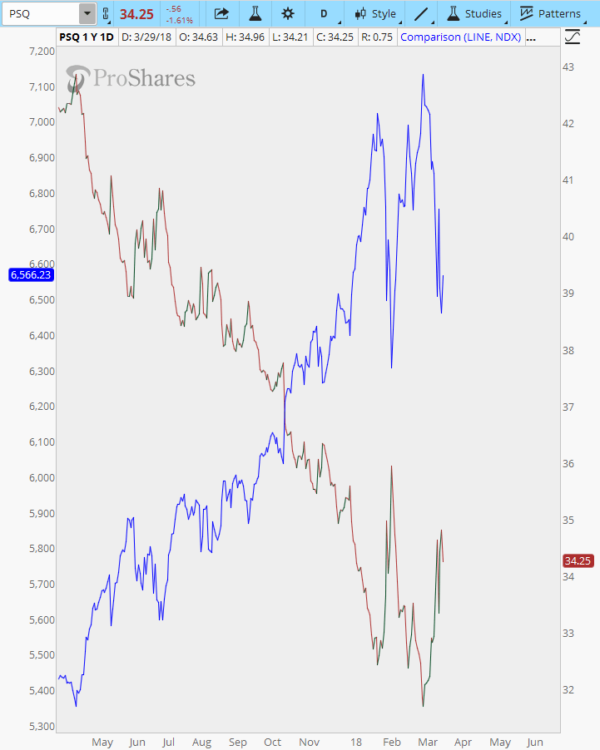

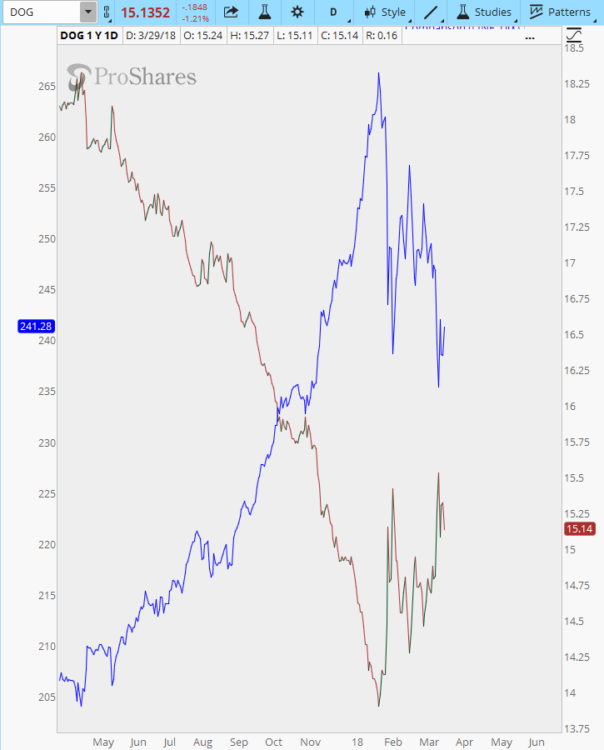

Today we will look at some Inverse ETFs that track the four major indices. Below are one year charts of the S & P 500, Russell 2000, Nasdaq 100, and Dow Jones Industrial Average indices. Overlaid on each chart is the corresponding Inverse ETF chart that correlates with the index.

Figure A. One year chart of the S & P 500 and the Inverse ETF SH

Figure B. One year chart of the Russell 2000 and the Inverse ETF TWM

Figure C. One year chart of Nasdaq 100 and the Inverse ETF PSQ

Figure D. One year chart of the Dow Jones 100 Industrial Average and the Inverse ETF DOG

You can see how price movement of the Inverse ETF (blue line) in each of the above charts has been in the opposite direction of the index itself (red and green line).

What are some advantages to Inverse ETFs?

- Inverse ETFs can be used as an alternative to short selling, i.e. selling a call, to hedge a portfolio against downside risk . Because they are purchased, a margin account is not required. This can be a benefit for those who trade in Individual Retirement Accounts, where there are restrictions on taking a short position. Inverse ETF's allow any trader with a brokerage account to hold a short position if they feel the underlying will go down and they want to hedge their portfolio. For example, if a trader feels that the Nasdaq 100 will decline, he/she could simply buy shares of PSQ, or open an option trade on the Inverse ETF PSQ.

- Your risk is limited when purchasing an Inverse ETF. When you short an underlying, the losses could be significant if the market moves against you. With an Inverse ETF, your exposure is limited to the cost of the ETF or option.

- It is also possible for a trader to purchase an Inverse ETF on a specific sector, such as financials, energy, or technology. If an investor is bearish on any one of these sectors, they may want to purchase the Inverse ETF for which that sector is associated.

As with any investment strategy, there are risks associated with potential rewards. Here are a few disadvantages of trading Inverse ETFs:

- Inverse ETFs are best suited for those traders looking for a short term hedge, not as a longer-term investment. The reason is that many Inverse ETFs utilize daily futures contracts as a basis for their returns, which can fluctuate dramatically in price from day to day. Because of these potential wild swings, pricing is not always accurately representative of the index they correlate with when held longer than a day. Day traders may find Inverse ETFs a very effective addition to their trading plan.

- Open interest can be low on some of the options for the Inverse ETF's, which means it may be difficult getting filled at the price desired. This low open interest will most likely create a wide bid/ask spread, which could potentially create lower profits along with greater losses than anticipated.

- Some, but not all, Inverse ETFs are leveraged, which can act as a double edged sword.

What is leverage? “Leveraged investing is a technique that seeks higher investment profits by using borrowed money. These profits come from the difference between the investment returns on the borrowed capital and the cost of the associated interest. Leveraged investing exposes an investor to higher risk” according to Investopedia.com.

Here is an example of how a leveraged Inverse ETF works:

Let's say you purchased an Inverse ETF which is leveraged at 2x for a cost of $100, and it ends up at the end of the day at $110. The profit would be 10% for the day. Because the Inverse ETF is leveraged, you would realize a 2x profit of 20%. This can work the same way if the position goes against you. Let's say that this same Inverse ETF position goes against you the next day, and the value falls from $110 to $100, a loss for the day of 9%. The trader realizes a 2x loss on of 18%.

While this may not be that harmful on a small position, those losses can be significant depending on the size of the position. If the ETF you are considering is leveraged at 3x, it would mean that the profits AND losses would be three times greater than if there was no leverage.

In conclusion, investing in Inverse ETFs can be a useful tool for some traders. It may be worth considering the use of Inverse ETFs in your trade plan. It is wise have a full understanding of all the benefits – and risks involved. Be sure to know whether the Inverse ETF you are considering is leveraged, and to what extent, etc. Knowing all the risks involved in trading Inverse ETFs, as with any investment product, can help you make informed decisions on your trading.

If you have any experience on how you have used Inverse ETFs in your trading and would like to share, feel free to comment below.

Are you looking for a trading group, educational alert service, or mentoring? Look no more; join now!