Time decay in options, also called “Theta”, is the measurement of how much the value of an option will lose or gain each day as it gets closer to expiration.

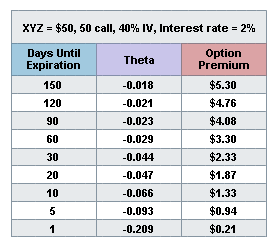

Time decay is not linear – the theoretical rate of decay accelerates as the option gets closer to expiration. The best way to explain time decay is using an example. The example below (courtesy of The Options Industry Council) shows how time decay tends to behave over time. The example is using a 50 strike call option on Company XYZ trading at $50.

Figure A. XYZ Time Decay Graph (Options Industry Council)

When you look at the graph shown in Figure A, you will see how rapidly the time premium begins to decay as the option gets closer to expiration. With the option premium $5.30 150 days until expiration, it decreases to only $1.87 by the time the option reaches 20 days to expiration. Please keep in mind that this example is based on volatility remaining constant at 40%, and interest rate of 2%. At 150 days to expiration, the theta is -.018. Theoretically, this means that the current price of the option will decrease in value by .018, all else remaining equal.

When you purchase an option, the passage of time will decay your position's value. Each day that passes, all else remaining equal, your long position will decrease in price. Instead of purchasing options, you can choose to sell them. When you sell an option, the passage of time works in your favor as illustrated in Figure A.

How traders can take advantage of time decay

There are numerous strategies out there – too many to include in this article – where traders can take advantage of time decay. I will just mention a few popular choices today.

-

Call or Put Credit Spreads

These are most often used when the trader has somewhat of a directional bias; either bullish or bearish. By combining the purchase of a long option with the sale of a short option, the trader now has time decay working, adding value to the position with each day. Because of this time decay, credit spreads have a “forgiveness factor” built in. The underlying can be in a trading range, or even move a bit against the position, and credit spreads can still be profitable.

-

Iron Condors

The Iron Condor is also a strategy used by many traders to benefit from time decay. The Iron Condor has four “legs” and consists of both short and long calls and puts. The Iron Condor makes the most out of time decay if the underlying remains within a particular trading range throughout the cycle of the trade. Iron Condors have the same “forgiveness factor” as credit spreads, so they have some room to move around between the puts and the calls as time decay erodes the value of the short options.

Credit Spreads and Iron Condors will be discussed further in upcoming articles.

-

Time Spreads, such as the Diagonal

The diagonal spread was discussed in an article published on April 2, 2017. A diagonal spread also consists of a long option and a short option. The short option has fewer days to expiration, and the long option is longer-dated. The diagonal spread benefits from time decay of the short option.

In summary

When you purchase an option, your position gets weaker with the passage of time. You will want the underlying to move in your favor in order for the position to reach your desired profits. When you sell an option, your position gets stronger as time erodes the value as long as it remains out of the money.

If you haven't already taken action, join Capital Discussions here: Capital Discussions

Whether you are a novice or experienced trader, you will benefit from the variety of services offered including mentoring, educational alert services, trading groups, and more.