A diagonal spread, also known as a time spread, may be a strategy you would like to implement into to your trading arsenal. Today we will discuss how a diagonal spread is created. We will also discuss some of the advantages and disadvantages of a diagonal spread.

A diagonal spread is a strategy which occurs when two options are bought or sold. These two options use the same instrument. These two options are of the same type, either two calls or two puts. The two options are at different strike prices, as well as two different cycles of expiration.

When a long diagonal spread is initiated, it can either be a net debit or a net credit to your account. A long diagonal spread consists of an option which you buy with more days to expiration than the option which you sell with fewer days to expiration. The strikes which are bought or sold to create the diagonal spread will determine if the spread is a debit or credit.

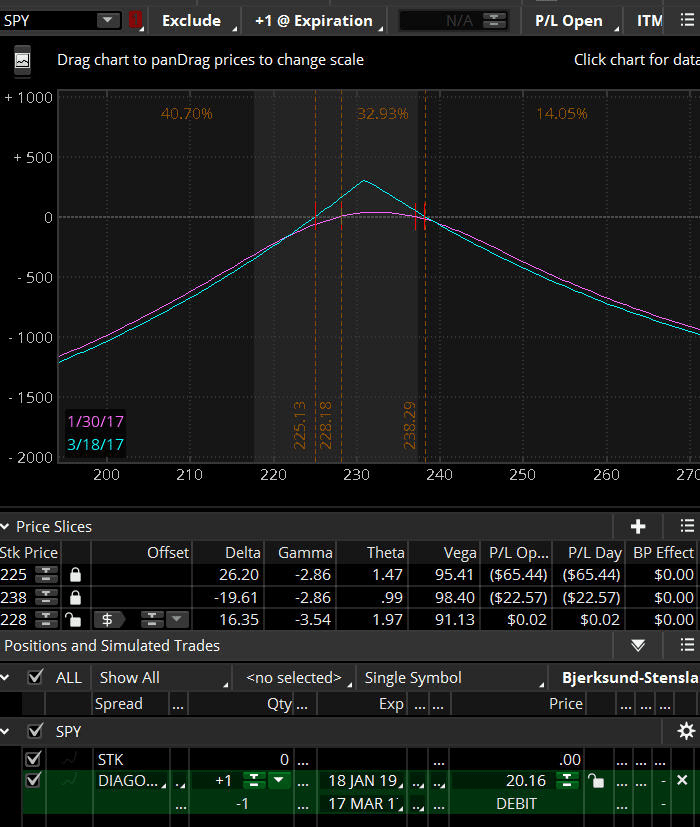

Below is a risk graph of an example of a Call Diagonal Spread on SPY

SPY Call Diagonal Spread from Think or Swim

An Example of a Bullish Diagonal Spread

A bullish diagonal spread can be composed by buying an in-the-money call option. Then, sell an additional call option with a dissimilar strike price which is usually a little out-of-the-money, along with a different date of expiration.

The diagonal can be used in a similar manner as a covered call. A covered call can tie up a lot of capital because you have to purchase at least one hundred shares of stock to create the basis for a covered call.

For example, a diagonal spread could be created by buying an in-the-money call option 12 months in the future. This call option would immediately have intrinsic value due to it being in the money.

For instance, if XYZ stock is trading at $40.00, you could purchase an XYZ option for $35.00. Your XYZ option would have $5.00 of intrinsic value because the option would be $5.00 in the money. This long option would be a type of stock substitute, as compared to purchasing 100 shares of stock which would be required for a covered call.

Due to buying the option further out in time, which in this case is 12 months, there will be some time premium added to the price of the option. Most of this options' premium or cost will be the intrinsic value and the rest will be time value.

For instance, if the $35.00 XYZ option strike cost $8.00, five dollars of the premium for the option is the intrinsic value because the option is five dollars in the money. The other three dollars of the premium, or cost of the option, would be the time value of the option.

Therefore, if you are able to accrue one dollar of premium for 12 months, you would accrue a total of twelve dollars in premium. You paid three dollars in time premium, so you would have nine dollars in profit by purchasing the option further out in time.

Using the above example, you could sell an XYZ option a little bit out-of-the-money, about 4 to 8 weeks out in time. The XYZ stock is trading at $40.00, you could sell a $41.00 XYZ call option.

If you are able to keep an eye on your trade more often, you could explore selling shorter-term options which could result in additional profits as well as losses. Of course, you do have more gamma risk with weekly options.

How a Bearish Diagonal Could Be Constructed

A bearish diagonal spread could be composed of selling an option and buying an additional option with a dissimilar strike price along with a different expiration date. If you are bearish on XYZ stock, you could enter a bearish diagonal. Your opinion is XYZ is going from $40.00 down to $35.00. You could buy the $45.00 in-the-money put option 12 months in the future, and sell the $35.00 out-of-the-money put 8 to 12 weeks in the future.

Jim Riggio of Capital Discussions discusses his version of a diagonal

Watch Trading a Diagonal Spread to see how veteran trader and educator Jim Riggio trades a diagonal spread. In this example, Jim was able to purchase a put leap option on SPY when volatility was at a multiyear low giving him an edge. Jim teaches from experience and says it is better to start trading diagonals using puts rather than calls to avoid the risk of being assigned. Jim teaches how the expiration graph will react as the trade progresses. Jim feels this will help you to understand and manage the diagonal spread as well as other trades you may presently be trading.

Some Key Facts about Diagonal Spreads

Many times diagonal spreads are directional strategies. Your goal when entering the trade is for the price of the instrument to trade to the short strike option you sold, but not to go beyond the short strike. If the price of the instrument crosses above the short strike of the option you sold, you may want to roll the option out in time and out in price. Or, you could close the short option position before expiration day, if the option has gone in the money.

If you are looking to join a trading group where traders of all experience levels share their trades and provide excellent feedback, look no more. Capital Discussions will give you everything you've been looking for, and more! Join now (it's free).

If you have any particular trade strategies incorporating diagonal spreads and would like to share, feel free to do so below.