The decisions of millions of investors and traders affect the price movements in the options market. There are many useful statistics in addition to price movement that indicate what other market participants are doing. This article will focus on two factors many traders consider when trading options; daily trading volume and open interest.

Trading Volume

Daily trading volume represents the number of option contracts being bought and sold, and will give you insight into the strength of the direction of the current market for the option's underlying stock/index. It is important to remember that trading volume is relative, and needs to be compared to the average daily volume of the underlying. A large percentage change in price, accompanied by larger-than-normal trading volume, is a good indication of the strength of the direction of the move. On the other hand, large percentage increases in price accompanied by small trading volumes are less likely to indicate a market direction. In reality, this may indicate that a reversal is likely in the short term.

Open Interest

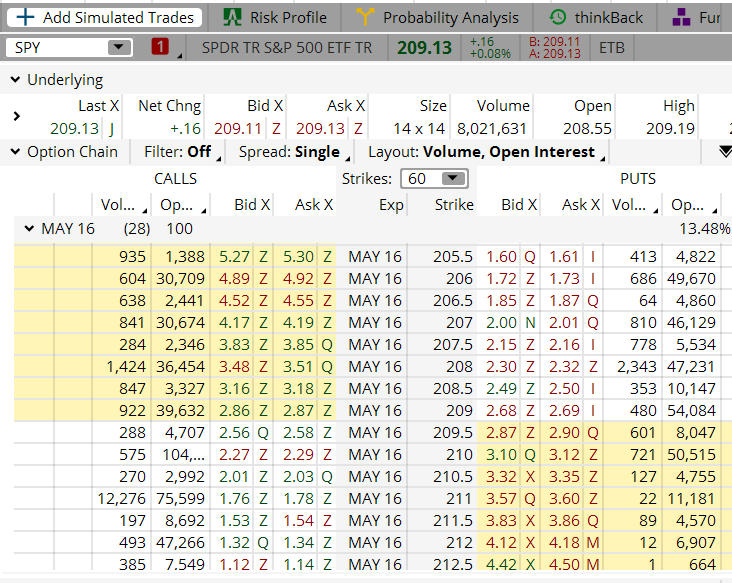

Open Interest is a concept that can sometimes be confusing, especially to novice traders. Although it is usually one of the default data fields on most brokers' option chains – along with bid price, ask price, volume, and implied volatility – some traders ignore open interest. It is often considered less important than the option price, or current volume, open interest provides some useful information veteran traders take into consideration when entering an option position.

Open interest will tell you the total number of each option contract that is currently open. This includes contracts that have been traded, but not yet liquidated by either an offsetting trade, an exercise, or assignment.

An option's open interest decreases when buyers and sellers of options close out their positions. An option's open interest increases when investors put on new long positions, and when sellers put on new short positions.

What are some differences between trading volume and open interest?

- While trading volume is updated constantly throughout the trading day, open interest is calculated only once a day, at the close.

- An option's trading volume can only increase, whereas an option's open interest could either increase or decrease. Unlike an option's trading volume which includes contracts being bought and sold, open interest shows only the amount of contracts that are held.

Why is open Interest an important factor in option trading?

When you are looking at the total open interest of an option, there is no way of knowing whether the options were bought or sold – which is probably why many option traders ignore it altogether. One way to use open interest is to look at it relative to the volume of option contracts traded. When the volume exceeds the existing open interest on any given day, this suggests that trading in that particular option was exceptionally high that day. Open interest can help you determine whether there is unusually high or low volume for any particular option.

Open interest also provides information regarding the liquidity of an option. If there is no open interest for an option, it may be harder to get decent fills on a trade entry or exit. When options have large open interest, it means there are a lot of buyers, and sellers, which can results in an easier fill at a good price.

Summary

We all know that trading is more of an art than a science. A measure of what other traders are doing can be a valuable tool in your trading business. Daily trading volume and open interest are useful indicators to enhance your trade entries, and exits, at the best price possible.

If you have additional thoughts on how volume and open interest help in your options trading, feel free to comment below.