You will likely find it very difficult to reach your trading goals if you do not “keep score.” Keeping score is more than just tracking your profits and losses on a regular basis. Said another way… keeping score means being aware of how you're performing, and how this compares with your historical performance.

Keeping score makes sense if you think of your trading activities as a business. Any successful business tracks their sales closely on a consistent basis. They know not only how much they have sold, but the quantity of each item in their inventory. In certain economic times, some items – perhaps lower-priced – will have a larger quantity sold than more expensive items. The company that keeps track of these trends on a regular basis will be in the best position to shift their product mix when the marketplace dictates in order to maximize profit potential.

Put in a nutshell, you cannot properly manage your business if you don't understand what your business is doing right and wrong. If you don't go through the data collection process, it's impossible to establish the benchmarks that let you track progress and improve your results.

What's important to track in your trading business to become consistently profitable?

- Your equity curve; tracking changes in your overall portfolio over time.

- Your number of winning versus losing trades.

- The average size of your winning trades, and the average size of the losers.

- The average win/loss per trade strategy.

We'll take a look at each of these elements in a bit more detail

Equity Curve

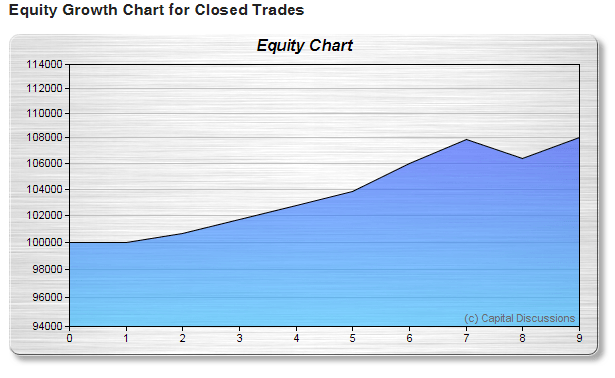

When tracking your equity curve, you are interested in the slope of your trade returns and changes in the slope. It's important not to overreact to every slight variation in your equity curve. It is when your current equity curve varies significantly from your past performance that you may want to make adjustments. If the variation that you see is in a profitable direction, you should identify what is working for you, so that you can full advantage. If the equity curve variation is creating larger and more frequent losses than normal, you may want to cut your risk by reducing the size of your trades, and diagnose the problem. Back testing can be a good method to analyze and modify your trading plan when called for.

The sample equity curve shown below are actual results from one of the educational services offered at Capital Discussions, the Road Trip Trade. You can see the smooth, upward slope of the equity curve, which is indicative of a trade with a successful track record.

Learn more about the Road Trip Trade at http://roadtriptrade.com/.

Winning Versus Losing Trades

The importance of recording your winning trades versus the losing trades is not about hitting a certain number, but comparing your current performance to your own historical norms. As an example, let's say you are a trader who trades using price action with directional long or short options. You tend to profit on only 40 percent of those trades, but you ride out those winning trades for larger gains as compared to your losers, which creates more profit. If your win percentage on these trades suddenly drops to 25 percent, you will likely want to step back and diagnose possible problems. Perhaps the market has turned too choppy for directional trades? Or, have you changed the way you have entered these trades? Does your stop loss need to be changed? If you identify that it is your own trade management causing the drop in the equity curve, you will want to step back and evaluate a possible revision to your trade plan. If, however, this period of 25% winners is just a function of the market, you may choose to reduce your trade size. Reducing your trade size may allow you to ride out the choppy market without making major changes to your plan.

Average Size of Winning and Losing Trades

It doesn't contribute to your overall trading success if you have 60 percent winning trades if the average size of your losers is twice that of your winners. Keeping score of the average sizes of your winners and losers will tell you a great deal about your trading style. If your average win size AND loss size are expanding or contracting at the same time, you are probably just dealing with more or less market volatility, or you are altering your position sizes. It is the relative shifts in the size of the average wins and losses that are most important for ongoing success as a trader. If your winning trades are increasing in average size and your losers are decreasing, you're on the right track. Knowing this will allow you to identify what you are doing right, so you can be consistently profitable with those types of trades. On the other hand, when losing trades are increasing in average size and winners are not, you will once again want to step back and identify where the problem lies. As always, backtesting as well as reviewing your trade plan can help to improve your results.

Average Win/Loss per Trade

Let's use an example of a trader who earns a certain amount of money in January, and earns the same amount the next month. This trader may be tempted to come to the conclusion that he/she has traded equally well in both months, which could be a mistake. Why? If in January there were 25 trades placed, and 50 placed in February, then there was actually less profit made per trade in February. This may suggest that perhaps some of your trades are not producing good returns. We can relate this to a retail business that opens three new stores in a year, but reports the same sales volume year after year. The average sales per store has actually declined, while expenses have increased. Of course, the average win/loss per trade will vary with your type of trading, position sizing, and overall market volatility. In most cases, traders make as much, or more, money if they simply focus on their best ideas and reduce their total number of trade strategies. Many times focusing on your best trade will create a surging average win per trade. This will make you more confident in your trading, and more consistently profitable.

Summary

When you're managing your trading activities as a business, don't forget the scorekeeping. Scorekeeping can be a critical element in the journal of your trading business. The more you know about how your trades are performing, the more prepared you will be to build on your strengths as a trader.

Stay tuned for a follow up article on scorekeeping, with more tips how you may be able to improve your trading results.

If you are looking for like-minded traders who share their trade results – winners and losers, go to https://capitaldiscussions.com/join.

Feel free to comment below if you have additional ideas to share on how tracking your trade results helped your overall trading success.