One of the numerous strategies available to traders are vertical spreads. Credit spreads come in two varieties: the Bear Call spread and the Bull Put spread. This article will cover the Bear Call Spread …how they are constructed, how much can be gained, as well as how much capital can be lost. We will talk about Bull Put spreads in a subsequent article.

What is a Credit Spread?

Credit spreads are made up of two options with two different strike prices. One option strike is bought for a debit, and the other option strike is sold for a credit. This results in a net credit for the spread. Both options are in the same expiration period.

Bear call spreads explained

The bear call spread is generally used when a decline in the price of the underlying is expected. It is constructed by selling a call option at a specific strike price, while at the same time purchasing the same number of calls at a higher strike price.

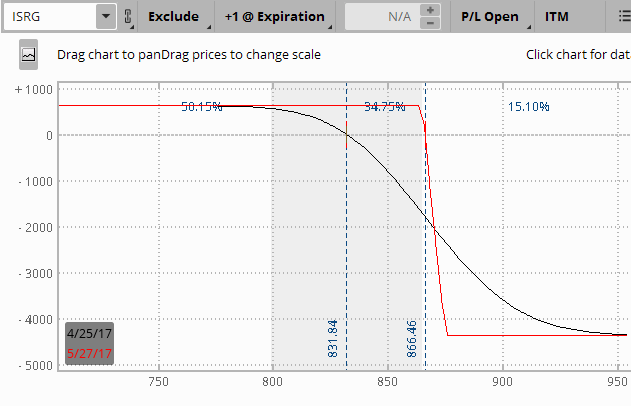

Below is an example of a bear call spread on ISRG opened 31 days to expiration, with ISRG selling at 832.

The bear call spread was opened as follows:

- Sold (5) 865 Calls @ $1.60 credit

- Bought (5) 875 Calls @ $.35 debit

Net credit: $1.60 credit less $.35 debit = $1.25 per lot, or $625 total credit for the position

How much profit or loss is in this bear call spread?

If the trader chooses to take the spread to expiration and ISRG remains below the short call strike of 865, the trader enjoys the full profit of $625, less commission. Taking spreads to expiration presents a risk many traders choose not to have in their trading plan, but the point of the example is to show the maximum profit potential within the spread.

Next, how much could potentially be lost on this position? Because the credit spread is 10 points wide (each point equates to $1,000 margin) and we have 5-lots, the gross margin for the position is $5,000. A credit of $625 was collected when the trade was opened, reducing the overall margin requirement to $4,375. If there was a large move taking the trade outside the expiration breakeven and the trader did nothing, the maximum potential loss would be $4,375. The expiration breakeven is calculated by taking

the short strike of 865 plus $1.25 credit received = $866.25, which is the expiration breakeven.

Other advantages of the Bear Call Credit Spread

Bear Call credit spreads offer traders a limited-risk strategy, along with a limited profit potential. One of the key advantages of credit spreads in general is that they don't normally require a very strong movement of the underlying, because the trade can profit from time-value decay. Because of this time-decay, Call Credit spreads have a “forgiveness factor” built in and can be used if the underlying remains in a trading range as well as if the trader has a strong directional bias.

As with any options trading strategy, it is important to have a full understanding how credit spreads work, back test them thoroughly, and start with a small amount of capital when first investing live.

Are you a trader looking for education in options education? Go to Join Capital Discussions. Don't delay!

They have a wide variety of programs including mentoring, trading advisories, trading groups, and veteran traders willing to share their trade techniques. When you surround yourself with consistently profitable traders, your own trading can improve.

Feel free to comment below.